Investor Insight Investor Bulletin: ACCR files members’ statement against re-election of Woodside Chair

ACCR has filed a members’ statement opposing the re-election of Woodside Energy Group Ltd Chair Richard Goyder at the company’s upcoming annual general meeting (AGM) on 24 April 2024.

Under the chairmanship of Richard Goyder, the current board has resisted change in the wake of major shareholder votes over the past four years, each relating to its failure to deliver a credible strategy that will maximise shareholder value in the face of the global energy transition.

Read the statement in full here.

The 2023 Climate Transition Action Plan (CTAP) released last week once again fails to address persistent investor concerns regarding Woodside’s strategy and approach to climate risk.

The chair carries ultimate responsibility for the company’s direction, and therefore it is the chair who must be held accountable for Woodside’s current approach.

Key points:

The primary elements of concern that investors have held regarding Woodside’s climate strategy and governance over the last four years are:

- Woodside is continuing to allocate the majority of its capital to developing new oil and gas projects

- Woodside’s scope 1 and 2 decarbonisation targets are not Paris-aligned

- Woodside has not set a scope 3 target to drive the decarbonisation of its products and value chain, even though scope 3 emissions constitute over 90% of total equity emissions

- Woodside’s scope 1 and 2 decarbonisation strategy, which applies to 8% of equity emissions, is dominated by offsets

- The company has been persistently unresponsive to the above concerns.

The 2023 Climate Transition Action Plan (CTAP) does not address these concerns in a material way.

- 88% of Woodside’s greenfield capex will be allocated to fossil fuel expansion. Woodside has not sanctioned a significant “new energy” project.

- No change to very weak scope 1 and 2 target of 30% reduction by 2030. The IEA’s 2023 report The Oil and Gas Industry in Net Zero Transitions states that to align with a 1.5C scenario, scope 1 and 2 emissions from oil and gas company operations need to be “cut by more than 60% by 2030 from today’s levels and the emissions intensity of global oil and gas operations must be near zero by the early 2040s”.

- Woodside has not set a credible, absolute scope 3 target. The 5 MtCO2e pa scope 3 “abatement target” is not a new target, it is just restating the existing US$5billion “new energy” capex target with a different metric. It is highly unlikely to reduce scope 3 emissions since Woodside is not planning to reduce production of oil and gas. Importantly, 5 MtCO2e pa represents just 7% of Woodside’s 2023 scope 3 emissions.

- It is ACCR’s strong view that the disclosed “large scale abatement” estimates are leading to an understatement of the role of offsets in Woodside’s strategy. This is because the estimates include all potential unsanctioned reductions that cost up to $500/tCO2e. In contrast, Woodside has not disclosed the scope 1 and 2 emissions increases associated with unsanctioned projects like Browse, H2Perth and Calypso, which ACCR estimates to be 80MtCO2e .

- Offsets and CCS projects will not lead to material, real-world emissions reductions in Woodside’s portfolio. Given Woodside acknowledged at the 2023 Investor Briefing Day that its offsets portfolio and nascent CCS projects are tools to support growth, it is clear these plans are about facilitating emissions production, rather than emissions reduction.

Woodside has faced the following major votes on climate governance and strategy at its recent AGMs:

- 2020 - 50% vote in favour of an ACCR resolution seeking that the company set Paris-aligned Scope 1, 2 and 3 targets, and to adjust capital allocation and remuneration accordingly.

- 2022 - 49% vote against Woodside’s Climate Plan under the Say on Climate mechanism, the lowest level of support for a climate plan since the inception of Say on Climate.

- 2023 - a record-breaking 35% vote against director Ian Macfarlane over climate governance concerns.

Best available climate science

At the release of the 2023 CTAP last week, CEO Meg O’Neil said; “I go back to the science, which is pretty clear around how the world can meet climate objectives …”

Due to persistent delays in global decarbonisation efforts, climate science requires regular updates to take account of the diminishing carbon budget. It is critical that users of scenarios understand the latest science, and are transparent about the age and key assumptions within each scenario. The IPCC scenarios referred to by Woodside (p45) rely upon a 500GtCO2 carbon budget, which was the best available science in 2020. However since then, global emissions have increased and we also have a better understanding of key parameters, such as the impact of non-CO2 emissions.

A recent assessment of IPCC data published in Nature Climate Change has concluded that the remaining carbon budget for just a 50% chance of limiting warming to 1.5C was 247 GtCO2 as of January 2023, which is equal to around six years of current CO2 emissions. This is half the carbon budget underpinning the IPCC scenarios referred to by Woodside, which has major implications for the scientific viability of new oil and gas developments.

Key questions for Woodside:

Customer demand and new project risks

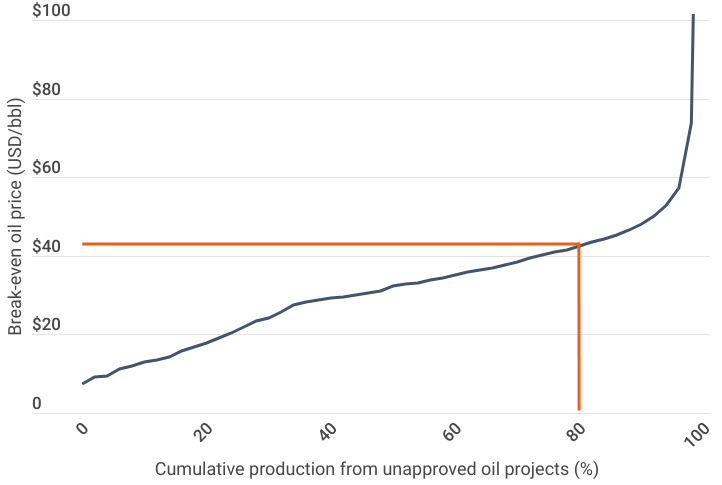

- Woodside’s first mitigation action to manage market risk is to be a “low cost, lower carbon company”, but the company recently made FID on Trion, which Woodside estimates has a break even price over $43/bbl. According to Rystad Energy’s cost curves more than 80% of unsanctioned oil projects are cheaper than this. In this context, doesn’t this make Woodside a high cost producer?

- Woodside has lower investment hurdles and/or higher oil price assumptions than BP, Chevron, ConocoPhillips, Eni, ExxonMobil, Equinor, Shell and TotalEnergies. Doesn’t this leave Woodside more exposed to the risks of falling demand than these other companies?

- Developing new oil and gas projects materially reverses Woodside’s limited decarbonisation efforts. Would Woodside ever consider returning capital to shareholders through share buybacks rather than using shareholder funds to pursue increasingly risky oil and gas developments? Has the company assessed this strategy?

Scope 3 emissions

- With regard to the “scope 3 emissions abatement target”, Woodside states “The (US$5billion) investment target tracks our work to develop these projects and bring them to market. The emissions abatement target will track the potential impact of these projects on customer emissions” (p34). Aside from some basic carbon accounting, will there be any additional activity from Woodside as a result of this target?

- The methodology for the scope 3 abatement target (p75-76) indicates this will be accounted for separately to Woodside’s scope 3 emissions, such as from LNG production. Will Woodside be taking any action to reduce the absolute scope 3 emissions from its oil and gas sales?

Scope 1 & 2 emissions

Can investors ever expect to see a strengthened Scope 1 and 2 reduction target from Woodside?

Large scale abatement costing >$80/tCO2e represents a significant proportion of Scope 1 reductions in Woodside’s potential pathway to net zero (p19) between 2031-2050:

- Is there any further guidance on the cost of abatement for these projects? The chart in the 2023 Investor Briefing Day (slide 19) referred to abatement costs up to $500/tCO2e.

- Has Woodside modelled what happens to its oil and gas business if a cost of $500/tCO2e was applied to its customers?

- Considering the high cost of these projects and the fact they are unlikely to be prioritised for older facilities, why is it appropriate to include all potential abatement in your indicative pathway (p19)?

- Woodside states that offsets will be used because “some decarbonisation technologies may prove too expensive to implement” (page 28). What is the probability that offsets will represent a far greater proportion of scope 1 reductions that indicated in this plan?

Use of climate scenarios

Considering that the IPCC takes several years to reflect the peer reviewed literature in its assessment reports and that half the remaining 1.5C carbon budget has been consumed since its latest publication, how is Woodside ensuring that it is relying upon the most current climate science when assessing the impacts of and risks to its projects?

| Investor Concern | 2021 Climate Report | Subsequent updates, including latest CTAP | ACCR analysis | Resolved? |

|---|---|---|---|---|

| Shareholder responsiveness | Single Say on Climate vote. No commitment to future votes. | Advisory vote will be held in 2024 and 3 yearly thereafter. | Woodside has not responded to firm and repeated investor feedback on its climate plan. More votes are unlikely to result in a different outcome. | partial* |

| Targets not science-based | Scope 1 equity: 15% net emissions reduction by 2025, 30% by 2030. Net zero aspiration for 2050. | No change. | Company not decarbonising in line with stated commitment to Paris Agreement. | ❌ |

| Scope 3 targets | Nil. Includes a $5bn capital target for ‘new energy’. | After dismissing scope 3 targets as too hard in the 2022 Climate Report, the 2023 CTAP has now expressed the ‘new energy’ target in terms of both a capital cost and avoided emissions. | Scope 3 emissions are over 90% of Woodside’s emissions. ‘New energy’ does not reduce scope 3 emissions, unless it displaces fossil fuel investment. Woodside is continuing to pursue fossil fuel expansion. | ❌ |

| Over reliance on offsets | >100% reliance on offsets for Scope 1 target, when considering the expected growth in absolute emissions. | Increasing disclosure of unsanctioned and indicative scope 1 emission reductions. No disclosure of scope 1 emissions increases associated with unsanctioned oil and gas projects. | Over reliance on offsets remains. Selective disclosure of data is arguably misleading. | ❌ |

*some investors view annual Say on Climate votes as essential for companies that operate in highly carbon-exposed industries, such as fossil fuel producers. In addition, regardless of the frequency, for Say on Climate votes to be a valuable governance mechanism, companies need to be responsive to investor voting