Investor Insight Investor Bulletin: ACCR response to WDS Notice of Meeting 2025

Woodside Energy Group Ltd has issued its Notice of Meeting (NoM)[1] ahead of its AGM on 8 May. It includes a response to members’ statements filed by ACCR, which explain why a vote against all directors standing for election at this year’s AGM is warranted.

The members’ statements say Woodside’s entire Board shares collective responsibility for the company’s failings, which include Woodside’s chronically poor shareholder returns and its ongoing failure to manage climate risk. The directors standing are:

- Ann Pickard

- Ben Wyatt

- Anthony (Tony) O’Neill

While we welcome Woodside’s engagement with the members’ statements, we think its response is insufficient and continues a habit of downplaying strong investor feedback.

The following outlines three key concerns we have with Woodside’s response to the members’ statements.

1. Responsible corporate governance includes holding the board to account

Woodside says:

"It is not consistent with responsible corporate governance to either individually or collectively oppose the re-election of directors in the form proposed, or for the reasons stated, in the Members’ Statement."[2]

ACCR’s response:

Directors are accountable for the performance of the company. Numerous governance principles and policies acknowledge the accountability role shareholders play in voting against board members when they fall short of expectations.

- The ASX Corporate Governance Principles state it is a “fundamental underpinning” of good governance that "security holders should be able to hold the board and, through the board, management to account for the entity’s performance.”[3]

- Institutional Shareholder Service (ISS) policy states: “Shareholders expect ‘collective accountability' of directors and boards of companies which have experienced governance failures, irrespective of whether directors consider themselves as not being directly responsible for actions of the company or those involved in it.”[4]

- CGI Glass Lewis says, regarding climate change, it may recommend “shareholders vote against the members of the board who are responsible for oversight of environmental and social risks.”[5]

Some voting guidelines note the specific accountabilities of Committee Chairs. For example, the Australian Council of Superannuation Investors (ACSI) guidelines recommend:

"In line with ACSI’s Climate Change Policy, where companies consistently fall short of our expectations, ACSI may recommend that our members vote against directors on a case-by-case basis. Our recommendations will focus on the individual directors most accountable for oversight of climate change related risks, for example company Chairs, and the Chairs of the Risk and Sustainability committees."[6]

Two Committee chairs are standing for re-election this year at Woodside, both of whom have responsibility for climate risk management:

- Ann Pickard has chaired the Sustainability Committee since 2017. The Committee’s role includes “making recommendations to the Board on, the Company’s policy and performance in relation to sustainability-related matters, including... climate change.”[7]

- Ben Wyatt, as current chair of the Audit and Risk Committee, has specific responsibility for oversight of risks including climate risk.[8]

2. Specific financial performance concerns outlined in the members’ statements have not been sufficiently addressed

The members’ statements raise specific issues relating to Woodside’s performance. While Woodside’s NoM response says it has “transparently and comprehensively addressed the topics raised”, we view the response as insufficient. The members’ statements:

a. outline how Woodside’s total shareholder returns (TSR) are consistently lower TSR than its peers’, the ASX 100 and MSCI World index. Woodside’s response does not address its relative TSR performance. It instead focuses on recent dividend payments, which are just one component of TSR, with only a brief acknowledgement that its share price is currently depressed.

b. note Woodside’s poor record of project execution, including late and over-budget delivery of both Pluto and Sangomar. Woodside’s response highlights that Sangomar recently started up, without contesting that it was late and over budget.

c. say that Woodside’s oil price assumption is higher than many of its peers’ and that it further increased its price assumption in early 2025. Woodside states that its price assumptions are “set with reference to third-party benchmarks” without saying what these benchmarks are, or where Woodside’s oil price sits relative to them. Its oil price assumption is 29% higher than the current Brent forward price.[9]

Woodside claims its current strategy will deliver sustained value: “investing in new projects is the means of delivering sustained value creation into the future – just as our previous investments in projects such as Pluto and Sangomar are returning value today.”

Based on the company’s sustained, poor financial performance and Woodside’s uncompetitive growth portfolio, we see little to substantiate a view that its current strategy will deliver compelling financial returns.

A strategy that prioritises capital returns over growth may generate more value, while allowing for a simpler, leaner and lower risk business.

3. Emissions performance and climate plan presents risk

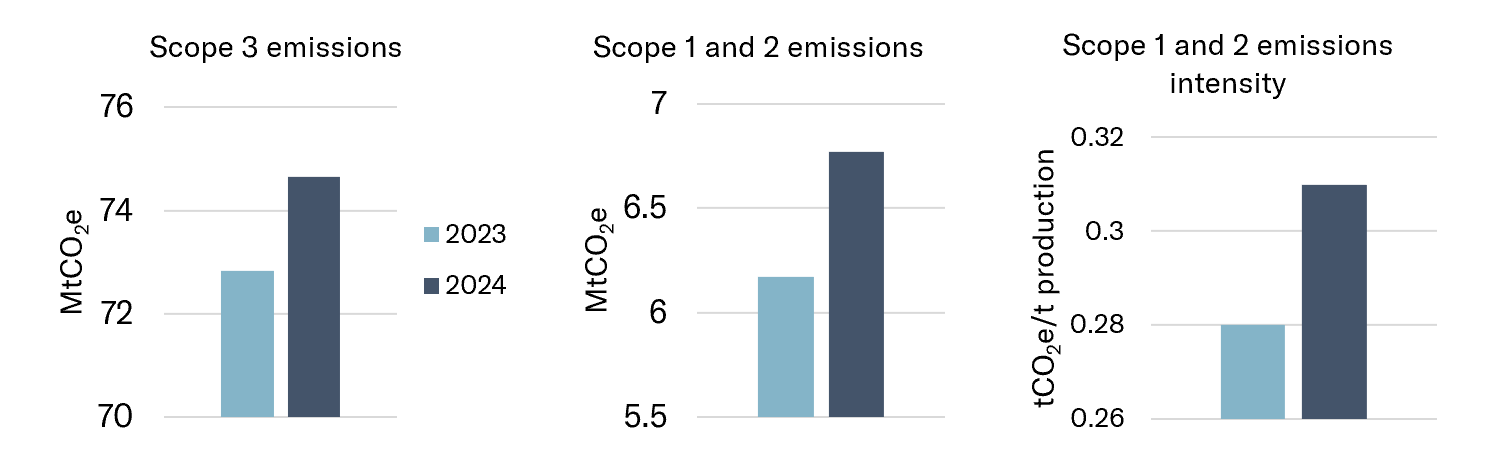

Woodside’s response highlights its progress towards its climate targets. It does not acknowledge that its scope 1 emissions, scope 1 emissions intensity and scope 3 emissions all increased in 2024.[10]

Woodside’s net scope 1 and 2 emissions only decreased because it more than doubled its use of offsets in 2024.

Woodside is still progressing a strategy that puts Paris alignment out of reach. For example, if it makes FID on Louisiana LNG, its scope 3 emissions will increase by between 27 and 91%.[11]

Despite the majority vote against its Climate Transition Action Plan and five years of escalating feedback, the Board’s response has largely been to restate the existing strategy. The board has demonstrated an ongoing failure to manage climate risk.

Download a PDF of Investor Bulletin: ACCR response to WDS Notice of Meeting 2025 | 04/04/25

Please read the terms and conditions attached to the use of this site.

Woodside Notice of Meeting, 2025 https://www.woodside.com/docs/default-source/asx-announcements/2025/018-notice-of-annual-general-meeting-2025.pdf?sfvrsn=9879fa44_3 ↩︎

Woodside Notice of Meeting 2025 p20 https://www.woodside.com/docs/default-source/asx-announcements/2025/018-notice-of-annual-general-meeting-2025.pdf?sfvrsn=9879fa44_3 ↩︎

ASX Corporate Governance Principles and Recommendations (4th Edition 2019) Recommendation 6.1 p23 https://www.asx.com.au/content/dam/asx/about/corporate-governance-council/cgc-principles-and-recommendations-fourth-edn.pdf ↩︎

ISS Australia Benchmark Policy Recommendations 2024 Australia-Voting-Guidelines.pdf p20 https://www.issgovernance.com/file/policy/active/asiapacific/Australia-Voting-Guidelines.pdf?v=1 ↩︎

CGI Glass Lewis Australia 2024 Benchmark Policy Guidelines Australia 2024 Benchmark Policy Guidelines.pdf p25 https://resources.glasslewis.com/hubfs/2024 Guidelines/2024 Shareholder Proposals ESG Benchmark Policy Guidelines.pdf ↩︎

ACSI Governance Guidelines (2023) Governance-Guidelines-December-2023.pdf p29 https://acsi.org.au/wp-content/uploads/2023/12/Governance-Guidelines-December-2023.pdf ↩︎

https://www.woodside.com/docs/default-source/about-us-documents/corporate-governance/board-and-committee-charters/sustainability-committee-charter-(december-2019).pdf?sfvrsn=c563fa7c_21 p1 ↩︎

2024 Annual report p99 https://www.woodside.com/docs/default-source/investor-documents/major-reports-(static-pdfs)/2024-annual-report/annual-report-2024.pdf?sfvrsn=b48b241c_2 ↩︎

Implied 2030 basis. Brent forward price sourced from Bloomberg Finance LP, used with permission of Bloomberg Finance LP. ↩︎

Woodside, Climate data table, accessed 26 February, 2025 https://www.woodside.com/sustainability/sustainability-databook/climate-data-table ↩︎

Relative to 2024 scope 3 emissions. 27% based on FID of the foundation projection at 50% stake; 91% based on FID of all potential trains at 100% ↩︎