Investor Insight Investor Bulletin: Analysis of Shell plc Capital Markets Day 2023

On June 14th Shell hosted its Capital Markets Day (CMD), providing an update that signals the company is set on steering a back-to-the-future course - expanding LNG capex into the head-winds of demand destruction, holding oil production flat until 2030 and continuing to pursue a divestment driven emissions reduction strategy that delivers minimal impact on reducing real world emissions.

Key points:

- IRR hurdle rates have been lowered for the hydrocarbon segments. This is surprising given the upward movements in bond yields since the 2021 February Strategy Day (SD), which leads to a higher cost of capital. It raises the question of why the required risk premium above the risk-free rate for new projects has been materially lowered for the hydrocarbon segments.

- A 2025-2030 expansion in LNG looks to be a questionable allocation of capital given our concerns with the longer-term supply and demand outlook for LNG based on IEA forecasts, coupled with the LNG sector’s long history of capex overruns and timing delays, against a lowered 11% IRR hurdle rate.

- Shell hasn’t considered potentially more value accretive options for this use of capital, namely re-allocating this capital to further increase shareholder distributions, especially share buybacks - notable given management's view that ‘we continue to believe our shares represent significant value’[1].

- Shell is relying on a divestment-driven emissions reduction strategy, meaning it’s making minimal progress in reducing underlying emissions.

- As a major player in a high-carbon emitting industry which is in long-term structural demand decline, Shell must develop an alternative strategy. The company could meaningfully decrease hydrocarbon capex and production and re-deploy capital to generate shareholder value either through increased shareholder distributions or developing value accretive new business segments.

Key stewardship considerations for investors

The following questions should be incorporated into future engagement strategies/meetings to better understand the risks associated with Shell's refreshed strategy.

- Why have the IRR hurdle rates for the hydrocarbons decreased, especially given the upward movements in the US 10-year Bond Yield (proxy for the risk-free rate), increasing from 1.16% to 3.79% between the 2021 February SD and the 2023 June CMD?

- What is the current cost of capital for new LNG projects?

- Has Shell modelled the returns to shareholders that would be generated by redirecting capital to shareholders via buybacks instead of new investments in growing LNG production?

- Does Shell see itself as a long-term natural owner of renewables businesses?

- In management’s view, what would have happened if Shell retained the assets it divested: would real-world emissions today be higher, neutral or lower?

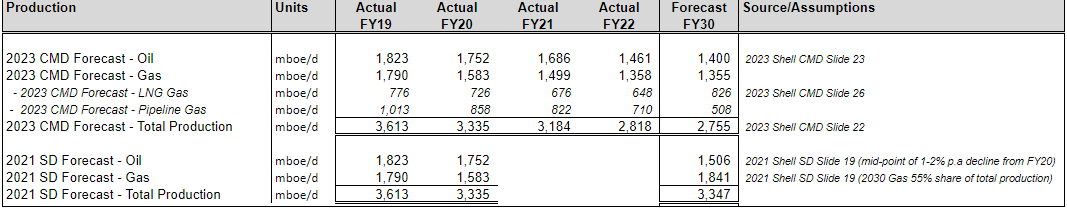

FY30 hydrocarbon production targets

The CMD provided Shell’s investors with an update on its 2030 hydrocarbon production targets, which allowed for a comparison with targets set at the February 2021 SD.

The forecast for oil production to 2030 is slightly lower (7%), whereas the forecast for gas production to 2030 is materially lower (26%) lower, due to steep declines in pipeline gas.

Shell has a more optimistic outlook for LNG with 11 Mtpa of forecast LNG new capacity additions by 2030 and plans to grow LNG 20-30% by 2030, where Shell ‘sees continued strong demand for LNG in the medium term’[2]. This strategy raises interesting questions on capital deployment which are discussed below.

Table: Shell FY30 Hydrocarbon Production Targets

LNG expansion or buybacks? Analysis of which option is more value accretive longer term to shareholders

- Whilst Shell sees continued strong demand for LNG in the medium-term, it is the longer-term supply and demand outlook for LNG that is more relevant, considering the LNG capacity under construction is not expected to come on stream until 2025-2030[3].

- LNG projects are capital intensive with long-term cash flows, which further emphasises the need to focus on the longer-term supply/demand outlook for LNG. For example, in the 2021 SD, Shell noted that Integrated Gas had a payback target before 2040. In contrast the Shell Marketing segment had a payback target of only 4-8 years[4].

- Longer term supply/demand conditions for LNG are forecast to deteriorate from current conditions. Whilst recent years have been prosperous for the LNG industry due to strong demand and limited supply, the IEA in its World Energy Outlook 2022 forecasts that in all scenarios except for the STEPS* scenario, LNG demand will turn negative from 2030 after a strong period of growth. Further IEA analysis also indicates a significant pick-up in supply in the second half of this decade. The prospect of falling demand and rising supply means there is risk to pricing and subsequently shareholder returns.

* It is worth noting that the STEPS scenario (based on 2022 policy settings) is associated with temperature rises of 2.5°C, which would lead to destructive climate-related impacts across the globe. It is also highly likely that policy settings will change to enable pledged targets (APS scenario) to strengthen pledged targets (towards NZE scenario).

Chart: IEA World Energy Outlook 2022 (WEO2022) Forecast Global LNG Demand

Chart: IEA Forecast Global LNG Demand (WEO2022 vs WEO2021)

Chart: IEA forecast LNG expected Import/Export Capacity Additions

- Another interesting observation is that through this current period of favourable conditions for LNG producers, Shell has decreased its LNG liquefaction volumes by 17% from 35.6mt in 2019 to 29.7mt in 2022[5] as a result of past decisions made when the cycle was weak. This raises a question as to whether Shell is making the mistake of chasing yesterday’s profits by expanding now.

- Another concern is the announcement at the CMD that the IRR hurdle rate for Integrated Gas has decreased from 12% (set at the 2021 Strategy Day) to 11%[6]. This is surprising given the upward movements in the US 10-year Bond Yield (proxy for the risk-free rate), increasing from 1.16% to 3.79% between the 2021 February SD and the 2023 June CMD. The new IRR hurdle rate indicates that the risk premium above the risk-free rate for LNG projects has been materially lowered, at a time when a higher cost of capital could reasonably be factored in. It would be an interesting question to ask management what it considers the current cost of capital to be for the LNG business.

In summary, the 2025-2030 expansion in LNG looks to be a questionable allocation of capital given our concerns with the longer-term supply and demand outlook for LNG, coupled with the history of capex overruns and timing delays in the LNG sector. This capital could be instead re-allocated to further increase the share buyback, especially given management's view that ‘we continue to believe our shares represent significant value’[7]. This potentially appears a more value accretive option for shareholders. It also has the benefit of limiting Shell’s contribution to global warming - noting that impacts will likely be felt portfolio-wide in a global economy heavily impacted by climate change.

The lowering of IRR Hurdle Rate

The CMD update provides IRR hurdle rates which are below what the company previously disclosed at the February 2021 SD for all segments, except the Chemicals and the Renewable and Energy Solution (ex-power) segments. Notably, the Integrated Gas IRR hurdle rate of 11% is now only 1% above the Renewable and Energy Solutions (ex-power) IRR hurdle rate. Given the upward movements in bond yields from 2021-2023, which leads to a higher cost of capital, it is not clear why the IRR hurdle rates were lowered for most segments.

Chart: Shell IRR Hurdle Rate Comparison

*In CY23-06 Capital Markets update, MKT hurdles rate include: MKT ex. LCF/EV 15%, LCF 12%, EV 12%

Power Generation hurdles rate of 6-8% is unlevered.

Climate Analysis

Renewable Segment Capex growth to slow

The maintenance of the IRR hurdle rate for Renewables (whilst all other segments, except for Chemicals, saw a reduction in IRR hurdle rate), combined with the declining capex growth rate for the Renewable and Energy Solutions segment, signals a shift in strategy by Shell away from the development of wind and solar energy.

The table below shows the Renewables and Energy Solutions capex from 2020 to 2025. However, it is important to note that the forecast FY24-25 Renewables and Energy Solutions Capex includes the Power business (includes trading of pipeline gas/trading of power) where capex is forecasted to be $2bn per annum, which is 40-50% of the forecast FY24-25 capex for the Renewables and Energy Solutions segment.

Chart: Shell Renewables and Energy Solutions Capital Expenditure (includes trading of pipeline gas/trading of power) from 2020 to 2025

In terms of Shell’s approach to cleaner energy, the key points are:

- In November 2021, former CEO Ben van Beuden stated that ‘the company’s plans for green energy could only be funded by oil and gas’[8]. However, cash flows from the legacy oil and gas business look to be increasingly directed towards shareholder distributions, with the CMD update showing an increase in shareholder distributions from 20-30% of CFFO to 30-40% through the cycle[9]. This makes it clear that the current strategy to FY25 for the renewables business is to confine it to a relatively small add-on business and not as a meaningful substitute for the legacy hydrocarbon business.

- In light of this, we have formed an updated view that Shell appears to have little interest in using its position in global energy markets to boost crucial supplies of renewable energy (especially in solar and wind).

- Additionally, from an emissions perspective, it is important to note that the primary metric for investors to consider is not the unambitious capex on renewables, but what Shell is doing with its hydrocarbon business. By holding oil and gas production broadly flat - regardless of its investment in cleaner energy - Shell is failing to make a meaningful impact on reducing real world emissions.

Use of divestments to meet emissions targets equates to minimal progress on reducing underlying emissions

- As one of the world’s largest carbon emitters, Shell has a responsibility to lower emissions from its hydrocarbon business. Shell stated in the CMD that they ‘satisfy more than 3% of (global) energy demand’[10], which is 3% of global energy GHG emissions.

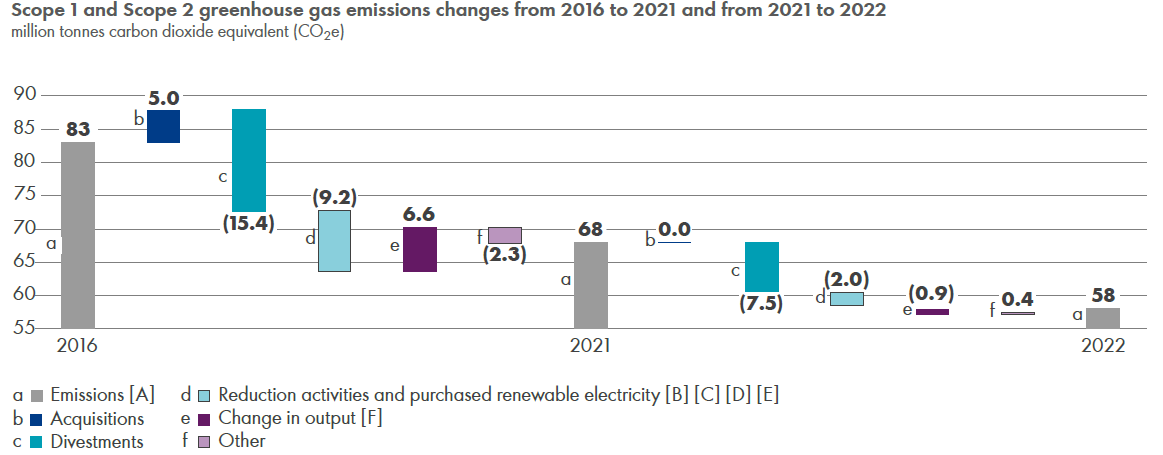

- Shell claims to have reduced its emissions, stating; “We reduced carbon emissions from our operations by 30% by the end of 2022 as compared with 2016 on a net basis… while globally energy-related emissions increased by 4% over the same period.”[11] However to date, the primary tool to achieve emissions reductions has been divestments without adopting the GHG Protocol Accounting standards for base year re-calculation for divestments (see explanation below).

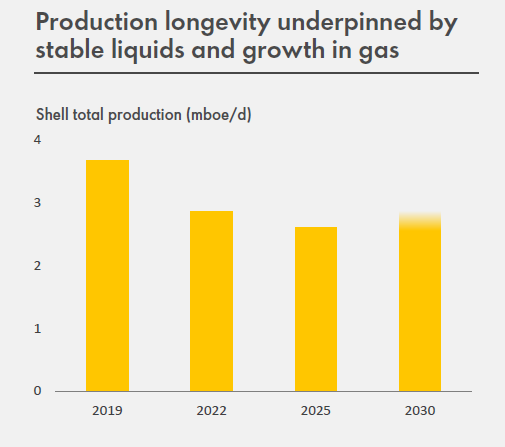

- When adding back divestments, underlying production is forecast to be broadly flat from FY2020-2030, indicating little reduction in Scope 3 underlying emissions since the February 2021 Strategy Day. Furthermore, 92% of the Scope 1 and 2 emission reductions from the 2016 Baseline year to 2022 have been due to divestments.

Chart: Shell forecasted hydrocarbon production inc. divestments, FY20-30 (mboe/d) broadly flat

Chart: Scope 1 and Scope 2 GHG Emission declines from 2016-2022, 92% due to divestments

Source: Shell Energy Transition Progress Report 2022, pg13

Why should divestments not be the primary tool for oil majors like Shell to reduce emissions?

- The GHG Protocol requires companies to retroactively recalculate base year emissions when significant structural changes occur in the reporting organisation, such as mergers, acquisitions, or divestments. Under the protocol, structural changes trigger recalculation because they merely transfer GHG emissions from one company’s inventory to another, without any change in emissions released to the atmosphere[12].

- Recent research from the Columbia Center on Sustainable Investment[13]on fossil fuel asset sales by supermajors found:

- Fossil fuel asset sales by the supermajors do not just shift greenhouse gas emissions but may increase them: “We assessed whether the supermajors’ asset sales affected the actual GHG emissions attributable to the sold assets after the sale. Here we used a sample of 46 assets, which featured in the transactions analysed throughout this study, that had complete emissions and production data in the proprietary database from the period 2017–2021. In this sample, post-sale emissions intensities tended to be higher, indicating that, on average, assets operated less efficiently after the sale. For 33 of the 46 assets in this sample, this percent change is positive: most transactions resulted in higher average emissions intensity in the year or years after the transaction year.”

- Fossil fuel assets sold by the supermajors may move to companies with poorer track records in environmental and other matters: On average, the non-supermajor buyer companies had 95% more environmental violations in the UK and the US than the supermajors (78 vs 40 per barrels of oil equivalent).

It would be interesting to get management’s view on what they think would have happened if Shell retained the assets they have divested: would real world emissions today be higher, neutral or lower? The evidence from the Columbia Center suggests that divestments by supermajors are at best ineffectual in reducing real world emissions and may in fact be increasing global emissions. At a minimum, Shell should be adhering to the GHG Protocol.

In summary, the CMD unfortunately reconfirmed a recommitment by Shell to hold hydrocarbon production levels broadly flat and to continue with divestments. As a producer of >2% of the world carbon emissions Shell needs to alter its divestment driven emissions reduction strategy and do more to reduce real world emissions. Shell must adapt to the reality that they are a major player in a high-carbon emitting industry which is in long-term structural demand decline. The company needs to develop an alternative strategy whereby it meaningfully decreases hydrocarbon capex and production and re-deploys capital to generate shareholder value either through increased shareholder distributions or developing value accretive new business segments.

Appendix

Normalised data digitised with plotdigitizer:

| x | y | |

|---|---|---|

| 2019 | 2019 | 1 |

| 2022 | 2022 | 0.78 |

| 2025 | 2030 | 0.71 |

| 2030low | 2030 | 0.75 |

| 2030high | 2030 | 0.78 |

Shell June Capital Markets Day, Slide 22

Shell June 2023 Capital Markets Day, Slide 20 notes ↩︎

Shell June Capital Markets Day, Slide 23 (Speaker Notes), 29 ↩︎

Shell June Capital Markets Day, Slide 22 (Speaker Notes) ↩︎

Shell February 2021 Strategy Day, Slide 13 ↩︎

Shell December 2022 Quarterly Data Book ↩︎

Shell June Capital Markets Day, Slide 43 & Shell February 2021 Strategy Day, Slide 61 ↩︎

Shell June 2023 Capital Markets Day, Slide 20 notes ↩︎

BBC, ‘Oil giant Shell says it needs oil to pay for green shift’, 3rd November 2021 https://www.bbc.com/news/business-59154930 ↩︎

Shell June 2023 Capital Markets Day, Slide 9 ↩︎

Shell June 2023 Capital Markets Day, Slide 8 notes ↩︎

Shell June 2023 Capital Markets Day, Slide 17 notes ↩︎

GHG Protocol (Corporate Standard), pg35 ↩︎

Arnold et al., 2023, 'Transferred Emissions Are Still Emissions: Why Fossil Fuel Asset Sales Need Enhanced Transparency and Carbon Accounting', Columbia Center on Sustainable Investment (CCSI), https://ccsi.columbia.edu/fossil-fuel-asset-sales.

See pp 5, 6, 45, 49. ↩︎