Investor Insight Investor Bulletin: BP’s recent climate disclosures - ACCR assessment

As foreshadowed in our response to BP’s Q4 update, we have now reviewed the disclosures from BP’s Net zero ambition progress update, 2022 Sustainability report and ESG datasheet. ACCR also recently met with the company to test our analysis and discuss key clarifying questions arising from our assessment of BP’s climate progress over the past year.

ACCR’s outstanding key concern is that despite the talk, we are not witnessing a company in a successful transition to decarbonise.

This concern is based on some key observations:

- In direct contradiction to BP’s public agenda of recent years, BP is pulling back on emissions reduction targets.

- BP’s scope 1 and 2 reductions, and its scope 3 target for upstream oil and gas production are predominantly driven by divestments.

- BP has changed the scope of how it defines ‘low carbon capex’ to include acquiring energy trading that includes fossil fuels.

- While enhanced disclosures on traded emissions is positive, there is no scope 3 target for these sizable emissions.

- BP’s oil and gas operations were supposed to fund transition growth engines (TGE) - yet now TGEs have a hugely wide scope - which also includes fossil fuels. Plus BP is investing very little into renewables, prioritising buybacks and dividends instead.

- There are no updates on decarbonising trading - BP is still levering its global distribution network to facilitate fossil fuels trade.

ACCR encourages investors to keep pressing BP for improvements to its approach to climate. Voting for the Follow This climate resolution on scope 3 and 2030 targets is an efficient way for investors to give voice to concerns about BP's direction of travel on climate and transition.

Below we outline in more detail our key responses to BP’s progress on each of the 5 Aims it has outlined to get BP to net zero.

Aim 1: Net zero operations - BP’s scope 1 & 2 target

BP has reported a reduction in its scope 1 & 2 emissions, from 54.4 MtCO2e in FY19 to 31.9 MtCO2e in FY22. The key lever for these reductions is divestment, accounting for 16 MtCO2e (over 70%).

Regarding the strategy of BP to use divestments as the primary method to decrease scope 1 & 2 emissions, our key concern is that divestments do not decrease real world emissions. Rather divestments are just a change of financial ownership from a seller to a buyer that have no immediate environmental consequences. Whilst divestments may be a sensible business decision we do not think it should be considered as climate action.

Furthermore, we are concerned that BP does not adopt the GHG Protocol Accounting standard in regards to base year re-calculation. To recap, the standard states:

‘A base year is a reference point in the past with which current emissions can be compared. In order to maintain the consistency between data sets, base year emissions need to be recalculated when structural changes occur in the company that change the inventory boundary (such as acquisitions or divestments).’[1]

Not adjusting the base year for divestments allows for BP to use divestments as the primary method to reduce emissions to reach Aim1 & 2 targets. It also creates a potential inconsistency if the buyers of BP’s divestments are adopting GHG Protocol Accounting Standards, as it effectively increases the collective baseline emissions of the oil and gas sector, which falsely gives the impression that the oil and gas sector as a collective is decreasing emissions at a faster rate than what is the underlying reality.

The preference would be for BP to focus less on divestments and more on sustainable emissions reductions and an overall reduction in oil and gas production to reach Aim 1 & 2 targets, which would have a positive impact on real world emissions reductions.

Aim 2: Net zero production - BP’s scope 3 target for upstream oil and gas production

As highlighted in ACCR’s Q4 Investor Bulletin, BP is now targeting a ~25% decline in oil and gas production by 2030, compared to the previous target of a 40% decline from a 2019 baseline. As a result of this updated production guidance, BP has downgraded its 2030 Aim 2 emissions reduction target (scope 3 emissions from upstream oil and gas production) from 35-40% to 20-30%.

In ACCR’s view, this change to BP’s production profile will result in an estimated 900 million boe of additional oil and gas production by 2030. That is equivalent to an additional estimated 338 million tonnes of cumulative emissions that will be pumped into the atmosphere between now and 2030. This is equivalent to keeping more than 70 million cars on the road between now and 2030.

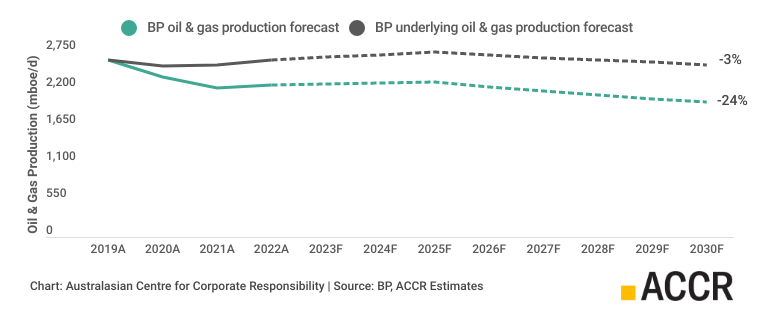

Furthermore, BP has indicated that the primary lever to reduce oil and gas production is divestments. BP plans to grow hydrocarbon production to ~2,300 mboe/d by 2025, then decline to ~2,000 mboe/d by 2030. Over the same period, they aim for ~200 mboe/d of divestments. ACCR estimates that up to 90% of production decline between 2019 and 2030 will be driven by divestments, with underlying production only declining 3%.

Chart: BP forecasted hydrocarbon production inc. divestments, FY19-30 (mboe/d)

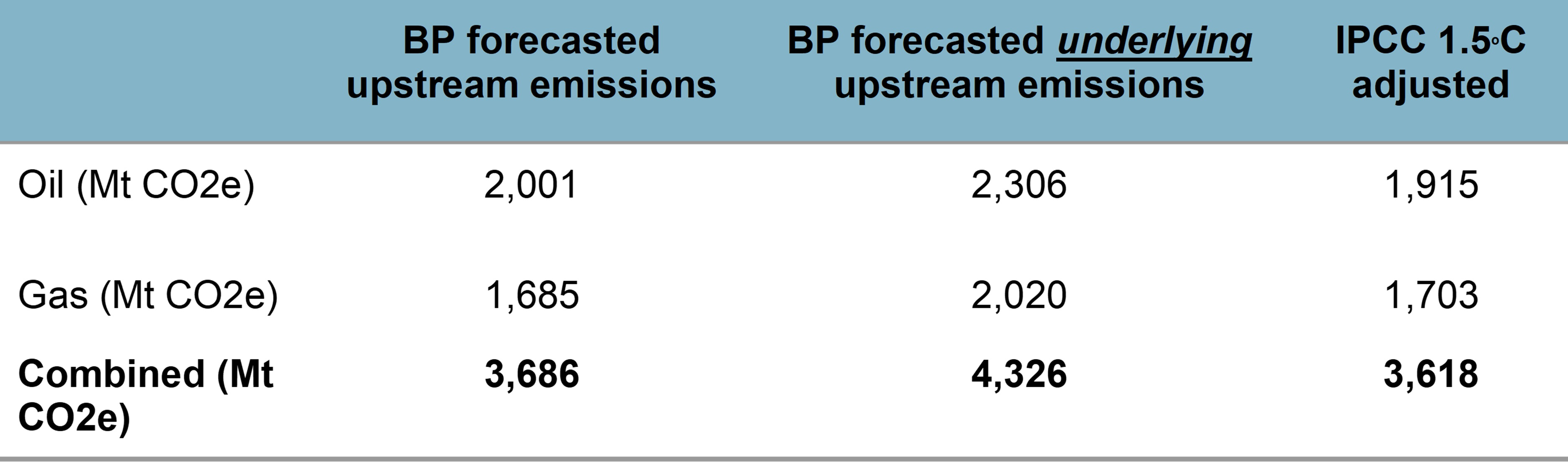

With the current pace of global emissions, the global carbon budget could be exhausted in less than a decade if business continues as usual. Therefore, it is important that high emitting companies, such as BP, work to reduce their absolute emissions now and actively aim to minimise their cumulative impact in the process. The table below summarises the cumulative emissions between FY19-30 resulting from BP’s current production targets, compared to the IPCC data point for 2030. This IPCC data point is based on AR6 scenarios that exclude heavy reliance on individual decarbonisation levers. This table outlines that BP’s forecasted underlying cumulative emissions to 2030 are above the median figure of the adjusted range of IPCC scenarios that are 1.5C aligned.

Table: Forecasted cumulative scope 3 emissions from upstream oil and gas production, FY19-30 (MtCO2e)

Aim 3: Net zero sales - BP’s carbon intensity target

Following their announcement in February 2022, BP has revised their Aim 3 carbon intensity metric to incorporate physically traded energy products. While this represents a progressive step, the company has not yet established absolute targets for third-party oil and gas emissions, which BP has indicated may grow until 2030.

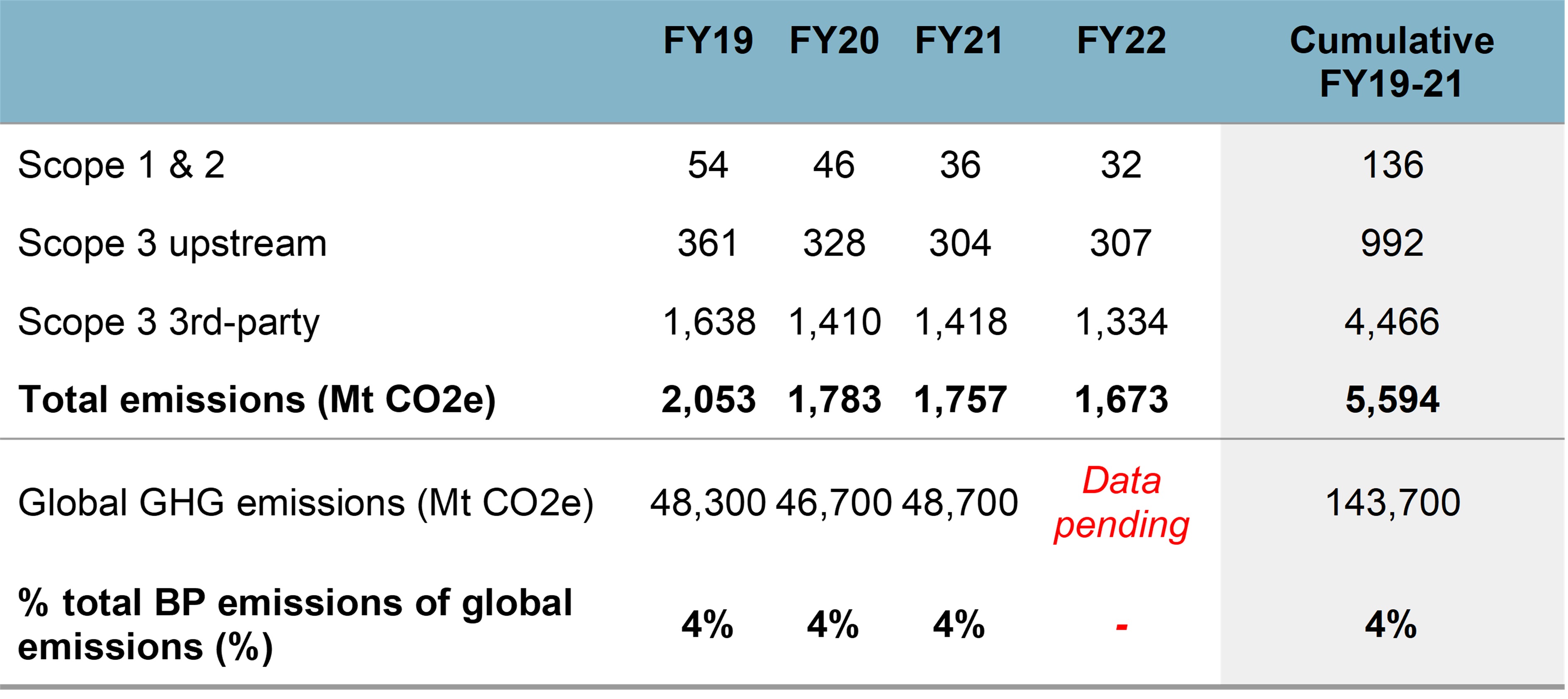

As mentioned above, it is crucial for businesses to demonstrate maximum ambition to address their absolute emissions over the next decade. This is underscored by BP's recent disclosure, revealing that between FY19-21, the company's cumulative emissions constituted 4% of global emissions during the same time frame.

Table: BP disclosed emissions vs global emissions, FY19-22 (MtCO2e)

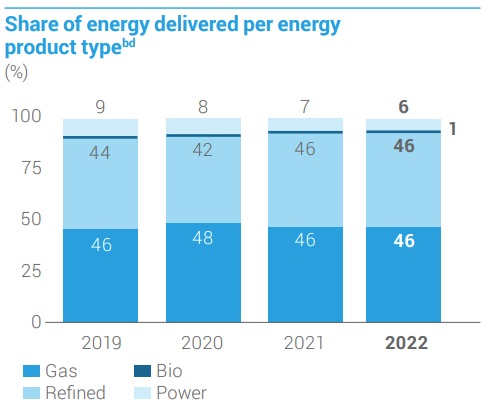

Moreover, it appears that BP's sales portfolio composition has regressed. In FY22, oil and gas represented 92% of sales, an increase from 90% in FY19. It is important to note that the 'power' category encompasses both renewable and non-renewable energy sources.

Aim 4: Reducing Methane

While progress on this Aim appears to be on track, it is difficult to assess with a new measurement approach to be rolled out by the end of 2023. This will include metering but also the combination of measurements and modeling which is essential to quantify methane emissions from BP’s major facilities. While a lot of testing has been done already, investors and the oil and gas sector as a whole would benefit from peer reviewed publications which would lead to sharing best practices to reduce methane emissions in the oil and gas sector as fast as possible.

A large part of the methane emissions reduction according to BP has been from divestments, which we believe should lead to a restatement of the baseline, not a measured reduction. BP notes that variations in production and divestments accounted for approximately 85% of the absolute reductions reported for 2022.

Aim 5: More $ into transition - BP’s transition investment target

BP has redefined its low-carbon expenditure under "Transition Growth Engines" (TGEs), which include bioenergy, convenience, EV charging, renewables and power, and hydrogen. We draw investors' attention to the following:

- 'Strategic convenience sites' refer to retail sites within BP's portfolio that sell BP-branded fuel.

- 'Hydrogen' includes blue hydrogen, produced using natural gas via steam methane reforming. This is coupled with CCS, which has not been proven to an industrial scale. To power a carbon capture plant, extra fossil fuels are required unless renewable electricity is utilized. However, this results in additional fugitive methane emissions that must be considered for an accurate evaluation of carbon intensity. Neglecting to account for these emissions could lead to a carbon footprint that exceeds even that of unabated "grey" hydrogen.

- 'Renewables and Power' now incorporates BP's power trading business, which includes fossil fuels. In its sustainability report, BP states under Aim 5: "In December 2022, we completed the purchase of EDF Energy Services" – a power trading company that includes fossil fuels.

Please read the terms and conditions attached to the use of this site.

Appendix E to the GHG Protocol Corporate Accounting and Reporting Standard - Revised Edition, Version January 2005. ↩︎