Investor Insight Investor Bulletin: Shell’s lobbying disclosures make incremental improvements, but step-change is needed

In November, Shell gave an update on its emerging markets lobbying, following a commitment earlier in 2024 to provide additional disclosures on its lobbying in “5-10 emerging and developing markets that are significant for our strategy, before our 2025 AGM”.[1] This commitment was given in response to investor pressure, including a shareholder resolution filed by institutional investors and ACCR.

Greater transparency of Shell’s climate and energy lobbying in emerging markets is crucial for investors. Our research, published last March, revealed investors have been flying blind, with Shell’s disclosures providing no substantial insight into its lobbying activities in emerging markets.

The new information includes previously undisclosed industry associations and new advocacy updates. Still to come is expanded coverage in Shell’s Climate and Energy Transition Lobbying Report in 2025. The updated disclosures still largely omit gas lobbying in markets which Shell’s bullish LNG growth strategy is targeting. This information is important because with over one billion tonnes of uncontracted LNG in its portfolio out to 2050, Shell has an incentive to lobby for increased LNG use in these markets. Shell needs to demonstrate to investors that its lobbying in key emerging markets does not slow the energy transition and is aligned with its decarbonisation commitments.

ACCR and institutional investors raised these concerns with Shell in December. This prompted small, additional changes in the company’s disclosures: the addition of ‘LNG’ to the name of its ‘gas and low-carbon gases’ advocacy category; and a note that the countries it has selected for disclosure “include our top 10 countries by expected cash flow from operations.”

A step-change in Shell’s approach to lobbying disclosures is still needed to ensure adequate insight into its material lobbying activities and to show investors it is lobbying in line with the Paris goals. Ahead of Shell’s Q1 advocacy updates, ACCR and investors will seek to meet with the company again to request these enhancements.

Key insights:

- The update was a welcome acknowledgement from the company that investors need better disclosure on its emerging markets lobbying.

- The new information on emerging markets includes six previously undisclosed industry associations on its membership list (across Brazil, China, Nigeria and Qatar), and a further 12 associations within its new advocacy updates on Brazil, China, Kazakhstan, Malaysia, Nigeria, Oman and Qatar. These advocacy updates provide information on Shell’s lobbying in emerging markets across a range of policy areas, though proportionally more of these relate to CCS, carbon pricing, methane, and net-zero implementation policies.

- Markets targeted for LNG demand growth are largely still omitted from disclosures. It is particularly notable that Shell does not disclose lobbying activities in India, despite it actively lobbying on gas-related policy in the country, which it considers a strategic growth market. Shell also does not disclose lobbying in other markets it has identified as key LNG growth centres, such as Vietnam, Thailand, and the Philippines. There is no mention of advocacy on gas or LNG in disclosures on China, despite the country being pivotal to the company’s bullish LNG outlook.

- The methodology Shell uses for selecting countries and associations to report on is not transparent, and fails to properly capture material lobbying, especially in emerging markets. The disclosures remain disproportionate to its strategic ambitions for fossil fuel growth in emerging markets, with disclosures relating to emerging markets being less detailed and transparent than for developed markets.

- Investors need transparency on Shell’s lobbying activities and spend in these markets because advocacy activities today potentially have a significant bearing on the company’s future ability to deliver on its business strategy and decarbonisation commitments.

Key stewardship considerations for investors:

Ahead of its 2025 AGM, Shell has the opportunity to address these shortcomings by enhancing its approach in its association list, advocacy updates, and upcoming Climate and Energy Transition Lobbying Report.

Investors can consider the following in their engagements with Shell on its climate and energy policy lobbying:

Methodology and proportionality of disclosures

- Why do Shell’s lobbying disclosures largely not include information on lobbying related to gas and LNG in key emerging markets on the demand side?

- What specific criteria does Shell use to select countries, topics and associations for its lobbying disclosures? What metrics and criteria, in addition to expected cash flow from operations (CFFO), can Shell include in its methodology to ensure its disclosures reflect the full scope of its business strategy, including its production, sales and decarbonisation goals?

Specificity of disclosures

- Why does Shell not consistently disclose its specific advocacy goals and policy positions it takes, policy outcomes, the amount it spends on lobbying or who it employs to lobby?

- Why is the level of specificity and evidence provided in emerging markets disclosures often less than for developed markets, and how can Shell narrow this gap?

Alignment with strategy and decarbonisation

- What efforts is Shell making to disclose an overall assessment of its lobbying activities and their impact on its transition strategy, as recommended by the Global Standard on Responsible Climate Lobbying and the TPT Disclosure Framework?

1. Shell’s new lobbying disclosures for emerging markets

Shell has added the following information about emerging markets lobbying to its disclosures:

- Six industry associations to its membership list from Brazil, China, Nigeria and Qatar.

- Advocacy updates for Brazil, China, Kazakhstan, Malaysia, Nigeria, Oman and Qatar. These updates include 12[2] associations that do not appear on Shell's membership list.

Shell’s additions to its advocacy updates provide new information on its lobbying in emerging markets. These updates are on policy engagement areas that correspond to Shell’s overarching policy positions, though proportionally more information is provided on CCS, carbon pricing, methane, and net-zero implementation.

Shell’s lobbying disclosures remain disproportionate to its business

These additions do not rebalance Shell’s disclosures to make them proportionate to its large fossil fuel growth ambitions and lobbying footprint in emerging markets.

Omission of markets targeted for LNG demand growth. Shell’s emerging markets disclosures focus more on countries where it has large fossil fuel production.

- It is particularly notable that Shell does not disclose lobbying activities in the South and Southeast Asian markets it sees as key growth drivers for its LNG business, such as India,[3] Vietnam, Thailand, and the Philippines.[4] This is despite our research finding that in each of these countries, Shell is a member of associations which lobby on climate and energy policy, including for increased gas use.

- India is an especially concerning omission. Shell is targeting large LNG growth in the country and considers it a strategically important market. Shell also actively engages with gas-related policy in India, both directly and through industry associations such as the Federation of Indian Petroleum Industry (FIPI), and supports significant growth and the creation of gas markets. It is similarly notable that Shell’s disclosures on lobbying in China do not mention gas, despite Shell expecting China to drive demand for LNG this decade and account for significant growth to 2040 under its bullish projections.[5]

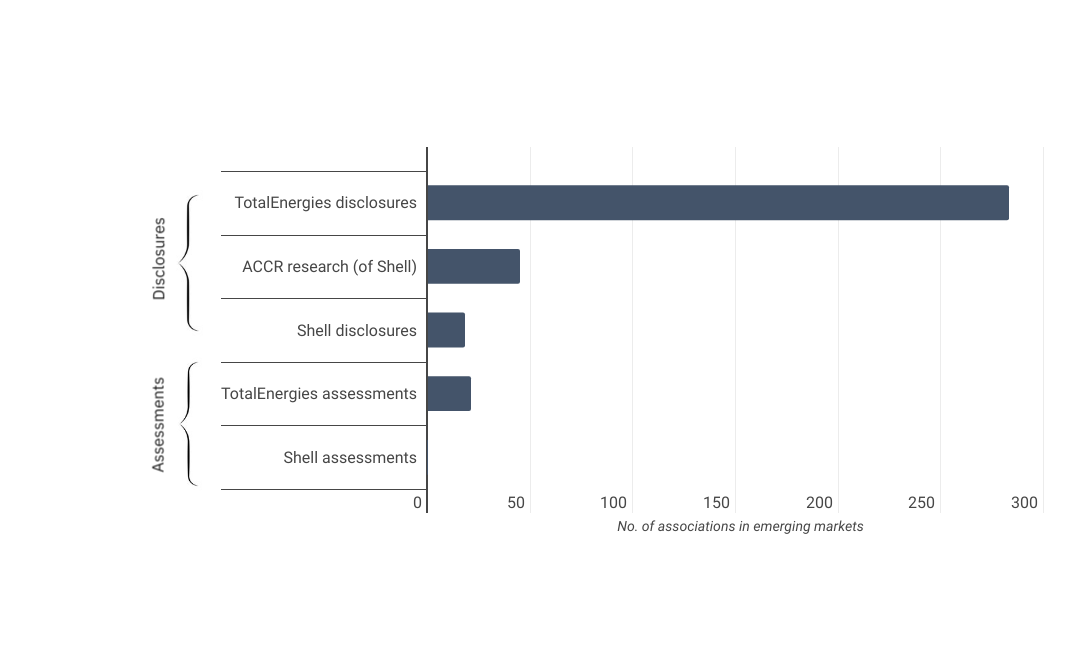

Few associations disclosed in emerging markets. Only a small proportion of the associations Shell discloses are based in emerging markets. Its list of industry associations contains six (<5%) and its advocacy updates mention another 12. This is despite a large proportion of Shell’s future production and sales being in emerging markets. TotalEnergies discloses and assesses significantly more associations in emerging markets in both absolute and percentage terms,[6] while ACCR’s previous research found at least 45 notable Shell associations which engaged in climate and energy policy advocacy in emerging markets.

Figure: Shell reports far fewer associations in emerging markets than TotalEnergies and ACCR’s research of Shell

Shell’s methodology for identifying material lobbying is not fit-for-purpose

The methodology Shell uses for selecting countries and associations to report on is not transparent, and fails to properly capture material lobbying, especially in emerging markets.

Opaque method for selecting countries does not properly capture material lobbying. Shell is not transparent about how it selects countries for its lobbying disclosures, saying only that it is “based on their expected contribution to the delivery of Shell’s strategy in 2024 and over the next decade” and that selected countries “include our top 10 countries by expected cash flow from operations.”[7]

- Shell’s selection methodology did not previously result in substantial disclosures on emerging markets. The fact that a strategically important market like India is not captured in expanded disclosures indicates that Shell’s selection methodology is still not fit-for-purpose.

- Shell has not clearly disclosed what metrics or criteria it uses to assess the strategic importance of different markets and advocacy areas. Shell does not mention any metrics apart from expected cash flow from operations (CFFO), and it is unclear if Shell uses CFFO to select countries, or as a post hoc measure of selected countries’ materiality.

- CFFO alone is insufficient for defining the scope of Shell’s lobbying reporting, as it reflects the materiality of supply-side production operations while ignoring demand-side drivers of cash flow. It also does not ensure that the most material advocacy areas are reported on, as the omission of gas in disclosures on China shows.

The criteria for selecting associations are also insufficient, especially in emerging markets. Shell currently uses a $50,000 annual fee threshold for its list of associations. Fees are a highly imperfect proxy for lobbying materiality, and moreover, Shell’s fee threshold does not increase regularly and is not adjusted for purchasing power parity. This leads to inconsistencies in Shell’s reporting.[8] Competitors have previously disclosed associations in emerging markets that Shell is a member of but that it did or does not disclose,[9] likely in part because they cross-reference their disclosures with InfluenceMap’s coverage.[10] Shell’s most recent Lobbying Report used additional (if relatively vague) selection criteria, but as our research pointed out, these also failed to select any industry associations in emerging markets for assessment.[11] Companies like Unilever have published more transparent and multi-factor materiality methodologies in their industry association assessments.[12]

Shell omits critical information about lobbying positions and associations

Shell’s advocacy updates are often vague, especially in emerging markets, and its list of associations lacks key information about their relevance, location, and Shell’s roles.

- Advocacy updates lack specific information on lobbying positions. In emerging markets, Shell provides less detail and evidence for its lobbying. Advocacy updates in Qatar, for example, are limited to one entry that states the company supports national policy ambitions and “engages with stakeholders” on “CCS, low-carbon fuels and methane emission reductions.” More information is provided for other emerging markets, but these also often lack information on specific advocacy positions, outcomes and links to detailed advocacy documents. While Shell needs to provide more specific information on its policy recommendations in all jurisdictions, this is especially important for enhancing accountability in emerging markets, where public policy transparency is often lower.

- Lack of key information limits value of association list. Investors gain little insight from this simple list of names. As our research and the investor-backed Global Standard on Responsible Climate Lobbying make clear, it is important that Shell provides information about which associations are relevant to climate and energy policy, where they are located, what leadership roles Shell holds, and how much it pays them. TotalEnergies has shown it is feasible to provide this information.

2. Investors need Shell to overhaul its lobbying disclosures

Shell’s lobbying is highly material to company strategy and decarbonisation goals, but its transparency and governance fall short of investor expectations

Shell’s bullish LNG outlook and large amount of uncontracted LNG – over one billion tonnes between now and 2050 – provide an incentive for it to lobby for expanded use of the fossil fuel. (For more information, see ACCR’s research – Shell’s LNG strategy: Overcooked?) Investors need much better transparency and governance of Shell’s highly active lobbying to understand whether it is aligned with decarbonisation goals.

- Highly active lobbyist with outsized impact and misaligned incentives. Shell is one of the largest investor-owned fossil fuel companies[13] and also lobbies more actively than most CA100+ companies, including its industry peers.[14] With a strategy (and remuneration structure) that targets LNG growth in emerging markets, and a large portfolio of uncontracted LNG, Shell has a strong incentive to lobby for more LNG use.

- Lobbying performance falls short of investor expectations. Shell’s disclosures fall short of expectations in the Global Standard on Responsible Climate Lobbying, and score only 36% on InfluenceMap assessments – behind numerous CA100+ companies and no better than a number of its peers.[15] Shell’s publicly visible lobbying is also not clearly aligned with the Paris goals and ranks only as mediocre among CA100+ companies.[16] Its impact may well be greater when accounting for lobbying outside the public domain and the emissions-intensive nature of Shell’s business.

Significant but feasible changes needed to lobbying disclosures

To provide investors with more in-depth and proportionate insight into its material lobbying activities globally, Shell’s advocacy updates in Q1 2025, additions to its membership list, and its Climate and Energy Transition Lobbying Report should seek to significantly enhance its approach, principally by:

developing and disclosing a more robust selection methodology that is calibrated to capture material lobbying in emerging markets and report it with the same level of detail. Building on expectations set out in the Global Standard on Responsible Climate Lobbying, this should include:

- detailed materiality criteria for the selection of countries, topics and industry associations to report on, including the financial metrics and other criteria used (beyond expected CFFO). The rationale for how these criteria ensure the capture of material lobbying relevant to the production, sales and decarbonisation elements of Shell’s strategy should also be provided.

- explanation of why the resulting scope of disclosures is proportionate to strategy, along with what was excluded from disclosures and why. This should also note if certain types of advocacy (e.g. on what Shell deems to be technical regulatory matters) are excluded and why they are not material.

disclosing the goals, specific positions and outcomes of lobbying efforts, as they relate to strategy and decarbonisation goals. This should include:

- an overview of how Shell seeks to use lobbying to enable its strategy, as recommended by best practice standards.

- The Global Standard on Responsible Climate Lobbying asks that companies disclose an overall assessment of their climate lobbying impact on "the company’s ability to deliver its own corporate transition strategy”.

- The TPT Disclosure Framework recommends that companies disclose an explanation of current and planned priorities for engagement with governments, public sector and civil society, as well as “the expected principal contributions of [these] activities towards achieving its Strategic Ambition.”[17]

- an explanation of the goals and outcomes of specific lobbying efforts.

- This means noting why specific advocacy positions were taken, what the policy outcomes were, and whether they are aligned with Shell’s transition strategy. Shell’s overarching Policy Positions provide a framework for its advocacy but rely on advocacy updates and other disclosures to give insight into the specifics of policy engagements.

- For example, if Shell advocates for policies that increase gas consumption in support of the Indian government’s ambitions to grow the share of gas in the energy mix, Shell should provide information on: what specific policy changes it advocated for; what policy changes occurred; and whether these changes and the government’s ambitions are aligned with Shell’s decarbonisation commitments.

- an overview of how Shell seeks to use lobbying to enable its strategy, as recommended by best practice standards.

Additionally, Shell should seek to align with investor expectations under the Global Standard on Responsible Climate Lobbying and recommendations from our research by:

- disclosing a comprehensive list of material third-party advocacy organisations globally, and providing critical information on their relevance to climate and energy policy, location, payments, and Shell’s roles. Information about these organisations is already recorded in Shell’s Code of Conduct Register.[18]

- disclosing the total lobbying expenditure and lobbyist headcount in each jurisdiction where Shell lobbies, not just where it is legally obliged to. In addition, we also recommend that Shell discloses secondments to and recruitments from the public sector. These are already logged in the Code of Conduct Register and/or flagged with the Ethics and Compliance Office.[19] This is particularly important for emerging markets, where oversight of ‘revolving door’ employment is often lower.

Download a PDF of Investor Bulletin: Shell’s lobbying disclosures | 13/01/25

Please read the terms and conditions attached to the use of this site.

See “Further planned disclosures” section at the bottom of: Shell, Climate and energy transition advocacy updates https://www.shell.com/sustainability/transparency-and-sustainability-reporting/advocacy-and-political-activity/climate-and-energy-transition-advocacy-updates.html ↩︎

Shell’s advocacy updates mention it has “engaged on CCS through industry associations including the China Petroleum and Chemical Industry Federation (CPCIF) and the Administrative Centre for China’s Agenda 21 (ACCA21).” It is unclear if Shell considers ACCA21 an industry association. ACCA21 is a government organisation “affiliated to the Ministry of Science and Technology of China” which cooperates with international organisations, researchers and the private sector. https://www.acca21.org.cn/trs/00010019/9833.html ↩︎

Business Standard, Shell to set up LNG stations, bullish on gas market in India https://www.business-standard.com/article/companies/shell-to-set-up-lng-stations-bullish-on-gas-market-in-india-122041000227_1.html ↩︎

Shell, LNG Outlook 2024, p.31 https://www.shell.com/what-we-do/oil-and-natural-gas/liquefied-natural-gas-lng/lng-outlook-2024/_jcr_content/root/main/section_125126292/promo_copy_copy_copy/links/item0.stream/1709628426006/3a2c1744d8d21d83a1d4bd4e6102dff7c08045f7/master-lng-outlook-2024-march-final.pdf ↩︎

Shell, LNG Outlook 2024, pp.27 and 35 https://www.shell.com/what-we-do/oil-and-natural-gas/liquefied-natural-gas-lng/lng-outlook-2024/_jcr_content/root/main/section_125126292/promo_copy_copy_copy/links/item0.stream/1709628426006/3a2c1744d8d21d83a1d4bd4e6102dff7c08045f7/master-lng-outlook-2024-march-final.pdf; ACCR, Shell’s LNG strategy: Overcooked? https://www.accr.org.au/research/shell’s-lng-strategy-overcooked/ ↩︎

TotalEnergies, Review 2023 professional associations and chambers of commerce https://totalenergies.com/sites/g/files/nytnzq121/files/documents/2024-05/totalenergies_review-2023-professional-associations-chambers-commerce_2024_en_pdf.pdf and Review of Industry Associations 2023 https://totalenergies.com/sites/g/files/nytnzq121/files/documents/2024-05/TotalEnergies_industry-associations-review-2023_2024-05-06_en_pdf.pdf ↩︎

Shell, Climate and energy transition advocacy updates https://www.shell.com/sustainability/transparency-and-sustainability-reporting/advocacy-and-political-activity/climate-and-energy-transition-advocacy-updates.html#iframe=%2Fpolicy-tracker%2Fpolicy-tracker.html ↩︎

For example: Some associations Shell deems material enough to appear in advocacy updates are not in its association list, and vice versa. Similarly, Shell has assessed influential associations like the International Gas Union in annual reporting despite them not meeting the fee threshold. https://www.shell.com/sustainability/transparency-and-sustainability-reporting/advocacy-and-political-activity/our-work-with-industry-associations/industry-associations-and-similar-organisations-we-are-members-of.html ↩︎

For example: Shell only disclosed its membership of the Brazilian oil & gas association ABEP now, after adding Brazil to its lobbying reporting. BP reported membership of ABEP in 2021 because it met its apparently jurisdiction-agnostic fee threshold of $50,000. BP also discloses South African associations that Shell does not, despite Shell being a member of the same associations. TotalEnergies discloses and assesses several associations in emerging markets that Shell does not disclose, but that ACCR research found it is a member of. https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/sustainability/our-participation-in-trade-associations-climate-2021-progress-update.pdf ↩︎

For example: Equinor https://cdn.equinor.com/files/h61q9gi9/global/203f06b6a38cab59ed7afa60db308c9379f137e0.pdf?review-of-industry-association-2023-equinor.pdf and TotalEnergies lobbying disclosures https://totalenergies.com/sites/g/files/nytnzq121/files/documents/2024-05/TotalEnergies_industry-associations-review-2023_2024-05-06_en_pdf.pdf, and InfluenceMap’s list of associations for Shell. https://lobbymap.org/company/Royal-Dutch-Shell ↩︎

Shell, Climate and Energy Transition Lobbying Report 2022, p.28 https://reports.shell.com/climate-and-energy-transition-lobbying-report/2022/_assets/downloads/shell-climate-and-energy-transition-lobbying-report-2022.pdf ↩︎

Unilever, Climate Policy Engagement Review https://www.unilever.com/files/unilever-climate-policy-engagement-review.pdf ↩︎

InfluenceMap, Carbon Majors Entities https://carbonmajors.org/Entities ↩︎

InfluenceMap, LobbyMap Scores https://lobbymap.org/LobbyMapScores ↩︎

InfluenceMap, Corporate Policy Engagement Disclosure Scorecards ↩︎

InfluenceMap, LobbyMap Scores https://ca100.influencemap.org/lobbying-disclosures ↩︎

Transition Plan Taskforce, Disclosure Framework https://www.ifrs.org/content/dam/ifrs/knowledge-hub/resources/tpt/disclosure-framework-oct-2023.pdf ↩︎

Shell, Industry associations and similar organisations we are members of (methodology tab) https://www.shell.com/sustainability/transparency-and-sustainability-reporting/advocacy-and-political-activity/our-work-with-industry-associations/industry-associations-and-similar-organisations-we-are-members-of.html ↩︎

Shell, Corporate Political Engagement https://www.shell.com/sustainability/transparency-and-sustainability-reporting/advocacy-and-political-activity/our-work-with-industry-associations/_jcr_content/root/main/section_415829613/simple_264594392_cop/promo_copy/links/item0.stream/1651131955254/26cf11a209cf2d3cdcf3172b62dc4e3544d5158c/cpe-final-January-21-2021.pdf ↩︎