Investor Insight Investor Bulletin: What Japan’s new Strategic Energy Plan means for J-POWER

Japan’s 7th Strategic Energy Plan (SEP) marks a major shift in energy policy, with renewables targeted as the dominant energy source for the first time. But the SEP’s shortcomings mean that J-POWER will need to take proactive steps to improve the strength of its own transition plan.

Japan’s government has just approved the nation’s 7th Strategic Energy Plan (SEP), setting the course for medium to long-term energy policy. The SEP, which is produced by the Ministry of Economy, Trade and Industry (METI) and is updated approximately every three years, directly affects the short and long-term investment decisions of Japanese utility companies – J-POWER included.

Under the 7th SEP, renewables are forecast to become the largest contributor to the 2040 power generation mix, overtaking thermal power. This marks a major milestone in Japan’s energy transition.

However, low ambition targets don’t give J-POWER – currently a laggard on renewables - a strong enough signal that it needs to accelerate investment. Policy ambiguity around the coal decarbonisation technologies that J-POWER currently invests in further raises the risk profile of the company’s decarbonisation strategy.

Rather than waiting for the government to provide a more definitive and ambitious strategy for Japan’s energy industry, J-POWER can – and should – proactively pursue proven decarbonisation strategies, with a view to protecting long-term shareholder value and maintaining competitiveness as the energy transition gathers pace.

Key Points

Insufficient ambition on renewables

- The 7th SEP’s target for renewables’ share of the energy mix is 40-50% by FY2040, which is an increase of 17–27% from its current share of 22.9%[1] in FY2023. While this is a significant step forward – seeing renewables overtake thermal coal as the dominant power source for the first time – it is insufficient for meeting Japan’s COP28 pledge to triple renewable capacity by 2030 compared to 2022 levels.

- While J-POWER recognises the importance of renewable energy for its business and has a modest target for growing its renewable energy portfolio, it has so far fallen short of harnessing the potential of renewables as a primary decarbonisation tool. Notably, an undue focus on extending the life of coal-fired power plants is detracting from the necessary push to cleaner energy solutions. The insufficient ambition on renewables in the 7th SEP does not provide the strong signal that J-POWER needs to accelerate - raising the risk the company will fail to make progress in the near term.

Mixed signals on the role of technology to reduce emissions from thermal coal power

By keeping thermal power at 30-40% of the 2040 energy mix, the 7th SEP implies that thermal power will likely need to be nearly fully decarbonised with the use of hydrogen, ammonia co-firing and carbon capture and storage (CCS) if Japan is to achieve its target of a 73% emissions reduction by 2040. However:

- compared to the previous SEP, the 7th SEP does not have specific targets for hydrogen and ammonia as part of the energy mix (previously targeted for 1% by 2030)

- in the 7th SEP these technologies are primarily positioned as solutions for decarbonising hard-to-abate sectors, rather than reducing emissions from thermal power generation

- high cost also remains a factor, with METI’s estimates for 2040 generation costs showing that hydrogen, coal with CCS, and coal with ammonia co-firing are two to three times more expensive than solar and wind power.

J-POWER’s current decarbonisation strategy is to invest across a wide range of technologies to decarbonise its coal fleet, including hydrogen, ammonia co-firing and CCS - suggesting uncertainty about which will be pivotal for achieving the company’s target of net zero by 2050. The lack of clear policy direction for these technologies in the 7th SEP, and expected high costs, poses significant challenges for J-POWER – potentially diverting resources from proven decarbonisation technologies with lower costs.

Next steps for J-POWER

- J-POWER should prioritise adopting proven decarbonisation strategies that protect shareholder value. In particular, it should take steps to integrate flexibility retrofits into its coal plants - a proven decarbonisation strategy that also mitigates financial risks caused by increasing electricity price volatility as the capacity of renewables increases in the grid.

- J-POWER needs to evolve its Blue Mission 2050 plan to manage the risks of investments in ammonia, hydrogen and CCS – which are forecast to be more expensive than renewables and have limited decarbonisation potential.

- Given the importance of supportive public policy frameworks for meeting company decarbonisation goals and creating long-term shareholder value, J-POWER needs to demonstrate how its policy and government engagement activities are supporting the delivery of its strategy. Its current disclosures on policy are insufficient for investors to make this assessment and need to be improved in line with global standards.

1. Japan’s 7th Strategic Energy Plan (SEP) and submitted 2035 Nationally Determined Contribution (NDC)

Two vital frameworks that will guide Japanese energy policy over the medium to long-term have recently been published: the 7th Strategic Energy Plan (SEP) and the country’s 2035 Nationally Determined Contribution (NDC) submission.

The 7th SEP is an important component of Japan’s update of its NDC, the latter of which was recently submitted to the United Nations Framework Convention on Climate Change (UNFCCC) ahead of the UN Conference of the Parties 30 (COP30) in November 2025.

While both progress Japan along the path of national emissions reductions, neither are sufficient for what is required to be 1.5°C compatible, nor do they represent the highest possible ambition, as stipulated in article 4 of the Paris Agreement.[2],[3]

1.1 Japan’s 2035 NDC submission

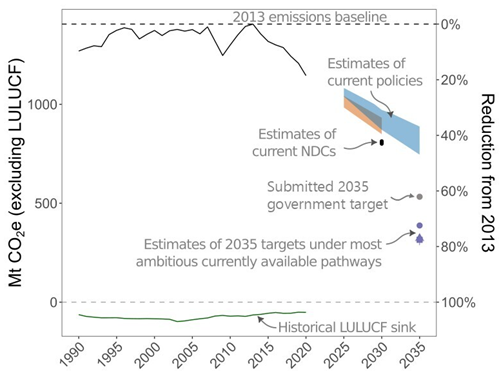

Japan’s submitted NDC sets emissions reduction targets of 60% by 2035, and 73% by 2040.

These proposed targets are far less than what highly ambitious scenarios consider plausible for a developed nation like Japan. The Paris Agreement asks for NDCs that reflect the “highest possible ambition”, with developed countries to take the lead given their different national circumstances.

For Japan’s submitted NDC to be compatible with 1.5°C-aligned domestic emissions reduction pathways, it needs to target at least a 70-78% emissions reduction by 2035.

Chart 1: Japan’s submitted 2035 NDC is not 1.5°C compatible or Paris-aligned[4],[5],[6]

Source: adapted from Climate Action Tracker and Network for Greening the Financial System (NGFS)

1.2 Japan’s 7th SEP

Under the 7th SEP, renewables are forecast to become the largest contributor to the 2040 power generation mix, marking a significant shift in Japan's energy policy.

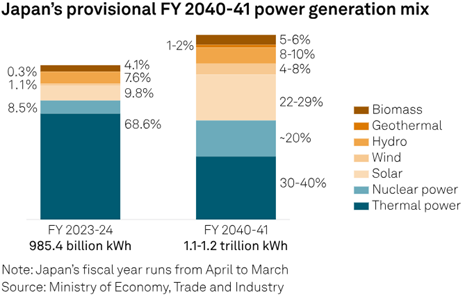

The target for renewable’s share of the energy mix is 40-50% by FY2040, which is an increase of 17–27% from its current share of 22.9% in FY2023.[7],[8]

However, given Japan’s endorsement of the COP28 pledge to triple renewable capacity by 2030 compared to 2022 levels, this target is not sufficient. It does not provide the necessary signal Japanese companies require to accelerate renewable buildout at a pace that meets the COP28 pledge – a target crucial for keeping the 1.5°C goal within reach.[9]

By FY2030, renewable energy is expected to reach a 36-38% share of the energy mix, which the International Energy Agency (IEA) estimates would translate to 187-201 GW of capacity.[10] This is just a 26-35% increase from 2022.[11]

The new 40-50% renewable target for FY2040 aims for 460-575 TWh[12] of generated electricity, which represents a 110-162% increase from 2022 levels.[13] This increase in generation volume is unlikely to translate to a tripling of renewable capacity, especially considering the COP28 pledge is meant to be achieved by 2030.

Chart 2: Renewable energy as the largest power source for the first time.

Source: S&P Global

2. Implications of the 7th SEP for J-POWER

While the new SEP sets higher renewable energy targets, the broad range of targets for each generation source could enable J-POWER to continue its non-committal approach to meaningful decarbonisation.

2.1 The broad renewable target makes room for low ambition on renewable capacity expansion

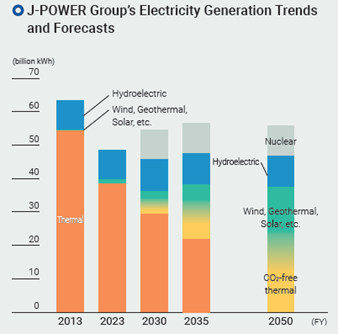

While J-POWER plans to expand its renewable energy generation in the coming decades (see Chart 3), the broad renewable target does not provide a sufficient signal for the company to make progress in the near term.

- The 7th SEP incorporates five different scenarios for the FY2040 energy outlook,[14] leading to wide ranges for various generation sources in the projected mix (Chart 2).

- The previous renewable energy target of 36-38% by FY2030 has been increased to 40-50% by FY2040[15] - requiring only a minimal 2% increase to reach the lower end of the FY2040 target.

Chart 3: J-POWER has not yet set its 2040 electricity generation forecast, but an increase in renewable generation and investments is expected

Source: J-POWER, Integrated Report 2024, p60.

2.2 The unclear role of thermal power sources in Japan’s 2040 energy mix may delay J-POWER’s transition of its coal fleet

The 7th SEP does not provide clarity on the future role of different thermal power sources in Japan’s FY2040 generation mix.

It outlines a target of 30-40% for thermal power by FY2040 (see Chart 2), down from 68.6% in FY2023.[16],[17] While the reduced reliance on thermal power aligns with global trends and is an encouraging step, the target range is too broad. Additionally, the new SEP does not include a breakdown of thermal power generation sources, such as coal, LNG, and oil, which differs from the 6th SEP’s approach.[18]

The absence of a defined roadmap for coal’s role in the FY2040 energy mix could delay critical decisions on retrofitting or decommissioning coal plants. It could also hinder J-POWER's ability to plan for its future generation asset portfolio, increasing the risk of stranded assets or uncompetitive operations.

2.3 Uncertainty for J-POWER amid vague targets and high costs of decarbonisation technologies

The SEP does not provide certainty around decarbonisation technologies such as hydrogen, ammonia co-firing, and carbon capture and storage (CCS). Each come with questions about their high costs and effectiveness, and all are part of J-POWER’s current decarbonisation strategy.

This uncertainty poses significant challenges for J-POWER, which is investing in a variety of decarbonisation technologies as part of its strategy and appears uncertain as to how it will achieve its own net zero by 2050 target.

Decarbonisation technologies

The SEP implies that thermal power will likely need to be nearly fully decarbonised with the use of hydrogen, ammonia co-firing and CCS if Japan is to achieve its 73% emissions reduction by 2040 target while retaining a 30-40% range of thermal power in the energy mix.[19],[20]

However, the new SEP also de-emphasises hydrogen and ammonia as decarbonisation solutions for thermal power and does not specify a 2040 target for their use. Further, while the previous SEP set a 1% energy use target for both technologies by 2030, the 7th SEP primarily positions hydrogen and ammonia as solutions for hard-to-abate sectors.[21] The viability of CCS also remains uncertain.[22]

The lack of clear long-term policy targets means that J-POWER’s investments in these technologies could become misaligned or inefficient because of an uncertain market environment, making it difficult to justify ongoing capital allocation.

Generation costs

METI's estimates for 2040 generation costs show that hydrogen (29.9 yen/kWh), coal with CCS (27.7 yen/kWh), and coal with 20% ammonia co-firing (27.3 yen/kWh) are among the most expensive generation sources, only after biomass. These technologies are projected to cost two to three times more than solar and wind power.[23]

This means that J-POWER may risk over-investing in technologies that are not cost-competitive in Japan’s evolving energy landscape, which could lead to inefficiencies and sunk costs.

3. How should J-POWER respond to the SEP?

Rather than waiting for the government to provide a more definitive and ambitious strategy for Japan’s energy industry, J-POWER should set a credible, clear strategy that aligns with the goals of the Paris Agreement, and proactively adopt proven decarbonisation strategies that protect shareholder value.

3.1 Adopting proven coal decarbonisation strategies

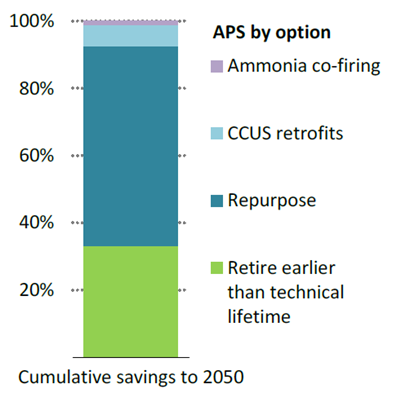

As outlined in our recently published research on coal flexibility retrofits, repurposing coal plants for flexibility is a proven strategy for decarbonising coal plants that also mitigates financial risks caused by increasing electricity price volatility as renewables capacity increases in the grid.[24]

The IEA has recommended since 2021 that Japan's newer and more efficient coal power plants should undergo retrofitting or repurposing to function as flexible energy sources, preventing them from becoming stranded assets.[25]

The IEA has also shown that the flexible use of repurposed coal plants will be the largest contributor to projected global CO2 emissions reductions through 2050 under the Announced Pledges Scenario (APS), accounting for 60%, with early retirements contributing the second-largest share at 33%.[26]

Chart 4: The repurposing of coal plants for flexibility is widely adopted under the IEA’s APS

Source: IEA

J-POWER can take proactive steps to integrate flexibility retrofits into its coal plants. This approach will help ensure that J-POWER addresses the long-term interests of shareholders by:

- utilising proven decarbonisation strategies and leveraging the experiences of other countries

- managing financial risks more effectively

- remaining adaptable amid policy uncertainties in Japan.

3.2 Disclose policy advocacy

J-POWER needs to demonstrate how its policy and government engagement activities are supporting the delivery of its decarbonisation goals and long-term shareholder value. This should include explanation not only of what policy the company is engaging with the government on, but also why this is important to its strategy, and what the outcomes of its engagements are. J-POWER’s current disclosures on policy are insufficient for investors to make this assessment, and need to be improved in line with global standards.

3.3 J-POWER’s Blue Mission 2050 strategy

The company also needs to show how its Blue Mission 2050 plan[27] will evolve to manage the risks of investments in ammonia, hydrogen and CCS; meet its decarbonisation goals; and remain competitive in Japan’s energy transition. As part of this evolution, J-POWER should ensure that Blue Mission is clear and credible by aligning with the goals of the Paris Agreement.

Key stewardship questions for investors

The following questions may help investors in their engagements with J-POWER:

- How does the new SEP change J-POWER's Blue Mission 2050 strategy and risk profile?

- How does J-POWER plan to achieve a commercial return on investments in hydrogen, ammonia and CCS, given their high projected generation costs for 2040 and the uncertainty of their role in coal decarbonisation?

- What steps is the company taking to retrofit coal plants for flexibility with proven technologies that can protect shareholder value, as outlined in our recently published research?

- How does J-POWER see its role in the buildout of renewable capacity in Japan?

- How does J-POWER engage with the Japanese government on key energy policy issues? What input did/does J-POWER have in the formation of the SEP and NDC?

- What steps is J-POWER taking to improve its disclosure of policy engagement and lobbying/advocacy activities, in line with global standards?

- How does J-POWER see its role in supporting countries where it owns assets to reduce their emissions? Does J-POWER engage with the Japanese Government to clarify what role the company has in supporting Japan to meet its fair share obligations under the Paris Agreement by supporting developing countries in reducing theirs?

Download a PDF of What Japan’s new Strategic Energy Plan means for J-POWER | 27/02/25

Please read the terms and conditions attached to the use of this site.

Preliminary value. ↩︎

UNFCCC, Paris Agreement, 2015. https://unfccc.int/sites/default/files/englishparis_agreement.pdf ↩︎

Climate Action Tracker, Japan 2035 NDC, Nov 2024. https://climateactiontracker.org/countries/japan/2035-ndc/ ↩︎

Japan’s historical national greenhouse gas emissions (GHGs) in black and estimated pathways under current policies in blue and orange (PBL and Climate Resource), excluding LULUCF emissions. Also shown Japan’s current 2030 NDC target and its submitted 2035 NDC target. Purple 2035 targets show the 70-78% targets that Japan should endorse to align with the highest possible ambition scenarios (Climate Action Tracker and NGFS). ↩︎

Climate Action Tracker, Japan 2035 NDC, Nov 2024 https://climateactiontracker.org/countries/japan/2035-ndc/ ↩︎

70-78% exclude LULUCF sink; NGFS, NGFS Phase 5 Scenario Explorer, accessed Jan 2025. https://data.ene.iiasa.ac.at/ngfs ↩︎

Preliminary value. ↩︎

METI, Outline of the Strategic Energy Plan (Japanese), Feb 2025, p9. https://www.enecho.meti.go.jp/category/others/basic_plan/pdf/20250218_02.pdf ↩︎

IEA, Tripling renewable power capacity by 2030 is vital to keep the 1.5°C goal within reach, Jul 2023. https://www.iea.org/commentaries/tripling-renewable-power-capacity-by-2030-is-vital-to-keep-the-150c-goal-within-reach ↩︎

IEA, COP28 Tripling Renewable Capacity Pledge, Jun 2024, p16. https://iea.blob.core.windows.net/assets/ecb74736-41aa-4a55-aacc-d76bdfd7c70e/COP28TriplingRenewableCapacityPledge.pdf ↩︎

149 GW of renewable capacity in 2022; BNEF, Historical capacity data by market and sector. https://www.bnef.com/capacity?region=jpn&= ↩︎

40-50% of the forecast generated electricity of 1,100-1,200 TWh for FY2040 (mid-point). ↩︎

Japan generated 1,010.6 TWh of electricity in FY 2022, and renewables accounted for 21.7% (219.3 TWh). ↩︎

METI, Energy Supply and Demand Outlook for FY 2040 (Related Materials) (Japanese), Feb 2025. ↩︎

METI, Outline of the Strategic Energy Plan (Japanese), Feb 2025, p9. https://www.enecho.meti.go.jp/en/category/others/basic_plan/pdf/6th_outline.pdf ↩︎

Preliminary value. ↩︎

METI, Outline of the Strategic Energy Plan (Japanese), Feb 2025, p9. https://www.enecho.meti.go.jp/en/category/others/basic_plan/pdf/6th_outline.pdf ↩︎

METI, Outline of the Strategic Energy Plan, Nov 2021, p12. (Japanese version) https://www.enecho.meti.go.jp/en/category/others/basic_plan/pdf/6th_outline.pdf ↩︎

The Institute of energy Economics, Japan, Japan Drafts 7th Strategic Energy Plan, Dec 2024 https://eneken.ieej.or.jp/data/12236.pdf ↩︎

Renewable Energy Institute, Comments from Renewable Energy Institute on the Government's Strategic Energy Plan Draft, Dec 2024. (Japanese version) https://www.renewable-ei.org/en/activities/reports/20241220.php ↩︎

Power Japan, Bird’s-Eye View of the Shifting Ground, Jan 2025. https://powerjapan.substack.com/p/birds-eye-view-of-the-shifting-ground?utm_source=post-email-title&publication_id=1311592&post_id=154579757&utm_campaign=email-post-title&isFreemail=true&r=26w6wx&triedRedirect=true&utm_medium=email ↩︎

Carbon Tracker, Curb your Enthusiasm: Bridging the gap between the UK’s CCUS targets and reality, Mar 2024, p14-15. https://carbontracker.org/reports/curb-your-enthusiasm/ ↩︎

METI, Energy supply and demand outlook for FY2040 (related materials) (Japanese), Feb 2025, p35 https://www.enecho.meti.go.jp/category/others/basic_plan/pdf/20250218_03.pdf ↩︎

ACCR, Investing in coal plant flexibility: A strategic approach for J-POWER’s transition, Dec 2024, p14. (Japanese version)https://www.accr.org.au/downloads/jpower_investing-in-coal-plant-flexibility_dec2024.pdf ↩︎

IEA, Innovation and market reform needed to drive Japan’s clean energy transition, IEA policy review finds, Mar 2021. https://www.iea.org/news/innovation-and-market-reform-needed-to-drive-japan-s-clean-energy-transition-iea-policy-review-finds ↩︎

IEA, Coal in Net Zero Transitions, Nov 2022, p66. https://iea.blob.core.windows.net/assets/4192696b-6518-4cfc-bb34-acc9312bf4b2/CoalinNetZeroTransitions.pdf ↩︎

J-POWER, J-POWER “BLUE MISSION 2050”, Feb 2021. https://www.jpower.co.jp/english/news_release/pdf/news210226_4.pdf ↩︎