Investor Insight Investor Bulletin: Woodside’s 2024 Annual Report and Climate Update

Woodside has released its 2024 Annual Report and Climate Update. In what will come as no surprise to those who’ve been following the remarkable intransigence of this company over the past five years, Woodside is doubling down on its high capex, high risk, fossil fuel growth strategy – despite chronic share price underperformance and a majority vote against its last climate plan.

Key takeaways

On the back of 82% lower free cash flow for the year, Woodside reduced its final dividend by 12%. Since the BHP Petroleum merger in 2022, Woodside has doubled its capex and halved its dividend. This bucks the industry trend to allocate more funds to shareholder returns relative to capex.

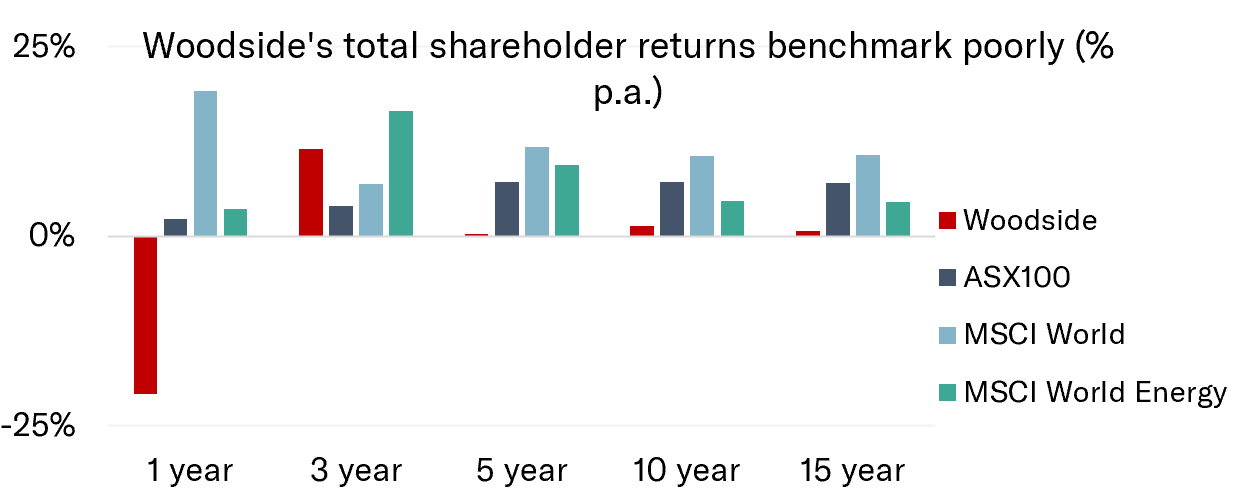

Woodside’s capital management framework is unchanged, despite Woodside having consistently underperformed both its peers and the market.[1]

Over 12 months, Woodside’s TSR has been -21%. Over 15 years it’s been 0.7% p.a.

In absolute terms over 15 years, Woodside delivered 168% lower TSR than the ASX100, 83% less than the MSCI World Energy index and 345% lower than the MSCI World index.

Over 15 years, even the US cash rate generated 11% higher returns than Woodside.

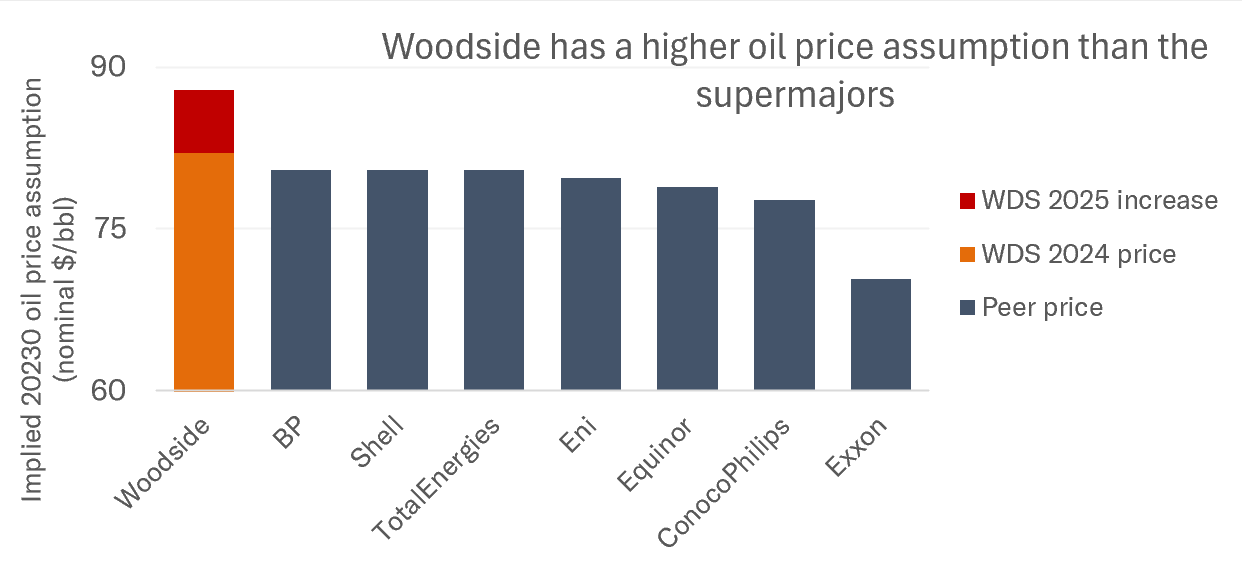

Despite claims of a “disciplined” capital allocation strategy, Woodside increased its oil price assumption from US$70 to US$78 per barrel. Its oil price assumption was already higher than every supermajor and this represents a further 7% increase.

The Annual Report highlights Sangomar as an example of “Woodside’s high-quality assets and disciplined execution”. However, Woodside is conflating a project that generates cash flow with one that creates shareholder value.

- Sangomar was 12 months late and 18% over its original US$4.2 billion budget.

- Woodside also spent over US$1 billion across 2016 and 2020, acquiring its current 82% share of Sangomar, despite trying to sell down from its original stake.

- We estimate that Sangomar eroded US$835 million in shareholder value on a 2016 NPV basis (the year of Woodside’s initial investment)[2].

Despite the majority (58%) of shareholders voting against Woodside’s Climate Transition and Action Plan (CTAP) at the 2024 AGM, the Climate Update released alongside the Annual Report contains no material changes to strategy.

The Chair, Richard Goyder, is still reiterating the company’s commitment to the strategy, whilst promising more engagement: “We take very seriously the concerns expressed through our shareholder vote on Woodside’s Climate Transition Action Plan. While confident in our strategy and proud of our progress, we will continue to engage deeply and frequently with all investors to ensure your feedback informs our approach.”[3]

In a recent Woodside report, “Climate-related Investor Engagement”, the company attempted to downplay the significance of receiving a majority vote against its climate plan last year, by including in its analysis votes which were not cast: Richard Goyder and Woodside bathe in absent votes.[4] Whilst this can be seen as an immaterial public relations exercise by Woodside, it is symptomatic of a deeper governance problem, which is a persistent refusal to accept that the strategy does not have the support of the market.

Download a PDF of Investor Bulletin: Woodside’s 2024 Annual Report and Climate Update | 26/02/25

Please read the terms and conditions attached to the use of this site.

USD TSR for year(s) ending 31 December 2024 | WDS | ASX100 | MSCI World | MSCI World Energy | US cash rate |

|---|---|---|---|---|---|

1 year (% p.a.) | -20.8% | 2.3% | 19.2% | 3.7% | 5.4% |

3 years (% p.a.) | 11.5% | 4.0% | 6.9% | 16.6% | 4.1% |

5 years (% p.a.) | 0.2% | 7.1% | 11.7% | 9.3% | 2.6% |

10 years (% p.a.) | 1.3% | 7.2% | 10.5% | 4.6% | 1.9% |

15 years (% p.a.) | 0.7% | 7.1% | 10.7% | 4.5% | 1.4% |

15 years (%) | 10.9% | 179.0% | 356.7% | 93.6% | 22% |

15 years (% absolute outperformance to WDS) | 168.2% | 345.8% | 82.7% | 11% |

TSR values calculated on a US$ basis for the year(s) ending 31 December, 2024. US cash rate is based on the US Federal Reserve bank’s interest rate. Data sourced from Bloomberg Finance L.P.; used with permission of Bloomberg Finance L.P. See above for a more detailed data table. ↩︎

NPV calculated based on asset model from Rystad Energy, including capex costs as per Rystad, acquistion costs as per WDS disclosures, a discount rate adjusted for country risk (14%) and a forward price deck. Removing the country risk premium (by using a 10% discount rate) results in the project having eroded US$515 million on a 2016 NPV basis. ↩︎

annual-report-2024.pdf p.11 https://www.woodside.com/docs/default-source/investor-documents/major-reports-(static-pdfs)/2024-annual-report/annual-report-2024.pdf?sfvrsn=b48b241c_2 ↩︎

https://www.woodside.com/docs/default-source/investor-documents/major-reports-(static-pdfs)/2024-annual-report/climate-update-2024.pdf ↩︎