Investor Insight Newsletter: science-based stewardship - April 2025

This is an excerpt from our April newsletter. Subscribe to receive our latest research, insights and updates directly to your inbox.

While the current geopolitical environment is at times alarming, it is worth remembering that navigating change is an inherent part of investing. While new political and market dynamics will emerge, fiduciary obligations to mitigate systemic market risks remain.

It was encouraging to see the recent Asset Owner Statement on Climate Stewardship. Signed by a coalition of asset owners with US$1.5tn under management, it asks asset managers to urgently develop robust stewardship strategy addressing climate-related risks and financial market resilience. The importance of resilience was also recently highlighted by Norges Bank Investment Management (NBIM) CEO, Nicolai Tangen, who said;

"Being a responsible investor is about contributing to value creation today, in ten years, fifty years, and one hundred years."[1]

A focus on understanding the climate science is essential for investors seeking to fulfil their fiduciary duty to mitigate systemic market risks. For example, two new studies have found that even if stringent emissions reduction begin now, the earth is still likely to cross the 1.5°C threshold. This raises the question; Is your institution factoring the consequences of 1.5°C overshoot into its decision making?

As Dr Sarah Kapnick, former Science Chief at the US National Oceanic and Atmospheric Administration (NOAA), said in her first note as Head of Climate Advisory at J.P. Morgan, we must rethink risk paradigms with a forward-looking approach from now on. Past data will not accurately predict future climate risks.

“Continuing with static thinking based on experience alone will make it difficult to identify emerging climate risks and accurately price them in and will make it harder to identify opportunities to lead in response to these risks.”[2]

Responsible investors need to be factoring in and pricing emerging climate risks. As fiduciaries, investors need to focus on understanding and quantifying the scale of the cost where possible, and deploying other strategies where quantification falls short.

Key to stewardship needs to be the understanding – based on irrefutable science – that increasing the pace of fossil fuel phase out is the best way to manage the future risks of extreme weather and tipping points.

Science-based stewardship

Dimitri Lafleur, ACCR Chief Scientist

The impacts of climate change are not waiting for anyone. The last three months have shown why governments, companies and investors all need to be working towards the Highest Possible Ambition as agreed in the Paris Agreement.

December 2024, Los Angeles wildfires. A World Weather Attribution study showed that climate change has already made a wildfire disaster in Los Angeles 35% more likely, and the area could be on the hook for similar extreme fire weather conditions within 17 years.[3] The event resulted in:

January 2025, the world reached a record 1.75°C above the pre-industrial monthly average. In the same month, climate scientists developed an explanation for the “gob-smackingly bananas”[7] heat the world experienced in 2023[8] - showing how a lack of low hanging clouds increases the amount of radiation that hits the earth’s surface. This is especially pertinent for ocean temperatures, since 70% of the earth is covered with water (a dark surface),indicating that more radiation is being absorbed by the oceans. Scientists are still assessing whether this is a positive feedback loop (more warming ? less low hanging clouds cover ? more warming), and the extent to which aerosol reduction regulation is a contributing factor.[9]

A study[10] shows that glacier melting around the world is accelerating, faster than ever recorded, with melting over the last decade more than a third faster than the decade prior.

- melting from Alaska, Canada & Greenland represents 55% of the total alone

- in slightly more than 20 years, New Zealand has lost almost a third of its glaciers

- January’s records were followed by the lowest ever levels of sea ice extent in February and March.[11]

The findings are significant because glaciers contribute some 20% to global sea rise. Since 2000, global sea level has risen over 6 cm, and the rate is accelerating: last decade’s rate of rise was double of the rate of the 20th century.[12]

A final note: Warming over the last 15 years was at least 50% faster (around 0.3°C/decade) than the 35 years prior (0.18°C/decade).[13] This, more than ever, is a call for the strongest mitigation possible.

Question of the Quarter: How should investors navigate the inherent uncertainties associated with pricing physical climate risk?

Harriet Kater, Impact Lead

Investors are rightly seeking to enhance their understanding of the costs that climate damages will impose upon their portfolios under different scenarios. For some, this is driven in part by mandatory climate disclosure obligations.

Placing heavy emphasis on the need to quantify all aspects of potential climate change damage does introduce the real risk of false precision due to the sheer complexity of the task.[14] There is also growing recognition that quantitative scenarios do not effectively model all complex, cascading climate impacts, and an emerging view that complementary qualitative methods should also be deployed alongside quantification efforts.[15]

The updated Network for Greening the Financial System (NGFS) scenarios

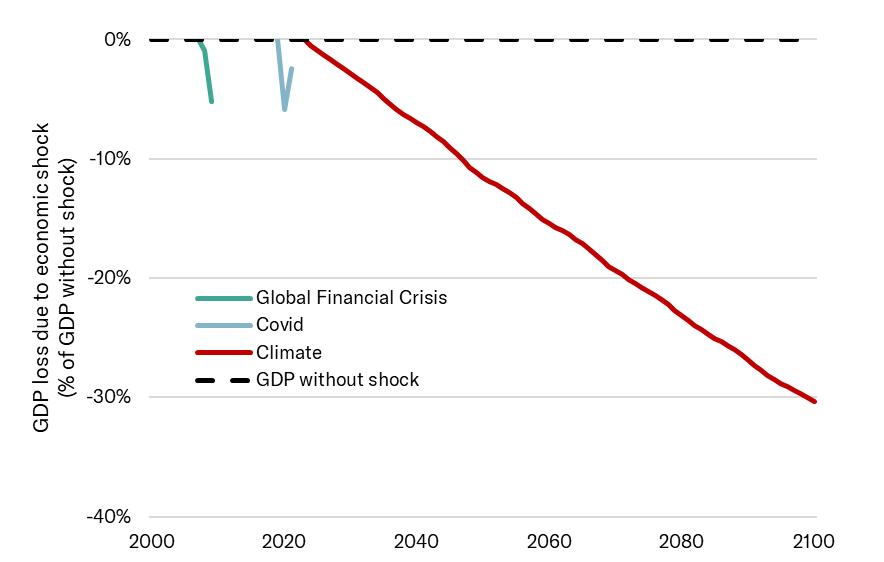

Based upon current commitments and policies, we are on track for nearly 3°C of warming by 2100.[16] The recently updated NGFS scenarios conclude that a 3°C current policies scenario will drive economic losses of 15% global GDP by 2050 and 30% by 2100.

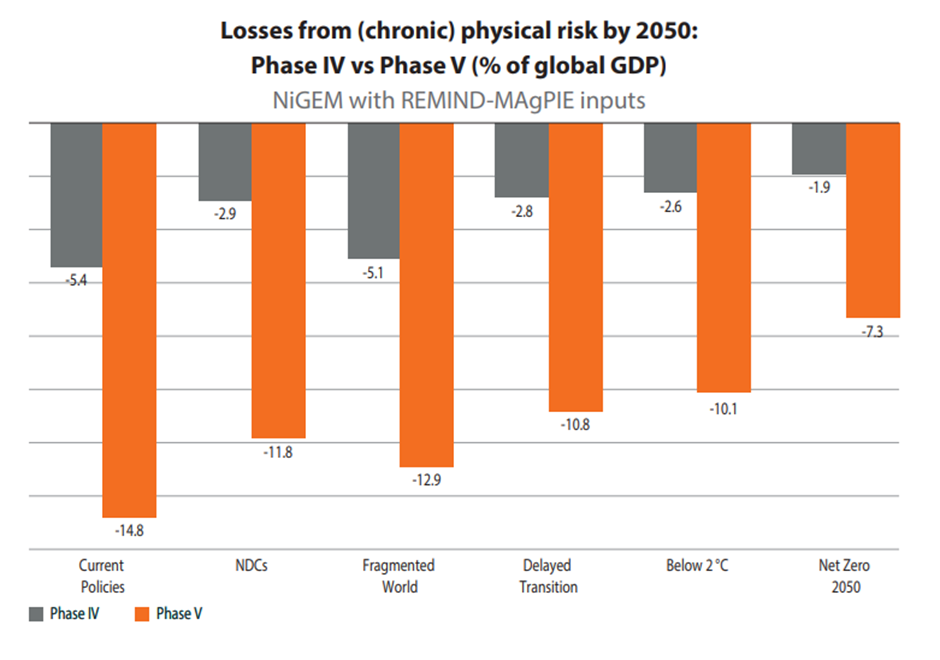

These estimates use an updated damage function, based upon the 2024 Kotz et al. paper in Nature, and while the losses are materially larger than previous NGFS scenarios (see Chart 1), the NGFS itself acknowledges that they remain uncertain and incomplete:

“While the NGFS scenarios are constantly improved, the uncertainty and limitations of climate and economic modelling remain high. For instance, tipping points are not represented in the NGFS scenarios.”[17]

Even with the knowledge that the updated NGFS damage function is incomplete, there is no denying that the results are material. As Chart 2 shows, calculated damages from a 3°C pathway will have a larger GDP impact than any major 21st century black swan event these impacts last indefinitely.

The recent Boston Consulting Group and University of Cambridge report, Landing the Economic Case for Climate Action with Decision Makers, calculated damages of a comparable magnitude to the NGFS under a 3°C pathway. The authors also concluded that losses are likely underestimated, in part, because;

“Current economic models are not sophisticated enough to capture the compounding economic damages of climate change... or account for spillover effects across countries and regions.”[18]

When considering and responding to these complexities, investors can:

- Build the climate science literacy of portfolio managers, trustees and boards so there is an enhanced base level knowledge of climate science and an ability to comprehend the known risks and existing blind spots of climate and economic models.

- Absorb the significance of current cost estimates but also deploy the precautionary principle in company and policy stewardship with the knowledge that these estimates are incomplete.

- Explore other strategies to fill the gaps where quantification of risk is unfeasible, such as the use of qualitative scenarios and storylines.[19]

ACCR is doing more work in this area, please reach out if you would like to discuss.

https://www.nbim.no/en/news-and-insights/reports/2024/responsible-investment-2024/web-report-responsible-investment-2024/ ↩︎

https://www.jpmorgan.com/content/dam/jpm/cib/documents/Building_intuition_for_strategic_decision_making.pdf ↩︎

https://www.worldweatherattribution.org/wp-content/uploads/WWA-scientific-report-LA-wildfires.pdf ↩︎

https://www.latimes.com/business/story/2025-01-24/estimated-cost-of-fire-damage-balloons-to-more-than-250-billion ↩︎

https://hbr.org/2025/01/the-la-fires-could-change-the-insurance-industry ↩︎

https://www.munichre.com/en/company/media-relations/media-information-and-corporate-news/media-information/2025/natural-disaster-figures-2024.html#-1537950557 ↩︎

https://www.tandfonline.com/doi/full/10.1080/00139157.2025.2434494 ↩︎

https://nsidc.org/sea-ice-today/sea-ice-tools/charctic-interactive-sea-ice-graph ↩︎

https://www.climate.gov/news-features/understanding-climate/climate-change-global-sea-level#:~:text=Global average sea level has,(13 feet)%20by%202150 ↩︎

https://www.carbonbrief.org/factcheck-why-the-recent-acceleration-in-global-warming-is-what-scientists-expect/ ↩︎

https://greenfuturessolutions.com/wp-content/uploads/2023/09/No-Time-To-Lose-New-Scenario-Narratives-for-Action-on-Climate-Change-Full-Report.pdf ↩︎

https://www.ngfs.net/system/files/import/ngfs/medias/documents/ngfs_scenarios_main_presentation.pdf ↩︎

http://web-assets.bcg.com/a1/fc/811b182f481fbe039d51776ec172/landing-the-economic-case-for-climate-action-with-decision-makers-wo-spine-mar-2025.pdf ↩︎