Stay Informed

Get email updates about new ACCR research and shareholder advocacy on specific topics of interest to you.

Sign UpACCR has filed members' statements with Woodside Energy Group (ASX:WDS) against the re-election of Ann Pickard, Ben Wyatt and Anthony O’Neill.

These resolutions will be voted on at Woodside Energy's AGM on Thursday 8 May 2025.

Last year’s 58% vote against Woodside’s Climate Transition Action Plan (CTAP) is the world’s only majority vote against a company climate plan. In response, the Board has not altered its strategy. This is a repetition of Woodside’s persistent failure to respond to material shareholder votes around climate risk management. In addition, Woodside has significantly and chronically underperformed relative to the local market and the global oil and gas sector. Downplaying strong investor feedback and persisting with a flawed strategy raises serious governance concerns.

Woodside’s directors share collective responsibility for the company’s failings. As Sustainability Committee chair since 2017, having oversight of climate plans which have received successive record-breaking votes against, Ann Pickard bears additional responsibility. A vote against her re-election is warranted.

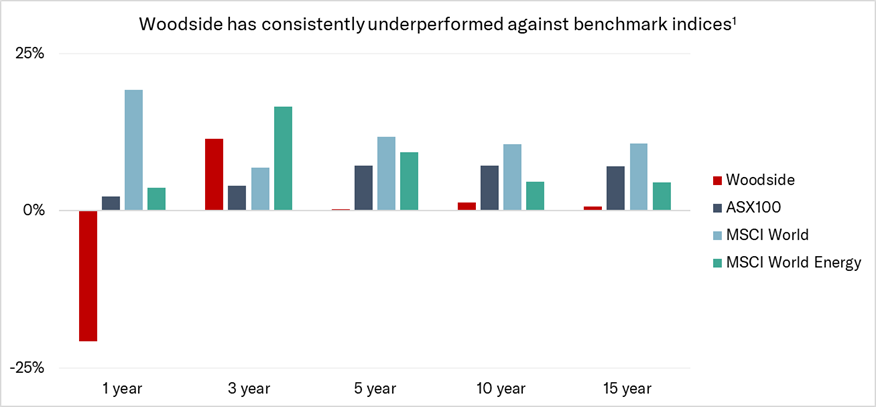

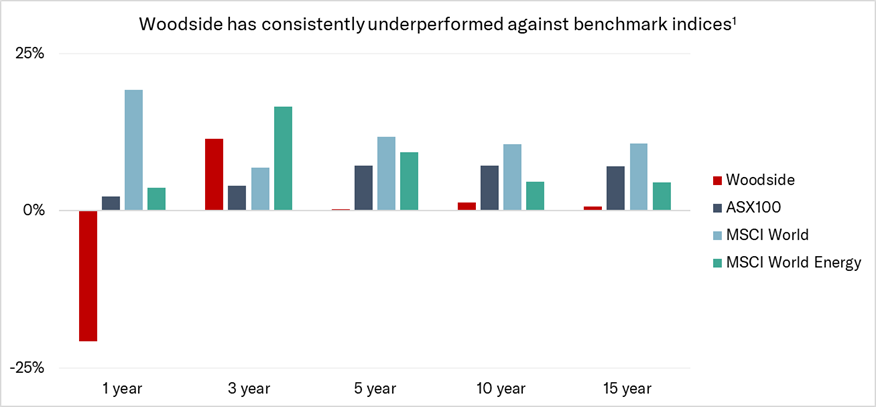

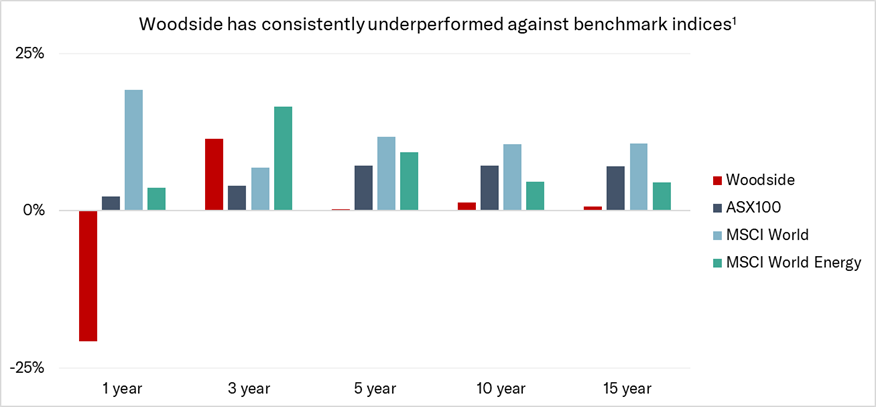

Woodside’s total shareholder return (TSR) in 2024 was -21%[1], (US$ basis). This continues a trend of material long term underperformance: over a 15-year period it delivered just 0.7% p.a. TSR. Woodside’s TSR also benchmarks poorly. Over five, ten and 15 years respectively, its absolute TSR was 40%, 86% and 168% lower than the ASX100. Whilst the Ukraine war did trigger stronger returns, Woodside still lags its sector: over one, three, five, ten and 15 years respectively, it delivered returns 24%, 20%, 55%, 43% and 83% lower than the MSCI Global Energy index.

Despite lacklustre returns, Woodside persists with a hydrocarbon growth strategy, progressing marginal projects abetted by a flawed capital allocation framework.

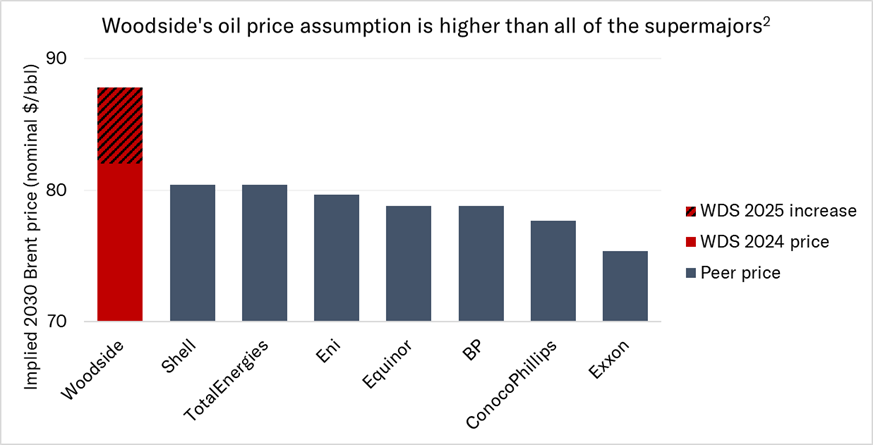

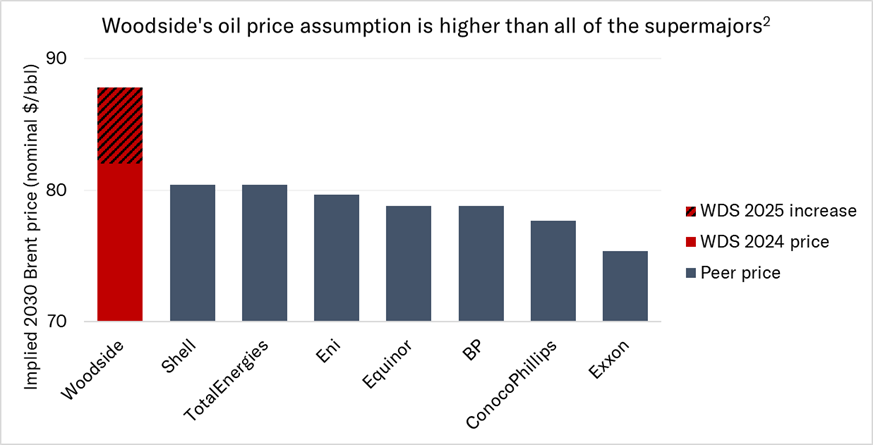

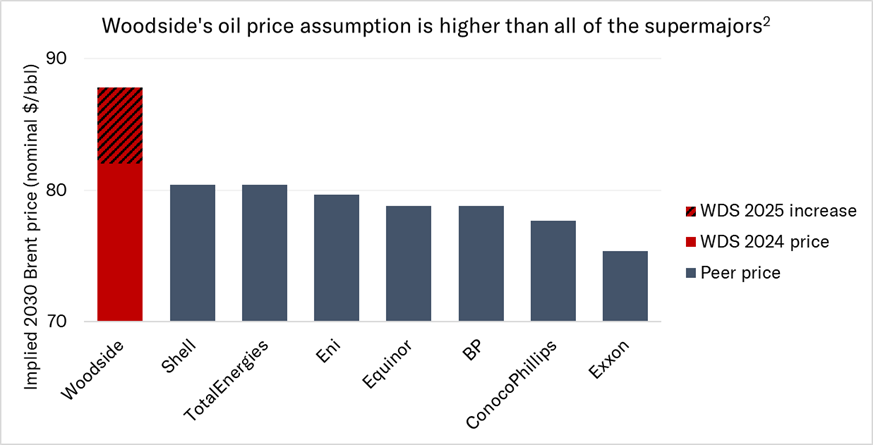

Woodside has a higher oil price assumption than many of its peers including BP, Chevron, ConocoPhillips, Eni, ExxonMobil, Equinor, Shell and TotalEnergies.[2] This year Woodside increased it by a further 7%.

Assuming higher revenue without higher hurdle rates risks Woodside sanctioning marginal projects, which would not meet some peers’ minimum return thresholds. For example, ACCR analysis suggested most peers (with disclosed hurdle rates or Return on Capital Employed targets) would not have invested in Trion due to either lower oil price assumptions, or higher hurdle rates.[3]

Woodside has increased its exposure to high-cost, pre-FID assets. When Woodside acquired Louisiana LNG in 2024, its business case appeared weak – higher cost than 76% of other US LNG projects[4], relying on operating the asset more effectively than the previous owner could, and a cross-subsidy from trading revenue.[5]

Woodside is persevering with Browse which is more expensive than 70% of other pre-FID gas projects globally.[6] Woodside spent over $800m[7] on the project from 2010-16, after which it stopped separately disclosing the project’s costs. This means that Browse has cost more than double KPMG’s independent valuation in 2022.[8] Shell divested its stake in 2023, because “in comparison with some of the other opportunities [Shell] had… it did not rank from a returns perspective. It was also disadvantaged from a carbon perspective.”[9]

Woodside’s poor record of project execution further raises risks associated with sanctioning new oil and gas projects. Its last completed major greenfields projects, Pluto[10] and Sangomar,[11] were both late and over-budget.

The Board’s capital allocation framework supports hydrocarbon production growth, which in recent years has included high-cost, high-carbon, low-value projects that have contributed to Woodside’s financial underperformance.

ACCR research[12] indicates that prior to the FY24 acquisitions, share buy-backs would generate an estimated 22% more value than executing Woodside’s pre-FID projects.

Some peers have recently adjusted their capital allocation frameworks to increase shareholder returns, including Santos, which has reduced its production guidance and is implementing a “capital ceiling”.[13]

Since the BHP Petroleum merger in 2022, Woodside has doubled its capex and halved its dividend.[14]

Woodside’s first climate plan in 2021 was voted against by 49% of investors; in 2024, this rose to 58% against.

From 2021-2025, Woodside added disclosures but has not substantively addressed investors’ climate concerns, including:

Despite the majority vote against its CTAP and five years of escalating feedback, the Board’s response has largely been to restate the existing strategy and hold more engagements with investors. Woodside still has no credible plan to become Paris-aligned and its CTAP does not have market support.

Because of the Board’s ongoing failure to manage climate risk and Woodside’s chronically poor shareholder returns, a vote against all directors is warranted.

Last year’s 58% vote against Woodside’s Climate Transition Action Plan (CTAP) is the world’s only majority vote against a company climate plan. In response, the Board has not altered its strategy. This is a repetition of Woodside’s persistent failure to respond to material shareholder votes around climate risk management. In addition, Woodside has significantly and chronically underperformed relative to the local market and the global oil and gas sector. Downplaying strong investor feedback and persisting with a flawed strategy raises serious governance concerns.

Woodside’s directors share collective responsibility for the company’s failings. Having sat on the Sustainability Committee for two years until December 2023, Ben Wyatt shares responsibility for the climate plan. As current chair of the Audit and Risk Committee his responsibilities include oversight of climate risk. A vote against his re-election is warranted.

Woodside’s total shareholder return (TSR) in 2024 was -21%[1:1], (US$ basis). This continues a trend of material long term underperformance: over a 15-year period it delivered just 0.7% p.a. TSR. Woodside’s TSR also benchmarks poorly. Over five, ten and 15 years respectively, its absolute TSR was 40%, 86% and 168% lower than the ASX100. Whilst the Ukraine war did trigger stronger returns, Woodside still lags its sector: over one, three, five, ten and 15 years respectively, it delivered returns 24%, 20%, 55%, 43% and 83% lower than the MSCI Global Energy index.

Despite lacklustre returns, Woodside persists with a hydrocarbon growth strategy, progressing marginal projects abetted by a flawed capital allocation framework.

Woodside has a higher oil price assumption than many of its peers including BP, Chevron, ConocoPhillips, Eni, ExxonMobil, Equinor, Shell and TotalEnergies.[2:1] This year Woodside increased it by a further 7%.

Assuming higher revenue without higher hurdle rates risks Woodside sanctioning marginal projects, which would not meet some peers’ minimum return thresholds. For example, ACCR analysis suggested most peers (with disclosed hurdle rates or Return on Capital Employed targets) would not have invested in Trion due to either lower oil price assumptions, or higher hurdle rates.[3:1]

Woodside has increased its exposure to high-cost, pre-FID assets. When Woodside acquired Louisiana LNG in 2024, its business case appeared weak – higher cost than 76% of other US LNG projects[4:1], relying on operating the asset more effectively than the previous owner could, and a cross-subsidy from trading revenue.[5:1]

Woodside is persevering with Browse which is more expensive than 70% of other pre-FID gas projects globally.[6:1] Woodside spent over $800m[7:1] on the project from 2010-16, after which it stopped separately disclosing the project’s costs. This means that Browse has cost more than double KPMG’s independent valuation in 2022.[8:1] Shell divested its stake in 2023, because “in comparison with some of the other opportunities [Shell] had… it did not rank from a returns perspective. It was also disadvantaged from a carbon perspective.”[9:1]

Woodside’s poor record of project execution further raises risks associated with sanctioning new oil and gas projects. Its last completed major greenfields projects, Pluto[10:1] and Sangomar,[11:1] were both late and over-budget.

The Board’s capital allocation framework supports hydrocarbon production growth, which in recent years has included high-cost, high-carbon, low-value projects that have contributed to Woodside’s financial underperformance.

ACCR research[12:1] indicates that prior to the FY24 acquisitions, share buy-backs would generate an estimated 22% more value than executing Woodside’s pre-FID projects.

Some peers have recently adjusted their capital allocation frameworks to increase shareholder returns, including Santos, which has reduced its production guidance and is implementing a “capital ceiling”.[13:1]

Since the BHP Petroleum merger in 2022, Woodside has doubled its capex and halved its dividend.[14:1]

Woodside’s first climate plan in 2021 was voted against by 49% of investors; in 2024, this rose to 58% against.

From 2021-2025, Woodside added disclosures but has not substantively addressed investors’ climate concerns, including:

Despite the majority vote against its CTAP and five years of escalating feedback, the Board’s response has largely been to restate the existing strategy and hold more engagements with investors. Woodside still has no credible plan to become Paris-aligned and its CTAP does not have market support.

Because of the Board’s ongoing failure to manage climate risk and Woodside’s chronically poor shareholder returns, a vote against all directors is warranted.

Last year’s 58% vote against Woodside’s Climate Transition Action Plan (CTAP) is the world’s only majority vote against a company climate plan. In response, the Board has not altered its strategy. This is a repetition of Woodside’s persistent failure to respond to material shareholder votes around climate risk management. In addition, Woodside has significantly and chronically underperformed relative to the local market and the global oil and gas sector. Downplaying strong investor feedback and persisting with a flawed strategy raises serious governance concerns.

Woodside’s directors share collective responsibility for the company’s failings. Tony O’Neill has sat on the Sustainability Committee since his appointment in June 2024, and therefore shares responsibility for the Board’s response to the majority vote against the climate plan. A vote against his election is warranted.

Woodside’s total shareholder return (TSR) in 2024 was -21%[1:2], (US$ basis). This continues a trend of material long term underperformance: over a 15-year period it delivered just 0.7% p.a. TSR. Woodside’s TSR also benchmarks poorly. Over five, ten and 15 years respectively, its absolute TSR was 40%, 86% and 168% lower than the ASX100. Whilst the Ukraine war did trigger stronger returns, Woodside still lags its sector: over one, three, five, ten and 15 years respectively, it delivered returns 24%, 20%, 55%, 43% and 83% lower than the MSCI Global Energy index.

Despite lacklustre returns, Woodside persists with a hydrocarbon growth strategy, progressing marginal projects abetted by a flawed capital allocation framework.

Woodside has a higher oil price assumption than many of its peers including BP, Chevron, ConocoPhillips, Eni, ExxonMobil, Equinor, Shell and TotalEnergies.[2:2] This year Woodside increased it by a further 7%.

Assuming higher revenue without higher hurdle rates risks Woodside sanctioning marginal projects, which would not meet some peers’ minimum return thresholds. For example, ACCR analysis suggested most peers (with disclosed hurdle rates or Return on Capital Employed targets) would not have invested in Trion due to either lower oil price assumptions, or higher hurdle rates.[3:2]

Woodside has increased its exposure to high-cost, pre-FID assets. When Woodside acquired Louisiana LNG in 2024, its business case appeared weak – higher cost than 76% of other US LNG projects[4:2], relying on operating the asset more effectively than the previous owner could, and a cross-subsidy from trading revenue.[5:2]

Woodside is persevering with Browse which is more expensive than 70% of other pre-FID gas projects globally.[6:2] Woodside spent over $800m[7:2] on the project from 2010-16, after which it stopped separately disclosing the project’s costs. This means that Browse has cost more than double KPMG’s independent valuation in 2022.[8:2] Shell divested its stake in 2023, because “in comparison with some of the other opportunities [Shell] had… it did not rank from a returns perspective. It was also disadvantaged from a carbon perspective.”[9:2]

Woodside’s poor record of project execution further raises risks associated with sanctioning new oil and gas projects. Its last completed major greenfields projects, Pluto[10:2] and Sangomar,[11:2] were both late and over-budget.

The Board’s capital allocation framework supports hydrocarbon production growth, which in recent years has included high-cost, high-carbon, low-value projects that have contributed to Woodside’s financial underperformance.

ACCR research[12:2] indicates that prior to the FY24 acquisitions, share buy-backs would generate an estimated 22% more value than executing Woodside’s pre-FID projects.

Some peers have recently adjusted their capital allocation frameworks to increase shareholder returns, including Santos, which has reduced its production guidance and is implementing a “capital ceiling”.[13:2]

Since the BHP Petroleum merger in 2022, Woodside has doubled its capex and halved its dividend.[14:2]

Woodside’s first climate plan in 2021 was voted against by 49% of investors; in 2024, this rose to 58% against.

From 2021-2025, Woodside added disclosures but has not substantively addressed investors’ climate concerns, including:

Despite the majority vote against its CTAP and five years of escalating feedback, the Board’s response has largely been to restate the existing strategy and hold more engagements with investors. Woodside still has no credible plan to become Paris-aligned and its CTAP does not have market support.

Because of the Board’s ongoing failure to manage climate risk and Woodside’s chronically poor shareholder returns, a vote against all directors is warranted.

Please read the terms and conditions attached to the use of this site.

TSR values calculated on a US$ basis for year(s) ended 31 December 2024. Bloomberg Finance LP, Used with permission of Bloomberg Finance LP. Raw data available at https://www.accr.org.au/downloads/wds-analysis update-2025.pdf ↩︎ ↩︎ ↩︎

Raw data and references at https://www.accr.org.au/downloads/wds-analysis update-2025.pdf ↩︎ ↩︎ ↩︎

https://www.accr.org.au/downloads/whats-next-for-woodside_01082024.pdf, pp 19-20 ↩︎ ↩︎ ↩︎

https://www.accr.org.au/downloads/whats-next-for-woodside_01082024.pdf, p15 ↩︎ ↩︎ ↩︎

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02830204-6A1216709&v=4015c7b87631faf94ecd96975272ff9ad5cb14c3, p8 ↩︎ ↩︎ ↩︎

https://www.accr.org.au/downloads/whats-next-for-woodside_01082024.pdf, p6 ↩︎ ↩︎ ↩︎

2010-2012: https://announcements.asx.com.au/asxpdf/20100902/pdf/31s942mnc6b4db.pdf. 2012-2016: Woodside annual reports. ↩︎ ↩︎ ↩︎

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02508781-6A1086006?access_token=83ff96335c2d45a094df02a206a39ff4, p109 ↩︎ ↩︎ ↩︎

Shell CEO. Cited in https://www.smh.com.au/business/companies/poor-returns-high-co2-forced-shell-s-hand-on-woodside-s-browse-lng-20230524-p5daru.html\ ↩︎ ↩︎ ↩︎

https://www.accr.org.au/downloads/accr_lnggrowthwave_271123.pdf, p7 ↩︎ ↩︎ ↩︎

https://www.accr.org.au/downloads/wds_growthportfolio_20230821.pdf, p13 ↩︎ ↩︎ ↩︎

https://www.accr.org.au/downloads/whats-next-for-woodside_01082024.pdf, pp 30-31 ↩︎ ↩︎ ↩︎

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02882248-2A1562754, p35 ↩︎ ↩︎ ↩︎

ACCR analysis of Woodside’s 2022 and 2024 Annual Reports and Q4 2024 report. ↩︎ ↩︎ ↩︎

Relative to Woodside’s 2024 emissions. Assuming FID of trains 1-3 and 50% sell down. Emissions from all trains with no sell down would reflect a 91% increase. ↩︎ ↩︎ ↩︎

ACCR analysis of https://www.woodside.com/sustainability/sustainability-databook/climate-data-table and https://www.woodside.com/docs/default-source/investor-documents/major-reports-(static-pdfs)/2024-annual-report/climate-update-2024.pdf?sfvrsn=6fd6a2bd_5 ↩︎ ↩︎ ↩︎

ACCR analysis of https://www.woodside.com/docs/default-source/investor-documents/major-reports-(static-pdfs)/2024-annual-report/annual-report-2024.pdf?sfvrsn=b48b241c_2, p260; https://announcements.asx.com.au/asxpdf/20250122/pdf/06dqxj5681qm8n.pdf, p15; https://www.woodside.com/docs/default-source/investor-documents/major-reports-(static-pdfs)/2024-annual-report/climate-update-2024.pdf?sfvrsn=6fd6a2bd_5, p3 ↩︎ ↩︎ ↩︎