Shareholder Resolution

Shareholder Resolution to Equinor on assessment of consistency of Company strategy

This resolution was filed by Sampension, Folksam and the Australasian Centre for Corporate Responsibility (ACCR).

This page contains the resolution and supporting statements.

Resolution

Request for Board assessment of consistency of Company strategy with shareholder expectations of Paris Agreement alignment.

Minority shareholders have an interest in understanding, from the Board’s perspective, material inconsistencies between the Company’s strategy and formal expectations set by the majority shareholder.

At the 2023 Annual General Meeting, the majority shareholder formally set expectations that the Company “sets targets and implements measures to reduce greenhouse gas emissions in both the short and long term in line with the Paris Agreement” [1] (Majority Shareholder Expectations).

Shareholders therefore request that the Board disclose:

- its assessment of the consistency between the Company’s planned increase in oil and gas production disclosed in its 2025 Energy Transition Plan and the Majority Shareholder Expectations, noting material inconsistencies,

- its assessment of the consistency between its growth strategy in the international segment of its upstream oil and gas business and the Majority Shareholder Expectations, noting material inconsistencies, and

- the remaining carbon budget assumptions relied on in making these assessments.

These disclosures shall be made by no later than the publication date for the 2025 Annual Report.

Supporting statement

1. Company ownership

The Company is approximately 71% owned by the State of Norway. As at 31 December 2024, the largest shareholder on the company’s share register was the Government of Norway, with 67% of the shares on issue, with that shareholding managed by the Norwegian Ministry of Trade, Industry and Fisheries. The Company’s second largest shareholder was listed as Folketrygdfondet, the state-owned asset manager that manages funds on behalf of the Government Pension Fund of Norway, with a 4% holding.[2]

2. Majority shareholder expectations

Given the Company’s ownership structure, formal public statements by the majority shareholder are highly relevant to minority shareholders.

At the Company’s 2023 Annual General Meeting, the chair of the meeting read a formal statement from the Ministry of Trade, Industry and Fisheries. The co-filing shareholders emphasise the following extract from that statement:

The state expects ... that:...

ii) The company sets targets and implements measures to reduce greenhouse gas emissions in both the short and long term in line with the Paris Agreement…[3] (Majority Shareholder Expectations)

The Majority Shareholder Expectations are a powerful signal to minority shareholders that could reasonably be expected to inform the Company’s strategic direction. No change to this formal statement has since been expressed by the majority shareholder.

3. Company plans appear materially inconsistent with Majority Shareholder Expectations

The co-filing shareholders have made the request set out in the resolution because the Company’s plans, in particular its focus on upstream oil and gas exploration and expansion, appear to be materially inconsistent with the Majority Shareholder Expectation that it “sets targets and implements measures to reduce greenhouse gas emissions in both the short and long term in line with the Paris Agreement.”

The goals of the Paris Agreement, to which the majority shareholder is a signatory, require “holding the increase in the global average temperature to well below 2°C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5°C above pre-industrial levels”[4].

Sanctioned oil and gas projects, globally, are forecast to emit 465 GtCO2 of emissions.[5] As at January 2025, the remaining carbon budget (RCB) for limiting global temperature increase to 1.5°C was approximately 171 GtCO2,[6] and the RCB for “holding the increase in the global average temperature to well below 2°C” was approximately 430 GtCO2.[6:1],[7] It is accepted that emissions from other sectors such as steel, electricity, cement or land use will take up some of the remaining budget. As such, there is no room for new oil and gas developments in remaining in carbon budgets “in line with the Paris Agreement”.[8]

Considering the Company’s material expansion plans, the co-filing shareholders therefore seek clarification on how the company assesses the consistency of those plans with the Majority Shareholder Expectations, and the carbon budget assumptions used to inform those assessments.

4. International upstream oil and gas growth strategy appears inconsistent with Majority Shareholder Expectations and does not generate acceptable returns

The long-lead times associated with the Company’s international upstream oil and gas segment point to additional inconsistencies of its growth strategy in this segment with the Majority Shareholder Expectations.

ACCR analysis of Rystad data shows that, in the international segment, the Company has historically taken 18 years on average to reach first production from the time of discovery of an oil and gas resource.[9]

The International Energy Agency (IEA) concluded that there is no need for new long-lead time upstream oil and gas projects under its only Paris-aligned scenario, the Net Zero Emission by 2050 scenario.[10]

However, a key pillar of the Company’s strategy has been the rapid growth of the international oil and gas business. This was affirmed at the recent Capital Markets Update with increased international production targets to >950 kboe/d by 2030, a 40% increase on 2024 production levels.

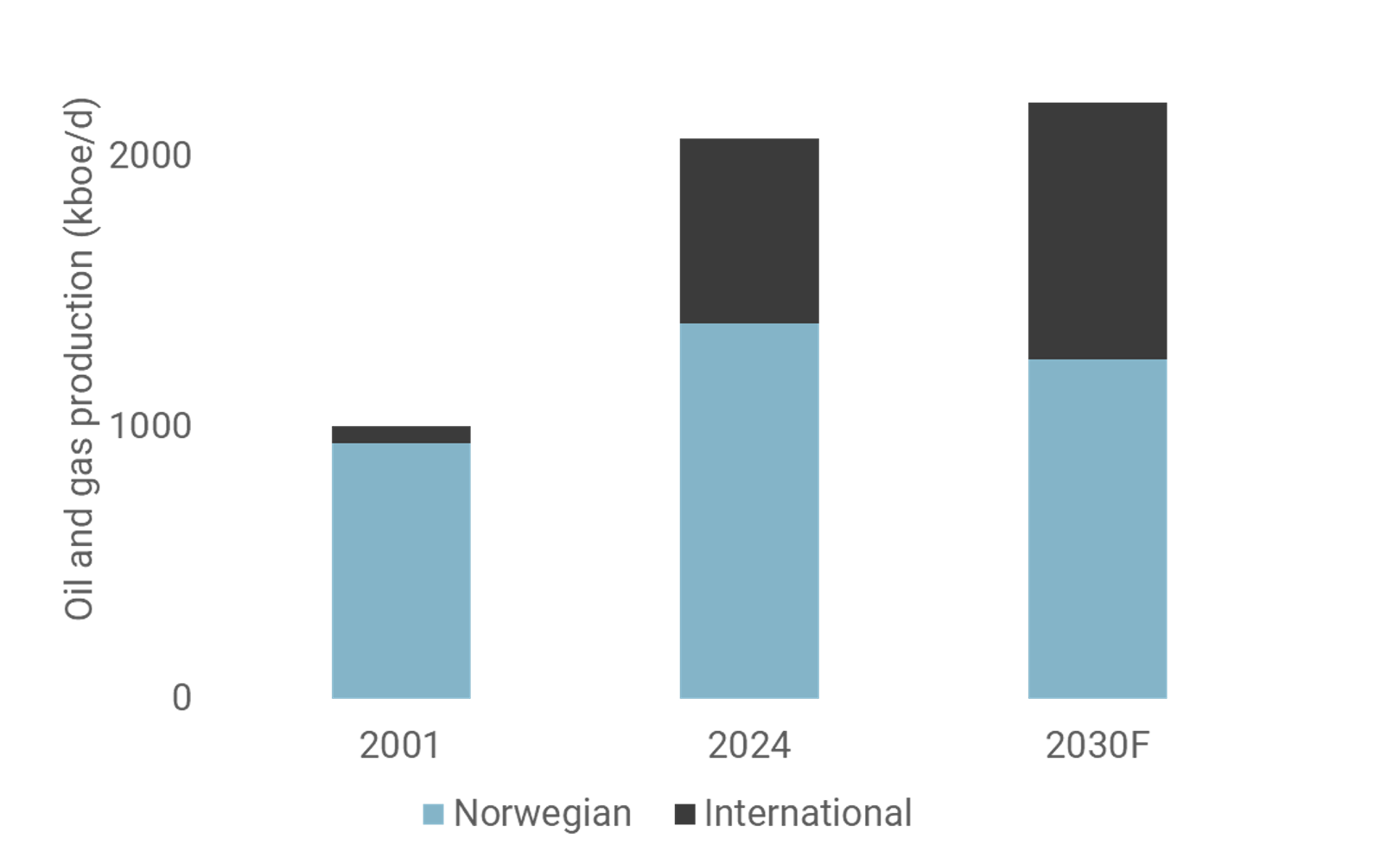

Chart 1: The Company’s international oil and gas production has increased tenfold since IPO, with plans for a further 40% increase by 2030

These growth ambitions include numerous large-scale international projects forecast to come on stream over the next 10 years, such as Bacalhau, Rosebank phase 1, Flemish Pass BdN and Roncador.[11] These project expansions appear to continue a strategy that is inconsistent with the Majority Shareholder Expectations.

The international oil and gas growth strategy has also delivered inadequate returns to shareholders. This appears in conflict with the majority shareholder’s goal, as owner, which is “the highest possible return over time in a sustainable manner.”[12]

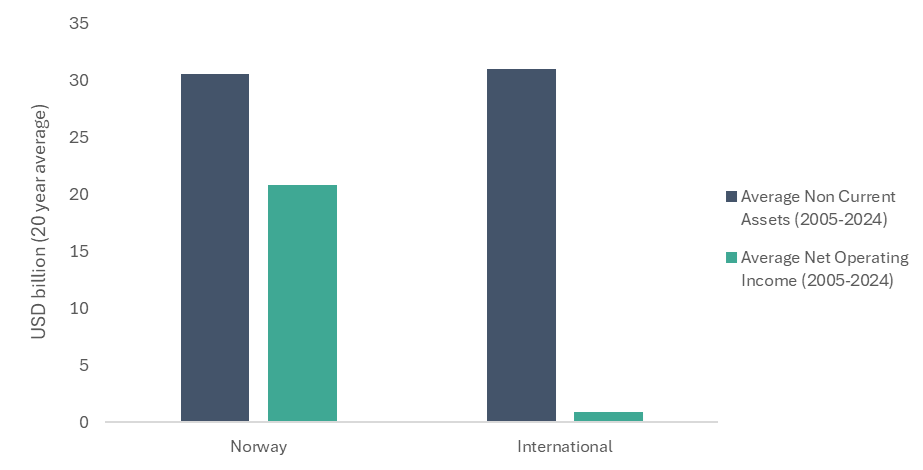

The Company’s two exploration and production segments – Norwegian and International – have delivered radically different return on asset profiles from their respective asset bases. The Norwegian E&P segment has delivered strong returns, with the average net operating income averaging 68% of average non-current assets over the last twenty years. This is 23 times the returns (on a similar basis) of the international E&P segment, which has averaged just 3%.[13]

Chart 2: The Company’s international assets return on net operating income have dramatically underperformed its Norwegian assets (2005-2024)

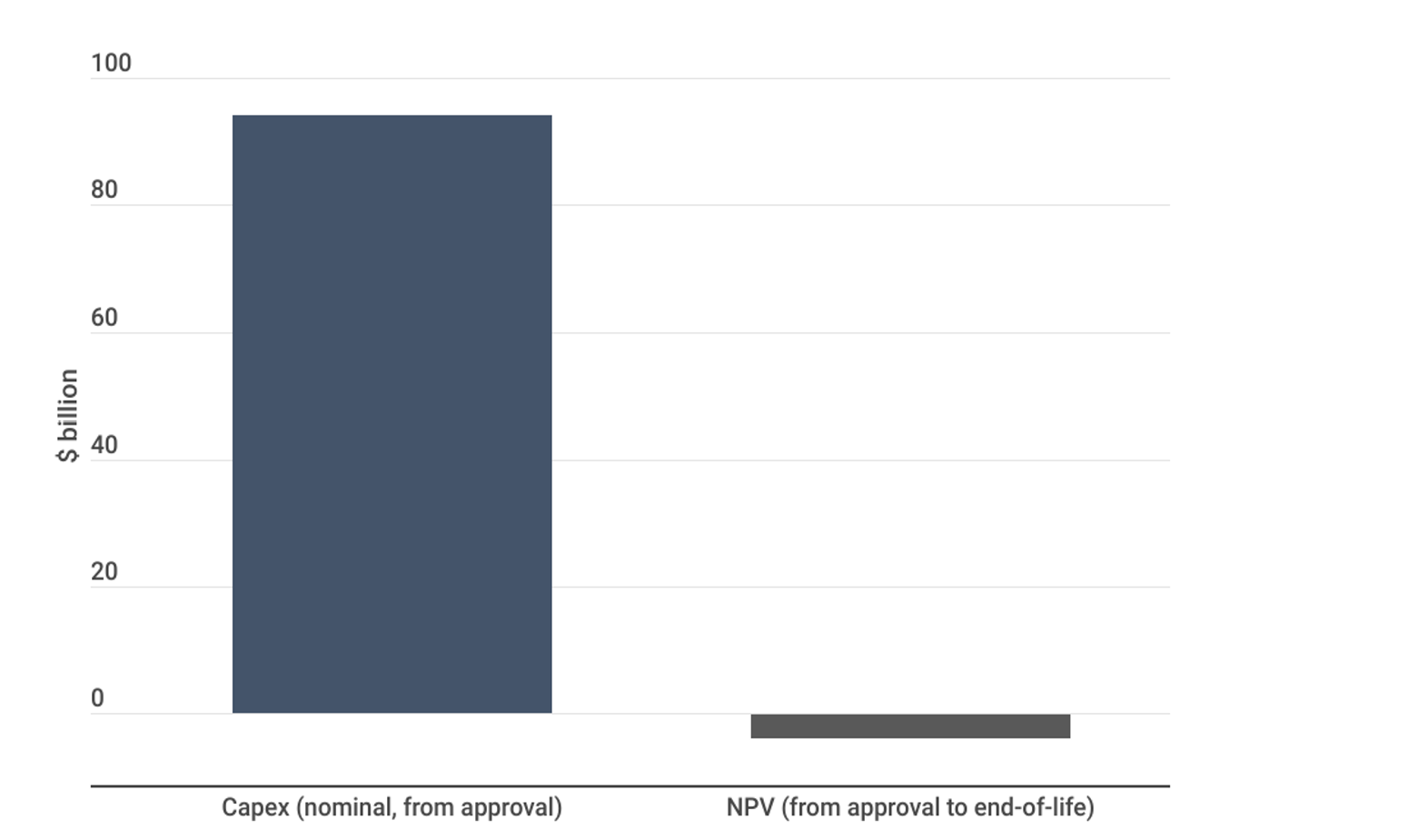

When looking at the returns from the Company’s sanctioned international projects, analysis produced by the Australasian Centre for Corporate Responsibility (ACCR) found[14] that these projects:

- consumed $14.5 billion (nominal) in acquisition and pre-FID costs

- consumed $94 billion (nominal) development capex

- eroded $3.6 billion Net Present Value (NPV).

Chart 3: ACCR analysis finds that ~$100bn of international capex is estimated to deliver negative $3.6bn of NPV

When looking at the International segment (including other costs such as unsuccessful exploration) since the Company’s 2001 IPO, ACCR found[15] that the International segment had:

- consumed $103 billion (nominal) of capex, and

- delivered $2 billion (nominal) of value.

The co-filing shareholders therefore note the apparent conflict between the Company’s international oil and gas growth strategy and the “highest possible returns” goal of the majority shareholder.

5. Relevance to shareholders

a. Interests of long-term, diversified investors

The physical and financial risks posed by climate change are systemic, portfolio-wide, and undiversifiable. Therefore, the actions of companies that directly or indirectly impact climate outcomes pose risks to the financial system, and to the entire portfolio of long-term, diversified shareholders.

b. Values basis

The co-filing shareholders have a strong basis for seeking to understand inconsistencies between the Majority Shareholder Expectations and Company plans. This interest is grounded in shared values of sustainability, transparency, good governance and risk management.

The co-filing shareholders encourage support for this proposal.

Minutes of Annual General Meeting, 10 May 2023 at point 9, Statement of the Ministry of Trade, Industry and Fisheries read by the company's Chair at the company's 2023 AGM https://cdn.equinor.com/files/h61q9gi9/global/8ec49409d8ac1bff4ba613604b3ffe36ee623d13.pdf?minutes-from-annual-general-meeting-in-equinor-asa-10-may-2023.pdf. ↩︎

Equinor website, accessed 2 April 2025 https://www.equinor.com/investors/our-shareholders ↩︎

Minutes of Annual General Meeting, 10 May 2023 at point 9, Statement of the Ministry of Trade, Industry and Fisheries read by the company's Chair at the company's 2023 AGM https://cdn.equinor.com/files/h61q9gi9/global/8ec49409d8ac1bff4ba613604b3ffe36ee623d13.pdf?minutes-from-annual-general-meeting-in-equinor-asa-10-may-2023.pdf. ↩︎

Paris Agreement, Article 2.1(a) ↩︎

ACCR analysis of Rystad Energy data. Includes all oil and gas production from operating and approved projects, from 2025 to 2100, multiplied by CO2 combustion emission factors for crude oil and natural gas. ↩︎

Lamboll, R.D., Nicholls, Z.R.J., Smith, C.J. et al. Assessing the size and uncertainty of remaining carbon budgets. Nat. Clim. Chang. 13, 1360–1367 (2023). https://doi.org/10.1038/s41558-023-01848-5. The remaining carbon budget (RCB) is adjusted to reflect the start of 2025, based on 2023 emissions data from the 2024 World Energy Outlook and estimated 2024 emissions from Carbon Brief analysis https://www.carbonbrief.org/analysis-global-co2-emissions-will-reach-new-high-in-2024-despite-slower-growth/. ↩︎ ↩︎

Schleussner, CF., Ganti, G., Rogelj, J. et al. An emission pathway classification reflecting the Paris Agreement climate objectives. Commun Earth Environ 3, 135 (2022). https://doi.org/10.1038/s43247-022-00467-w. The justification for using the 90th percentile stems from the interpretation of the Paris Agreement's "well below 2?°C" objective as a significant strengthening of the earlier "below 2?°C" goal, aligning it with the IPCC's calibrated uncertainty language where "very likely" corresponds to a ?90% probability. ↩︎

This assumes carbon removals are not available at an unprecedented scale. ↩︎

ACCR analysis of Rystad Energy data. Calculated as the time taken to commence production from initial discovery, using a resources weighted average. ↩︎

IEA (2023), Net Zero Roadmap: A Global Pathway to Keep the 1.5 °C Goal in Reach, IEA, Paris https://www.iea.org/reports/net-zero-roadmap-a-global-pathway-to-keep-the-15-0c-goal-in-reach, Licence: CC BY 4.0 ↩︎

Equinor Capital Markets Update 2025, pg53 ↩︎

White paper [Meld. St. 6 (2022–2023)] ‘Greener and more active state ownership” The State’s direct ownership of companies” https://www.regjeringen.no/en/dokumenter/meld.-st.-6-20222023/id2937164/?ch=1 ↩︎

Equinor financial statements from 2004 to 2023. When we refer to Equinor’s international segment, we are referring to all of its international oil and gas activities – even though they are currently reported as two separate segments. ↩︎

ACCR, Equinor’s challenge: which way to Paris? https://www.accr.org.au/research/equinor’s-challenge-which-way-to-paris/ ↩︎

ACCR, The road not taken: Equinor’s alternative to international oil and gas growth https://www.accr.org.au/research/the-road-not-taken-equinor’s-alternative-to-international-oil-and-gas-growth/ ↩︎