Publication Investor briefing: Say on Climate Voting in 2021

Summary and key findings

The ‘Say on Climate’ mechanism, launched in late 2020, aims to compel listed companies to develop and implement Paris-aligned transition plans, with increased accountability against those plans through annual shareholder votes.

In 2021, there were 19 votes on Say on Climate resolutions at 17 companies’ annual general meetings (AGM) in nine jurisdictions: Australia, Canada, France, the Netherlands, Spain, South Africa, Switzerland, the United Kingdom (UK) and the United States (US). On average, these resolutions obtained 95.2% shareholder support.

This level of investor support for companies’ climate plans in 2021 suggests that companies were rewarded for accountability, transparency, for being first movers or for their “direction of travel”, rather than the strength of their climate plans. None of the 17 companies have aligned their emissions reduction targets and capital allocation with a 1.5℃ pathway.

Recent votes at BHP Group in late 2021 (84%), Aena (94.4%), UBS Group (77.74%) and Anglo American (94.4%) in 2022, suggest there is an increasing range of investor views and ambitions when voting on companies’ climate plans. However, most voting does not appear to be based on 1.5℃ alignment.

Investors should be transparent about how they assess and vote on companies’ climate plans, and press companies for 1.5℃ alignment.

1. Introduction

The latest IPCC report underscores the “brief and rapidly closing window of opportunity to secure a liveable and sustainable future for all”[1] if global warming is not limited to 1.5℃. Human-induced climate change has already affected weather and climate extremes around the world. These climate risks impact all sectors and asset classes, significantly affecting investors with broad market exposure including superannuation funds and global investment managers.

ACCR advocates for asset owners such as super funds, and investment managers to use every tool available to achieve the most ambitious climate outcomes when engaging with companies on climate change—including how they vote on Say on Climate resolutions.

It is imperative that companies set ambitious decarbonisation targets and strategies, and align their capital expenditure and lobbying with 1.5℃ pathways. Through the power of proxy voting, shareholders can send a clear message to companies to mitigate systemic climate change.

2. Say on Climate mechanism

Say on Climate was pioneered by the Children’s Investment Fund Foundation (CIFF) in the UK, and was actively supported by ACCR, CDP and ShareAction. ACCR shares the view of CIFF founder Sir Christopher Hohn that the Say on Climate mechanism “can be as powerful as investors want it to be”.[2]

The Say on Climate mechanism is based on three key commitments from companies:

- Annual emissions disclosure;

- Annual reporting of a strategy to reduce emissions;

- An annual non-binding shareholder vote on the company’s plan at the AGM.

Asset managers in support of Say on Climate are expected to encourage companies to take these steps voluntarily, and in the event a company refuses, to file resolutions at company AGMs. Asset owners in support of Say on Climate are expected to ensure asset managers are “actively seeking to secure annual shareholder votes on company climate transition action plans as standard”.[3]

Following the 17 companies that held Say on Climate votes in 2021, at least 19 more companies will hold Say on Climate votes in 2022, with six companies providing a second vote in 2022: Canadian National Railway Company, Ferrovial SA, Glencore plc, National Grid plc, S&P Global Inc and Unilever plc (see Appendix, Table C).

Three additional companies enjoyed close to absolute (>99.5%) shareholder support for committing to provide a Say on Climate vote in 2022: Aviva plc, Iberdrola and SSE plc.

3. Report methodology

ACCR examined the proxy voting records of the largest 30 Australian superannuation funds by assets under management (AUM)[4] and the 30 largest global investment managers by AUM[5] on the 19 Say on Climate resolutions that went to a vote in 2021 across nine jurisdictions: Australia, Canada, France, the Netherlands, Spain, South Africa, Switzerland, the UK and the US.

To the best of our knowledge, these were all of the Say on Climate resolutions on climate transition plans held in the calendar year 2021. Proxy voting data was obtained from Proxy Insight.[6]

Climate Action 100+ (CA100+) Net Zero Company Benchmark data for the relevant companies was sourced from the CA100+ website and emissions reduction targets for the remaining companies were collated from the companies’ websites and reporting suites.

4. Findings

Disclosure

Superannuation funds

ACCR analysed the proxy voting records of the 30 largest Australian superannuation funds, representing more than $2 trillion in AUM and 87% of APRA-regulated assets under management. Of these 30 funds, 20 were shareholders in companies that held Say on Climate votes in 2021, and disclosed their proxy voting records for these resolutions.

The Australian superannuation funds included in this analysis include Active Super, AMP, AustralianSuper, Aware Super, BT Financial Group, CareSuper, Cbus Super, Equipsuper, Colonial First State, HESTA, HostPlus, Mercer, Mine Super, NGS Super, QSuper, REST, SunSuper, Telstra Super, UniSuper and Vision Super.

The 10 remaining funds that make up the 30 largest funds have not disclosed a complete proxy voting record for 2021. These funds are listed in the Appendix (see Note 1).

Investment managers

ACCR also analysed the proxy voting records for the 30 largest global investment managers by AUM.[7] These investment managers responsible for more than $55 trillion in assets under management, were BlackRock, Vanguard Group, State Street Global Advisors, JP Morgan, T. Rowe Price Associates, BNY Mellon, Amundi, Northern Trust Investments, Wellington Management, Legal & General Investment Management (LGIM), Schroders, DWS Investments, Allianz Global Investors, APG, Nordea, Dimensional Fund Advisors, AllianceBernstein, Abrdn, Fidelity, Capital Group, Goldman Sachs Asset Management, Pendal Group, Franklin Templeton, Massachusetts Mutual Life Insurance Co., Morgan Stanley Invesco Advisors, Geode Capital Management, Charles Schwab, and Wells Fargo.

Say on Climate voting behaviour

The 19 Say on Climate resolutions that were put to a vote by management in 2021 were supported, on average, by 95.2% of shareholders.

TABLE 1. NUMBER OF SoC RESOLUTIONS BY JURISDICTION

| Jurisdiction | Total resolutions |

|---|---|

| Australia | 1 |

| Canada | 1 |

| France | 3 |

| Netherlands | 1 |

| South Africa | 1 |

| Spain | 1 |

| Switzerland | 2 |

| UK | 7 |

| US | 2 |

| Total | 19 |

TABLE 2. SUPPORT FOR SoC RESOLUTIONS BY JURISDICTION

| Jurisdiction | Super funds | Investment managers |

|---|---|---|

| Australia | 76.47% | 77.78% |

| Canada | 77.78% | 96.43% |

| France | 68.18% | 89.29% |

| Netherlands | 50.00% | 92.00% |

| South Africa | 50.00% | 88.89% |

| Spain | 76.92% | 92.00% |

| Switzerland | 67.86% | 89.47% |

| UK | 77.01% | 91.85% |

| US | 71.88% | 79.31% |

UK-listed companies were the most represented in the 17 companies (see Table 1), with seven companies providing shareholders with a Say on Climate vote in 2021. Interestingly, these resolutions were also among the most supported by shareholders with 77.01% of the Australian superannuation funds supporting these resolutions and 91.85% of global investment managers supporting Say on Climate resolutions at UK-listed companies (see Table 2).

Royal Dutch Shell’s Say on Climate vote was supported by just 50% of the Australian superannuation funds analysed. BHP Group’s Say on Climate vote at its Australian AGM was supported by 78% of investment managers analysed. Overall in 2021, Australian superannuation funds supported 79.82% of Say on Climate votes, while global investment managers supported 89.07% of Say on Climate votes.

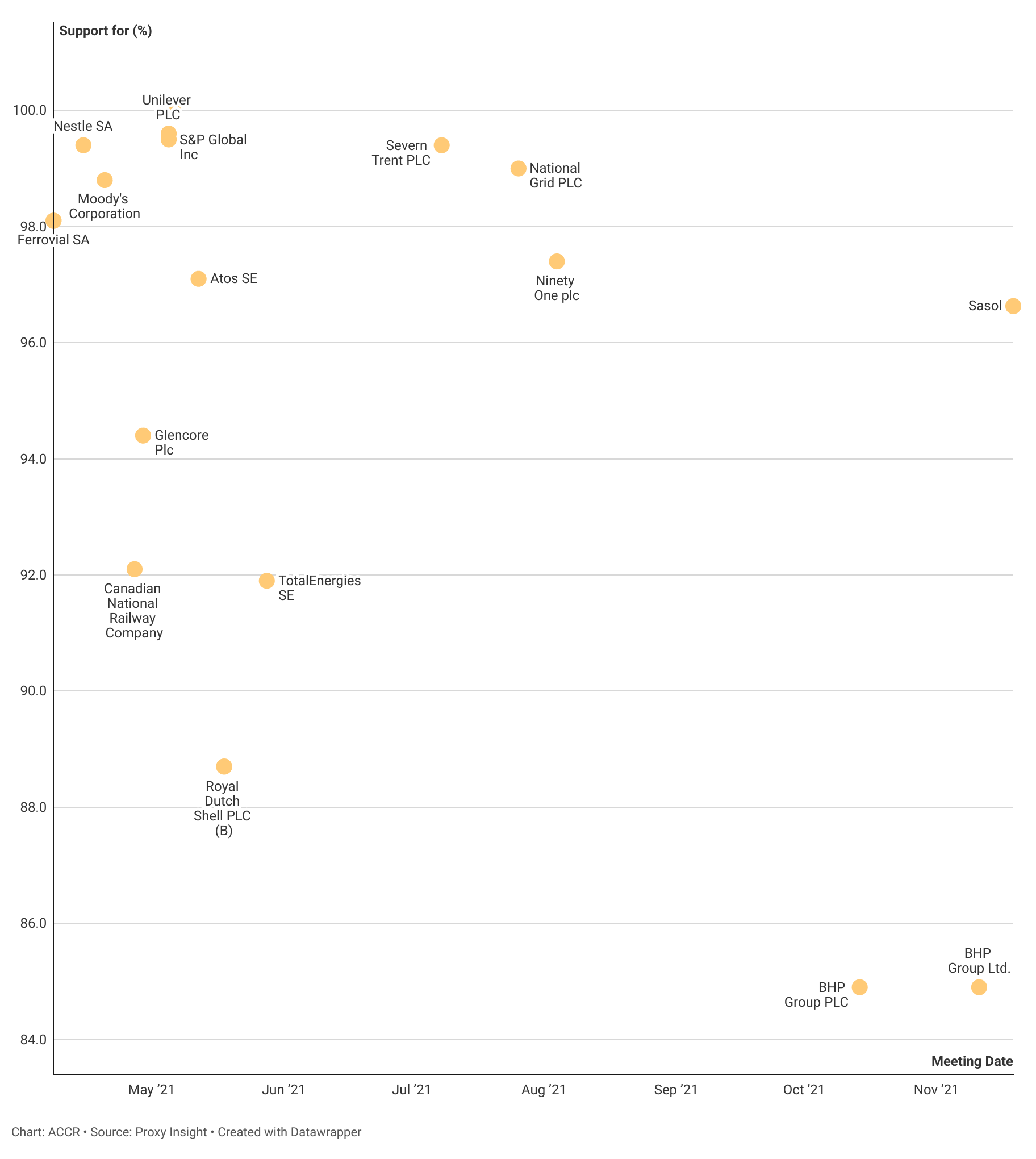

FIGURE 1. SUPPORT FOR SAY ON CLIMATE RESOLUTIONS IN 2021

The vast majority of Say on Climate resolutions were supported by more than 90% of shareholders in 2021.

Just two companies had Say on Climate votes that were supported by less than 90% of shareholders: Shell received 88.7% shareholder support in May 2021, while BHP Group received 84.9% shareholder support in October and November 2021.

Shell and BHP are two of the most carbon-intensive companies to have held Say on Climate votes, and both have been the subject of investor scrutiny and climate campaigns for several years, which may explain the lower level of support.

TABLE 3. AUSTRALIAN SUPER FUND SUPPORT FOR SAY ON CLIMATE RESOLUTIONS

| Fund | Supportive votes | Total votes | Support % |

|---|---|---|---|

| Colonial First State | 6 | 17 | 35.29% |

| Mine Super | 7 | 12 | 58.33% |

| HESTA | 9 | 15 | 60.00% |

| HostPlus | 11 | 16 | 68.75% |

| REST | 7 | 10 | 70.00% |

| Vision Super | 5 | 7 | 71.43% |

| SunSuper | 14 | 18 | 77.78% |

| BT Super | 13 | 16 | 81.25% |

| Cbus Super | 10 | 12 | 83.33% |

| Aware Super | 12 | 14 | 85.71% |

| Mercer | 9 | 10 | 90.00% |

| Equipsuper | 13 | 14 | 92.86% |

| Telstra Super | 14 | 15 | 93.33% |

| Active Super | 8 | 8 | 100.00% |

| AMP | 1 | 1 | 100.00% |

| AustralianSuper | 16 | 16 | 100.00% |

| CareSuper | 5 | 5 | 100.00% |

| NGS Super | 5 | 5 | 100.00% |

| QSuper | 15 | 15 | 100.00% |

| UniSuper | 2 | 2 | 100.00% |

Seven superannuation funds supported all Say on Climate resolutions at companies they held in 2021: Active Super (8), AMP (1), AustralianSuper (16), CareSuper (5), NGS Super (5), QSuper (15) and Unisuper (2).

Fifteen investment managers supported all Say on Climate resolutions at companies they held in 2021: Abrdn (18), AllianceBernstein (16), Allianz Global Investors (18), APG (16), BlackRock (19), Capital Group (10), Fidelity (11), Goldman Sachs (13), JP Morgan (13), Morgan Stanley (12), Pendal Group (3), State Street Global Advisors (17), Vanguard (19) Wellington (18), and Wells Fargo (11).

Notably, BlackRock and Vanguard supported all 19 Say on Climate resolutions held in 2021.

TABLE 4. INVESTMENT MANAGER SUPPORT FOR SAY ON CLIMATE RESOLUTIONS

| Fund | Supportive votes | Total votes | Support % |

|---|---|---|---|

| Dimensional | 3 | 19 | 15.79% |

| Charles Schwab | 6 | 12 | 50.00% |

| LGIM | 13 | 18 | 72.22% |

| Massachusetts Mutual Life Insurance Co. | 9 | 11 | 81.82% |

| Schroders PLC | 14 | 17 | 82.35% |

| Franklin Templeton | 10 | 12 | 83.33% |

| Invesco Advisers | 10 | 12 | 83.33% |

| Northern Trust Investments | 13 | 15 | 86.67% |

| DWS Investment | 14 | 16 | 87.50% |

| T. Rowe Price Associates | 15 | 17 | 88.24% |

| HSBC Global | 16 | 18 | 88.89% |

| Geode Capital Management | 11 | 12 | 91.67% |

| BNY Mellon | 12 | 13 | 92.31% |

| Nordea Investment Management | 15 | 16 | 93.75% |

| Amundi | 16 | 17 | 94.12% |

| Abrdn | 18 | 18 | 100.00% |

| AllianceBernstein | 16 | 16 | 100.00% |

| Allianz Global Investors | 18 | 18 | 100.00% |

| APG | 16 | 16 | 100.00% |

| BlackRock | 19 | 19 | 100.00% |

| Capital Group | 10 | 10 | 100.00% |

| Fidelity | 11 | 11 | 100.00% |

| Goldman Sachs | 13 | 13 | 100.00% |

| JP Morgan | 13 | 13 | 100.00% |

| Morgan Stanley | 12 | 12 | 100.00% |

| Pendal Group | 3 | 3 | 100.00% |

| State Street Global Advisors | 17 | 17 | 100.00% |

| Vanguard | 19 | 19 | 100.00% |

| Wellington | 18 | 18 | 100.00% |

| Wells Fargo | 11 | 11 | 100.00% |

Dimensional supported the fewest number of Say on Climate resolutions in 2021, supporting just 15.79%, though it abstained from on 16 of 19 votes. Only one superannuation fund and one other investment manager supported 50% or less of the Say on Climate resolutions in 2021: Colonial First State (35.29%) and Charles Schwab (50%). Colonial First State abstained on 8 of 17 votes. Charles Schwab abstained on 5 of 12 votes.

Overall, 84.9% of BHP Group (Ltd & Plc) shareholders supported its Climate Transition Action Plan. Only three of the Australian superannuation funds analysed voted against BHP’s plan: Aware Super, Cbus Super and Vision Super. Interestingly, HostPlus voted for BHP’s plan at the Plc AGM in London in October 2021, before voting against the same plan at the Ltd AGM in Melbourne in November 2022.

TABLE 5. CASE STUDY: BHP

| For | Against | |

|---|---|---|

| Active Super | Aware Super | |

| AustralianSuper | Cbus Super | |

| BT Super | Vision Super | |

| BHP Group - | CareSuper | |

| Approve the | Equipsuper | |

| Climate Transition | HESTA | |

| Action Plan (CTAP) | HostPlus | |

| NGS Super | ||

| SunSuper | ||

| UniSuper | ||

| AMP | ||

| Telstra Super |

Were the companies’ plans deserving of support?

Climate Action 100+ focus companies

Eight of the 19 companies that held Say on Climate votes in 2021 were focus companies for the Climate Action 100+ coalition: BHP Group, Glencore, National Grid, Nestle, Royal Dutch Shell/Shell, Sasol, TotalEnergies, and Unilever.

Launched in December 2017, Climate Action 100+ is an investor-led coalition engaging with the world’s largest corporate emitters. The coalition includes 700 investors globally and represents $68 trillion in assets under management.[8]

For the purposes of this analysis, credible company climate action plans were those that were consistent with the Climate Action 100+ Net-Zero Company Benchmark (‘Benchmark’), published in early 2021. The Benchmark evaluated company performance against 10 indicators, including emissions reduction targets, capital expenditure, climate governance, lobbying and climate-related financial disclosures.

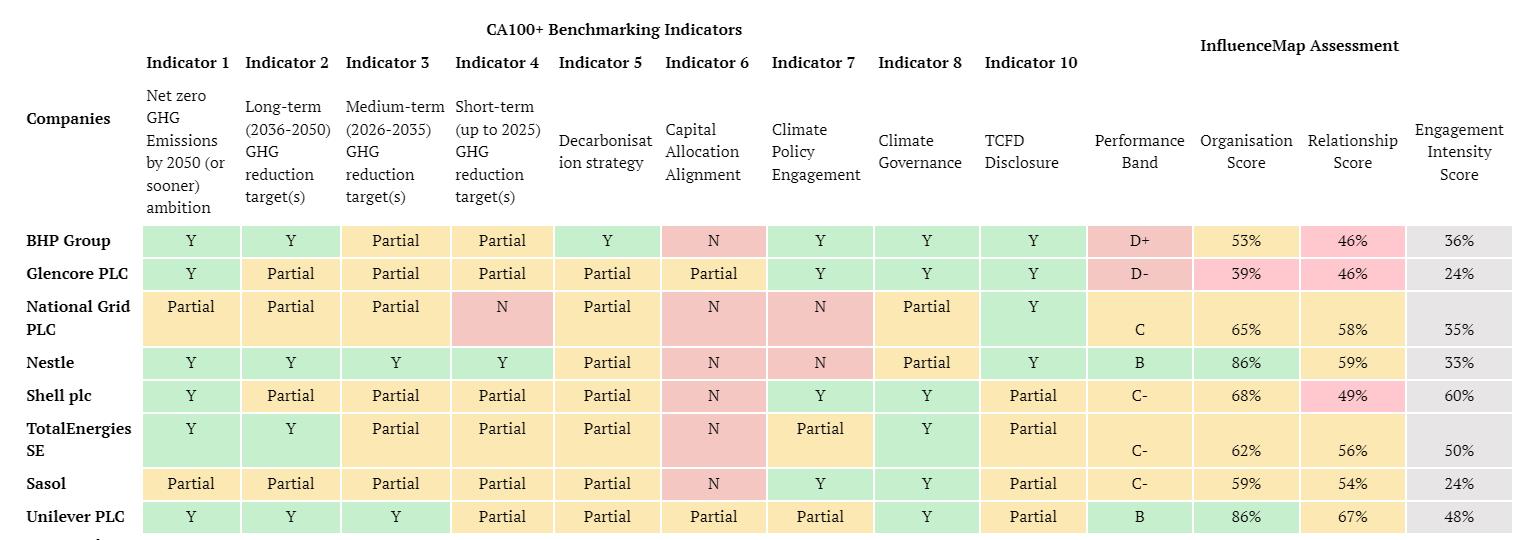

FIGURE 2. CA100+ BENCHMARK ASSESSMENTS FOR THE EIGHT COMPANIES PROVIDING SAY ON CLIMATE VOTES

Note: Indicator 9, “Just Transition” was excluded from this analysis as this assessment has not been disclosed through the benchmark. Source: Climate Action 100+, 2022.

None of the eight CA100+ companies that held a Say on Climate vote in 2021 were aligned with all Benchmark indicators (see Figure 2, Appendix Table A).

All eight CA100+ companies have announced an ambition or target to achieve net zero emissions by 2050 or sooner (Indicator 1). However, National Grid (UK) and Sasol (South Africa) were partially aligned on Indicator 1, as the companies do not include Scope 3 emissions in their net zero targets.

Only four of the eight CA100+ companies have long-term emissions reduction targets that include Scope 1 and 2, and material Scope 3 emissions, aligned with the goal of limiting global warming to 1.5℃ (Indicator 2). Of these companies, only two, Nestle and Unilever, have both medium- and long-term targets aligned with the Benchmark indicators (Indicators 2-3), and Nestle is the only company that has a short-term emissions reduction target aligned to a 1.5℃ pathway (Indicator 4).

Only one of the eight CA100+ companies, BHP Group, was found to have an aligned decarbonisation strategy (Indicator 5). However, this indicator was based on the company having a strategy to meet its emissions targets, regardless of the ambition of those targets. ACCR's analysis found that BHP’s 2021 Climate Transition Action Plan (CTAP) was not aligned with a 1.5℃ pathway.

Most notably, the eight CA100+ companies were found to be mostly misaligned on capital allocation alignment (Indicator 6). Six of the eight companies were completely misaligned and two companies were found to be partially aligned. None of the nine CA100+ companies has committed to align their capital expenditure with the goal of limiting global warming to 1.5℃.

On average, the eight CA100+ companies that held Say on Climate votes in 2021, received 92.81% support from shareholders.

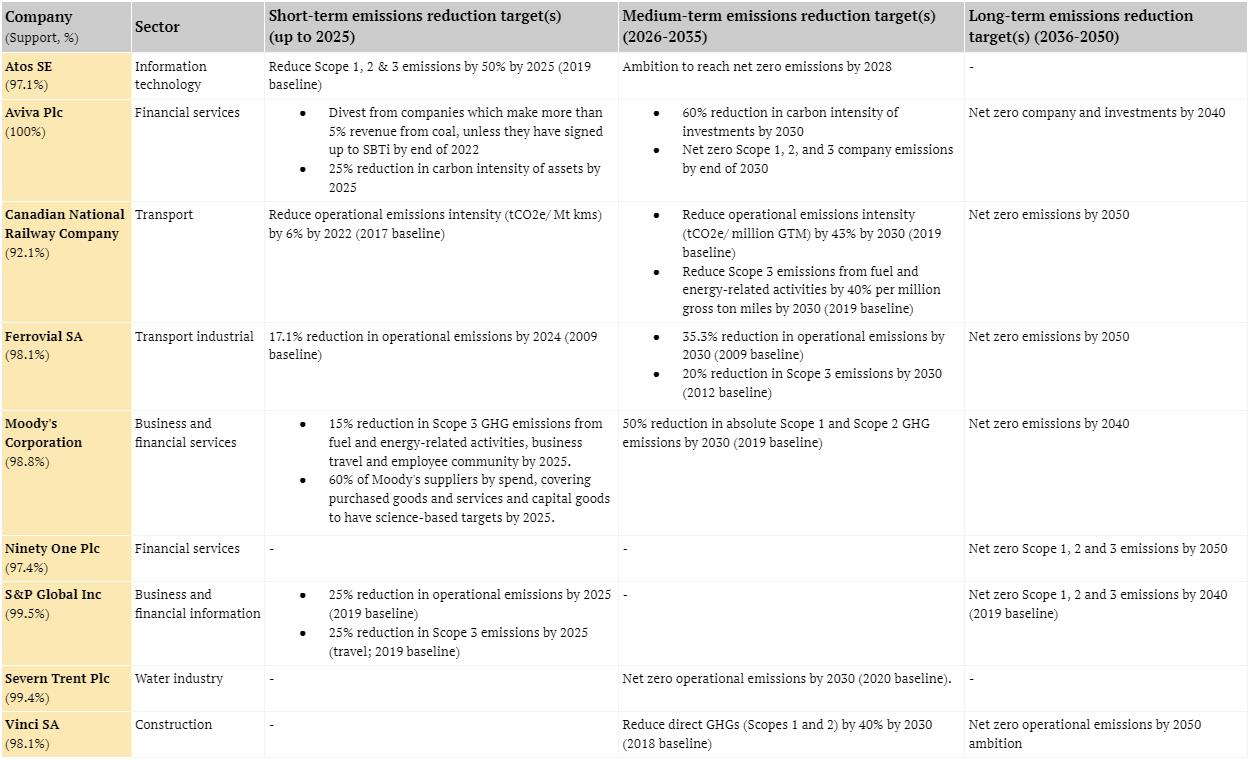

Other companies

The remaining nine companies (non-CA100+) that held Say on Climate votes in 2021 were Atos, Aviva, Canadian National Railway, Ferrovial, Moody’s Corporation, Ninety One, S&P Global, Severn Trent and Vinci. While these companies are not included in the CA100+ Net Zero Company Benchmark, we have collated their climate commitments (see Appendix Table B).

All nine companies have announced an ambition to achieve Net Zero GHG emissions by 2050 or sooner, with three companies looking to achieve net zero emissions by 2040 (Aviva, Moody’s Corporation and S&P Global), one company intending to reach net zero emissions by 2030 (Severn Trent[9]) and one company, Atos, has an ambition to reach net zero emissions by 2028. Notably, none of these companies are carbon-intensive businesses, so they arguably have an easier task to reduce their operational emissions.

However, only six of the nine non-CA100+ companies have short- or medium-term emission reductions targets that encompass Scope 1 and 2, and material Scope 3 emissions.

On average, the nine non-CA100+ companies that held Say on Climate votes in 2021, received 97.83% support from shareholders.

Conclusion

In 2021, Say on Climate resolutions received 95.2% overall shareholder support. While it was the first year the mechanism was in action, this level of support suggests investors rewarded companies for being “first movers”, for their commitment to accountability and transparency, and/or their “direction of travel”.

Of the 17 companies that provided a Say on Climate vote in 2021, none have aligned their emissions reduction targets and capital allocation with a 1.5℃ pathway. Moreover, none of the CA100+ focus companies that held Say on Climate votes in 2021 were aligned with all indicators in the Climate Action 100+.

The Climate Action 100+ and the Transition Pathway Initiative[10] provide useful measures by which to assess companies’ climate performance, but investors should be prepared to draw information from multiple sources in order to determine whether a company’s climate plan is worthy of support. Alignment with a 1.5℃ pathway should be the standard by which companies’ climate plans are judged.

Recommendations for investors

Rather than rewarding companies for their “direction of travel”, we encourage investors to assess climate plans on their alignment with a 1.5℃ pathway by using the suggested criteria below:

- Is the company pursuing further fossil fuel expansion?

- Will the company materially reduce its emissions before 2030?

- Do the company’s emissions reduction targets encompass all Scope 1 & 2 and material Scope 3 emissions?

- Has the company committed to aligning its capital expenditure with a 1.5℃ pathway?

- Has the company committed to aligning its lobbying in line with a 1.5℃ pathway?

- Are the company’s emissions reduction targets materially linked to remuneration?

Similarly, CIFF has outlined what it considers to be essential components of a climate action plan:[11]

- Short-term targets required: 5 year and 5-10 year plan

- Average absolute Scope 1-3 emissions reduction of 7-8% pa to 2030

- Phase out fossil fuel use and production, no financing of new supply

- Executive compensation, strategy and lobbying aligned with plan

- Necessary capital expenditure commitments

- End deforestation, credible use of offsetting only if strictly necessary

- Independent auditing of emissions

- Annual performance reporting to shareholders

Considering the urgent need to decarbonise, ACCR encourages investors to raise their expectations of companies and ambition when voting on company climate plans in 2022.

See the Appendix (Table C) for the list of known companies providing a Say on Climate vote in the months ahead.

Appendix

NOTE 1: Australian super funds not included in this analysis include Commonwealth Super Corporation, MLC, ANZ, IOOF, Macquarie, Spirit Super, Netwealth Super, LGIAsuper, CommBank Group, and HUB24 Super Fund. These funds were excluded from this analysis due to a lack of proxy voting disclosure, or the fund did not hold any of the 20 companies that held Say on Climate votes in 2021. CommBank Group Super, MLC and Spirit Super disclosed proxy voting data for Australian shares only, for the financial year to 30 June 2021. This was insufficient data to include in this analysis.

TABLE A. CA100+ BENCHMARKING ASSESSMENT OF THE FOCUS COMPANIES WITH SOC RESOLUTIONS IN 2021

Source: Climate Action 100+

TABLE B. NON-CA100+ FOCUS COMPANIES’ CLIMATE COMMITMENTS

Source: Company reports

TABLE C. COMPANIES PROVIDING A SAY ON CLIMATE VOTE IN 2022

| Company | Country | AGM date |

|---|---|---|

| Aena SME SA | Spain | 31 Mar 2022 (94.4%) |

| UBS Group | Switzerland | 6 Apr 2022 (77.74%) |

| Ferrovial SA | Spain | 7 Apr 2022 (92.5%) |

| Anglo American plc | UK | 19 Apr 2022 (94.4%) |

| Moody's Corporation | US | 26 Apr 2022 |

| Canadian Pacific Railway Ltd | CA | 27 Apr 2022 |

| Glencore plc | UK | 28 Apr 2022 |

| Santos | Australia | 3 May 2022 |

| Barclays plc | UK | 4 May 2022 |

| Holcim AG | CH | 4 May 2022 |

| S&P Global Inc | US | 4 May 2022 |

| Unilever plc | UK | 4 May 2022 |

| Rio Tinto | UK, Australia | 8 Apr, 5 May 2022 |

| Woodside Petroleum | Australia | 19 May 2022 |

| Canadian National Railway Company | Canada | 20 May 2022 |

| Shell plc | UK | 24 May 2022 |

| M&G plc | UK | 25 May 2022 |

| Iberdrola | Spain | June 2022 |

| Monster Beverage | US | June 2022 |

| AGL Energy | Australia | 2H 2022 |

| Incitec Pivot | Australia | 2H 2022 |

| National Grid plc | UK | 2H 2022 |

| Origin Energy | Australia | 2H 2022 |

| South32 | Australia | 2H 2022 |

| SSE plc | UK | 2H 2022 |

Please read the terms and conditions attached to the use of this site.

Australasian Centre for Corporate Responsibility

IPCC, Climate Change 2022: Impacts, Adaptation and Vulnerability ↩︎

As determined by the Australian Prudential Regulation Authority, as at 15 December 2021. ↩︎

According to data obtained from Proxy Insight. ↩︎

According to data obtained from Proxy Insight as at 2 April 2022. ↩︎

Note that Severn Trent’s Net Zero target is operational emissions only and would only partially meet the CA100+ Benchmark’s Indicator 1 or 2 as it does not cover material Scope 3 emissions. ↩︎