Introduction

The global steel industry is undergoing a rapid transformation. As previous ACCR research has identified, across every stage of the value chain a shift towards less carbon intensive steelmaking is underway, with progress in technology, innovation and policy settings suggesting the sector no longer deserves the reputation of ‘hard-to-abate’.

To better understand how investors view the shift towards green steel, ACCR commissioned a global survey of investors in the steel value chain. 500 respondents from 34 countries were surveyed, each from institutions with investments in steelmaking, iron ore and/or metallurgical coal mining. The largest cohort of respondents work as portfolio managers, investment managers or investment directors.

Our analysis of the results suggests institutional capital has a level of appetite for the green steel transformation that is starting to surpass many policymakers and companies, and that investors are willing to back greater ambition on steel sector decarbonisation – if the right frameworks are in place.

Methodology

In December 2023, 500 respondents answered a series of multiple-choice questions relating to the decarbonisation of the steel sector and its value chain.

The respondents were based across 34 different countries, nine types of financial institutions and all participants held investments in at least one part of the steel value chain. Find out more about the demographic of the respondents here (p. 4). All survey responses were recorded anonymously.

All survey results are reported as percentages (rounded to the nearest whole number). In instances where investors are asked to select two or three responses, the response total will add to 200% or 300% respectively.

Key findings

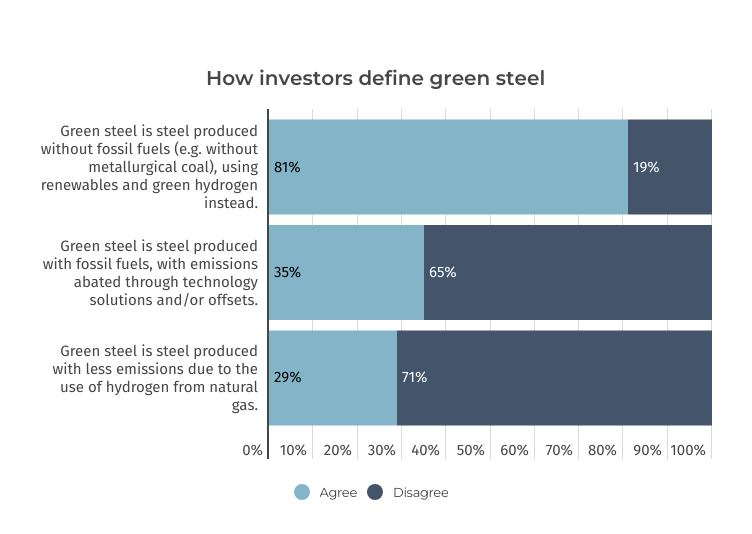

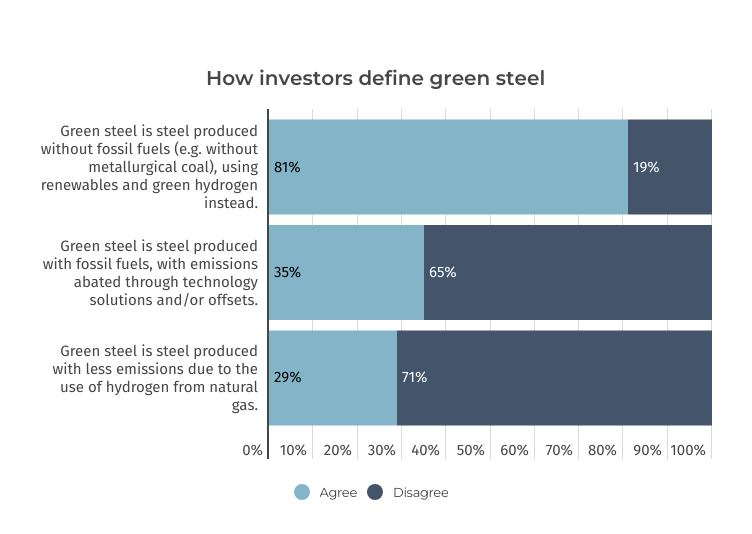

- The overwhelming majority of investors (81%) agree that ‘green steel’ cannot be produced with fossil fuels - suggesting companies pursuing ‘green’ steel solutions that use fossil fuels are out of step with investor expectations.

- The majority of investors (68%) foresee a transition away from metallurgical coal in steelmaking, and 80% believe metallurgical coal’s risk profile will increase in the next decade. This is a sentiment at odds with companies seeking to acquire mining stakes, expand current mines or extend the lives of metallurgical coal assets well beyond 2050.

- 59% of investors support the import of green iron as a practical solution in regions where renewable energy capacity is constrained. This indicates strong investment support for ‘green iron corridors’, placing countries like Australia and Brazil, where green hydrogen is cheaper to produce, in a strong position to become major green iron exporters to steelmakers in countries with limited access to renewables, like Japan.

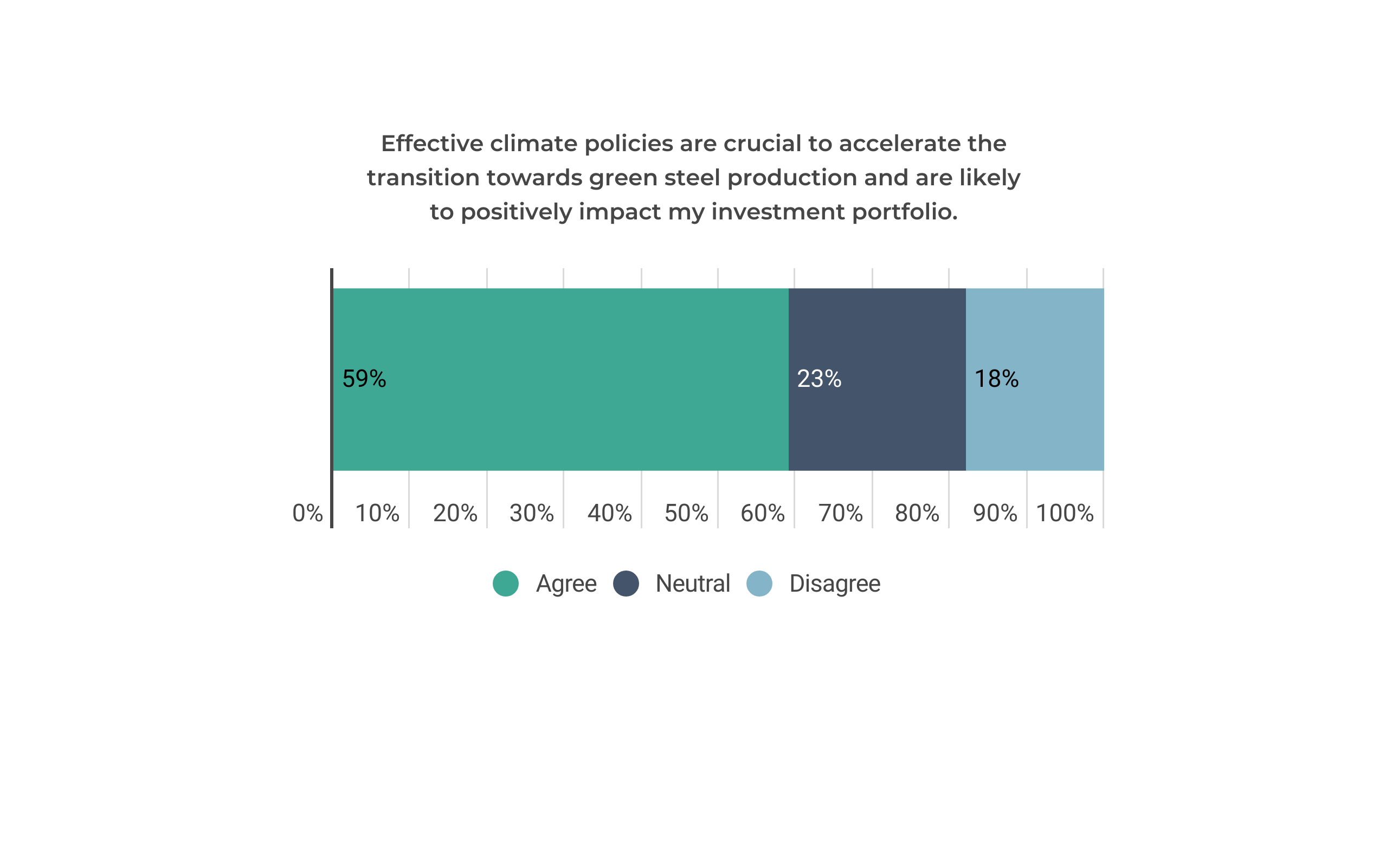

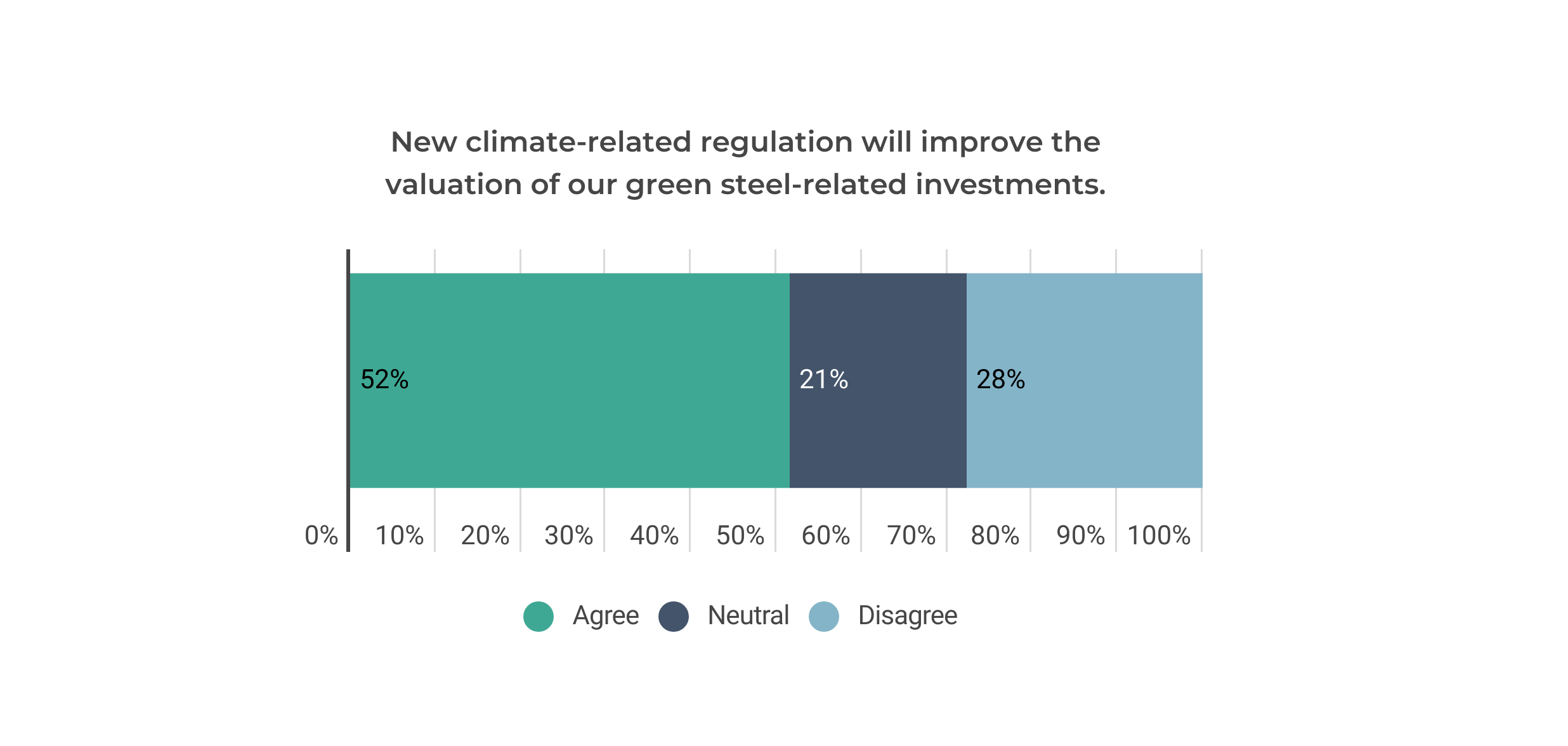

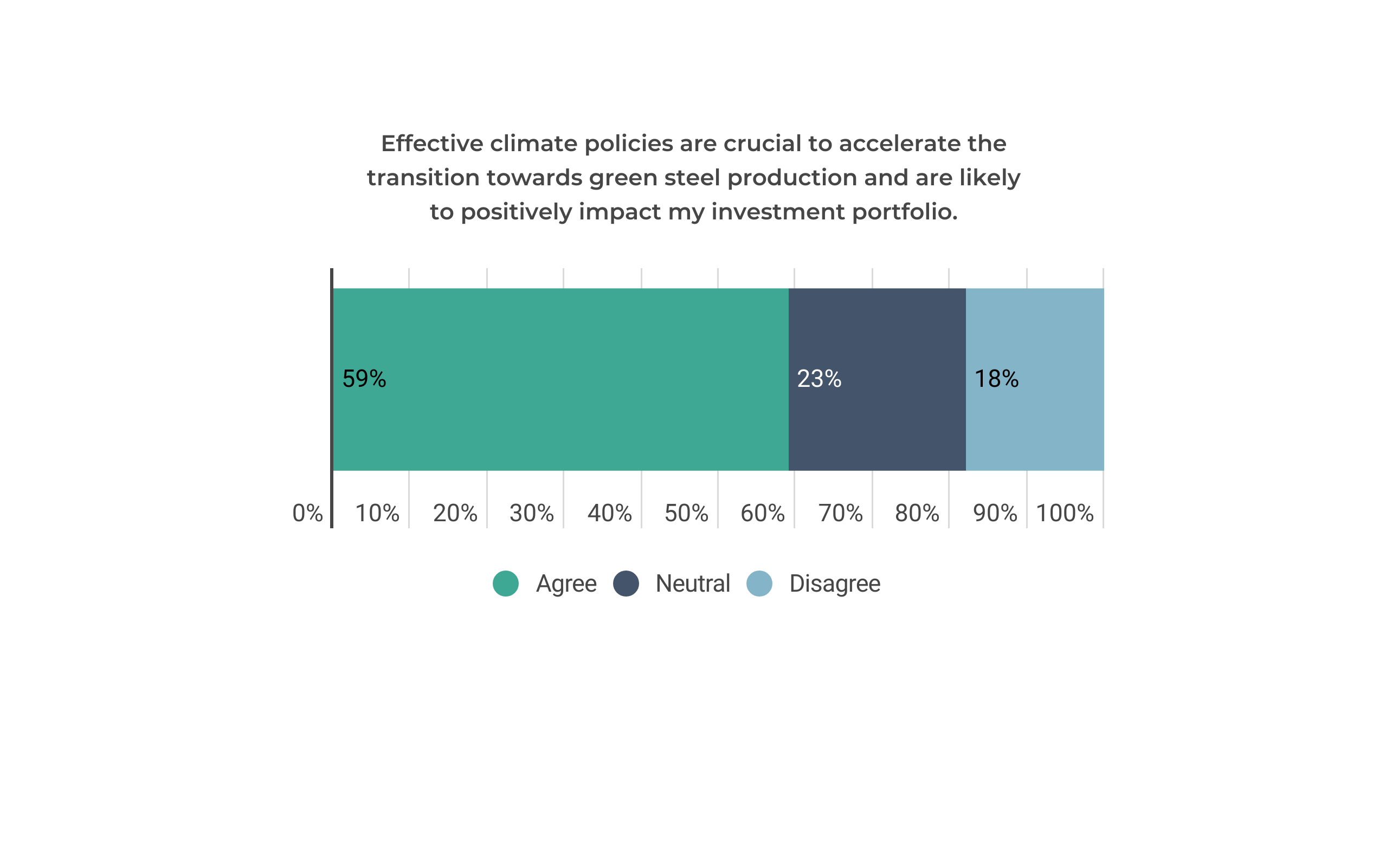

- 59% of investors agree that effective climate policies are crucial to accelerate the transition towards green steel production and are likely to positively impact their investment portfolio. This shows investor appetite for ambitious policy and regulation which removes barriers to the uptake of green steel.

- More than half (52%) of investors understand that lobbying by companies is a key contributor to the persistence of metallurgical coal in steelmaking, and 45% of respondents are undertaking their own lobbying which counters this. This suggests investors are aware that company lobbying to retain metallurgical coal in steelmaking contradicts its increasing risk profile.

See full survey results here.

1. Green Steel

The majority of investors (81%) agree that ‘green steel’ cannot be produced with fossil fuels.

- The results show investors are converging towards a clear definition of green steel, despite industry-wide uncertainty on its meaning, which has seen the ongoing use of fossil fuels in products labelled as ‘green’ steel.

- This also suggests certain technologies and methods marketed as ‘green’ may not align with investor expectations. One example is the mass balance approach, in which companies allocate emissions reductions across all operations of their business to a particular steel product marketed as ‘green’ or ‘low emissions’ steel.

- The sentiment expressed by investors suggests there is interest in genuine emissions reduction technologies like green hydrogen-based ironmaking (H2DRI) and electric arc furnaces (EAFs).

The majority of investors (55%) agree the market demand for green steel is growing rapidly, with confidence strongest amongst Nordic and EU investors, and lowest amongst respondents in China and India.

Australian investors believe there is rapid innovation in green steel and uncertain returns are not a key barrier to investment.

- The majority (52%) of Australian investors also agreed the market demand for green steel is growing rapidly. Concurrently, far fewer Australian investors believed economic uncertainty was a major barrier to green steel investments, with only 14% selecting difficulty in evaluating future returns as one of the top two barriers to investing in green steel (full results, p. 14).

- More than two-thirds of Australian investors do not believe metallurgical coal will be required for steelmaking in the decades to come (full results, p. 19), a stark finding given the high volumes of metallurgical coal produced in and exported by Australia. The majority of investors in Australia see steelmaking moving towards legitimate green steel technologies.

2. Metallurgical Coal

The majority of investors (68%) foresee a transition away from metallurgical coal in steelmaking.

- The finding suggests investors in steel and diversified mining are increasingly confident that steelmaking without metallurgical coal – and the increasingly global spread of recently announced fossil-fuel free steel projects – is a safe, long-term prospect for shareholders.

- This sentiment also contrasts significantly from the actions and words of companies who state metallurgical coal will be needed for decades to come, and/or are seeking to acquire mining stakes, expand current mines or extend the lives of metallurgical coal assets well beyond 2050.

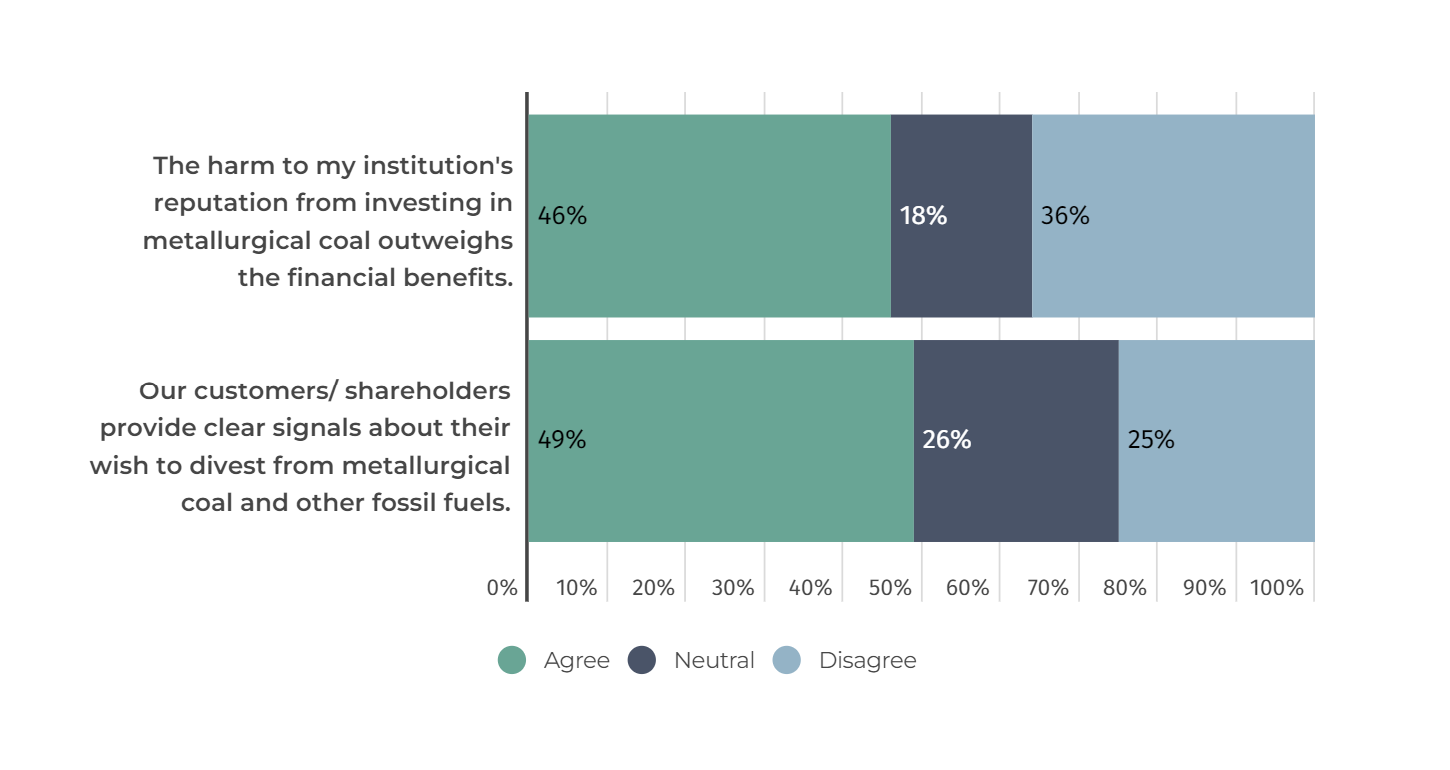

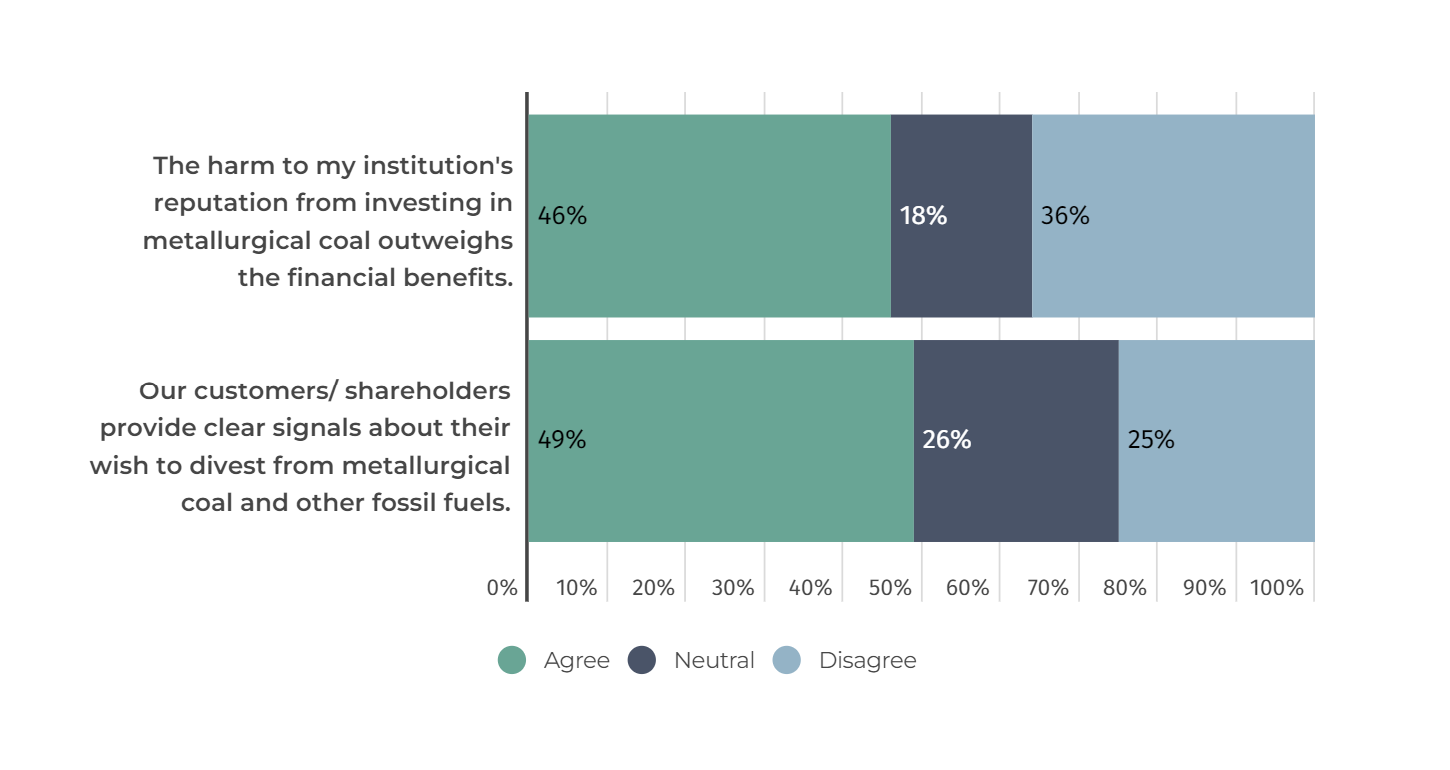

Almost half of investors (46%) agree the reputational risk from metallurgical coal outweighs its financial benefits.

- 41% of investors also agreed the fear of stranded assets was a risk factor with the use of metallurgical coal (full results, p. 25).

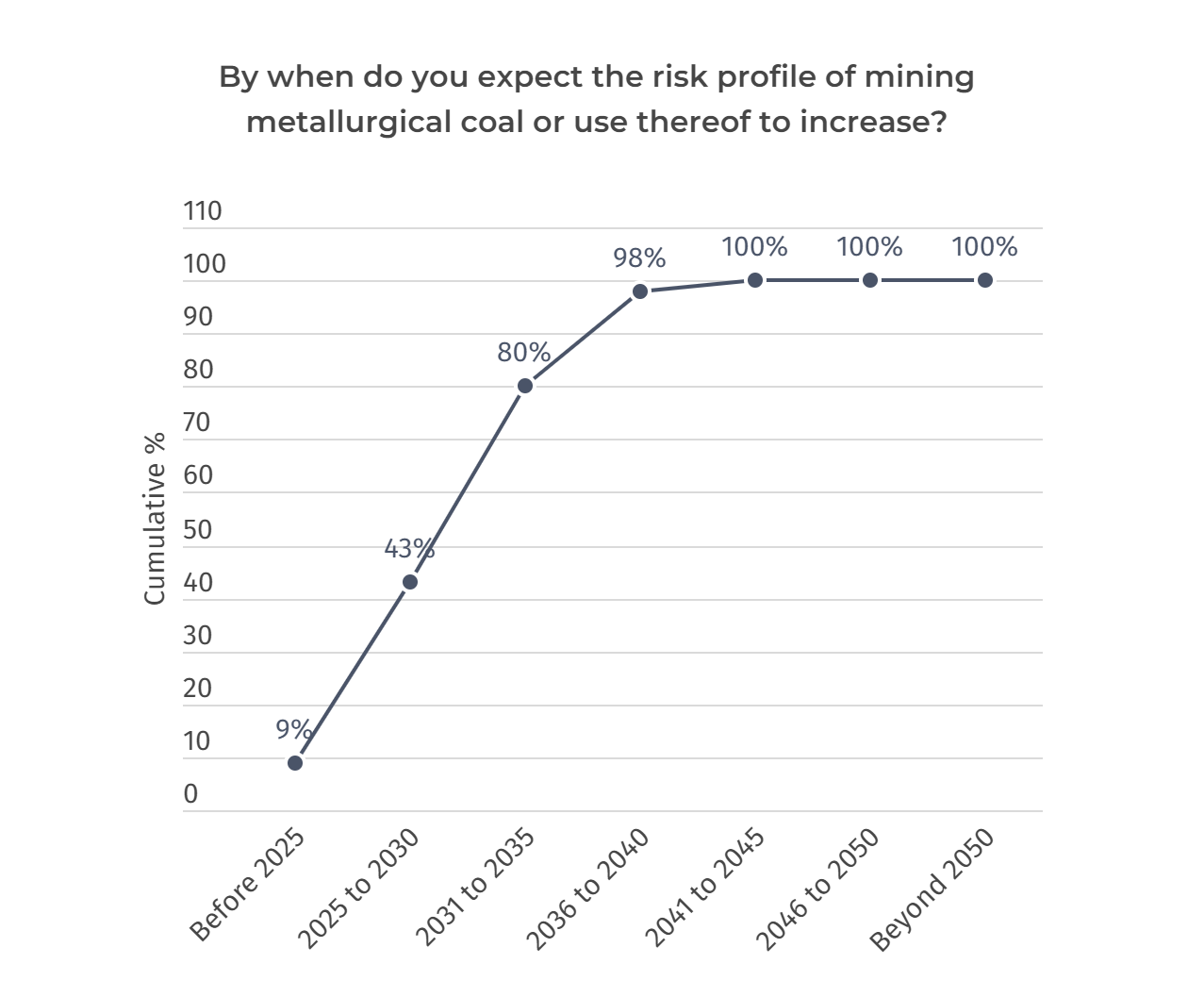

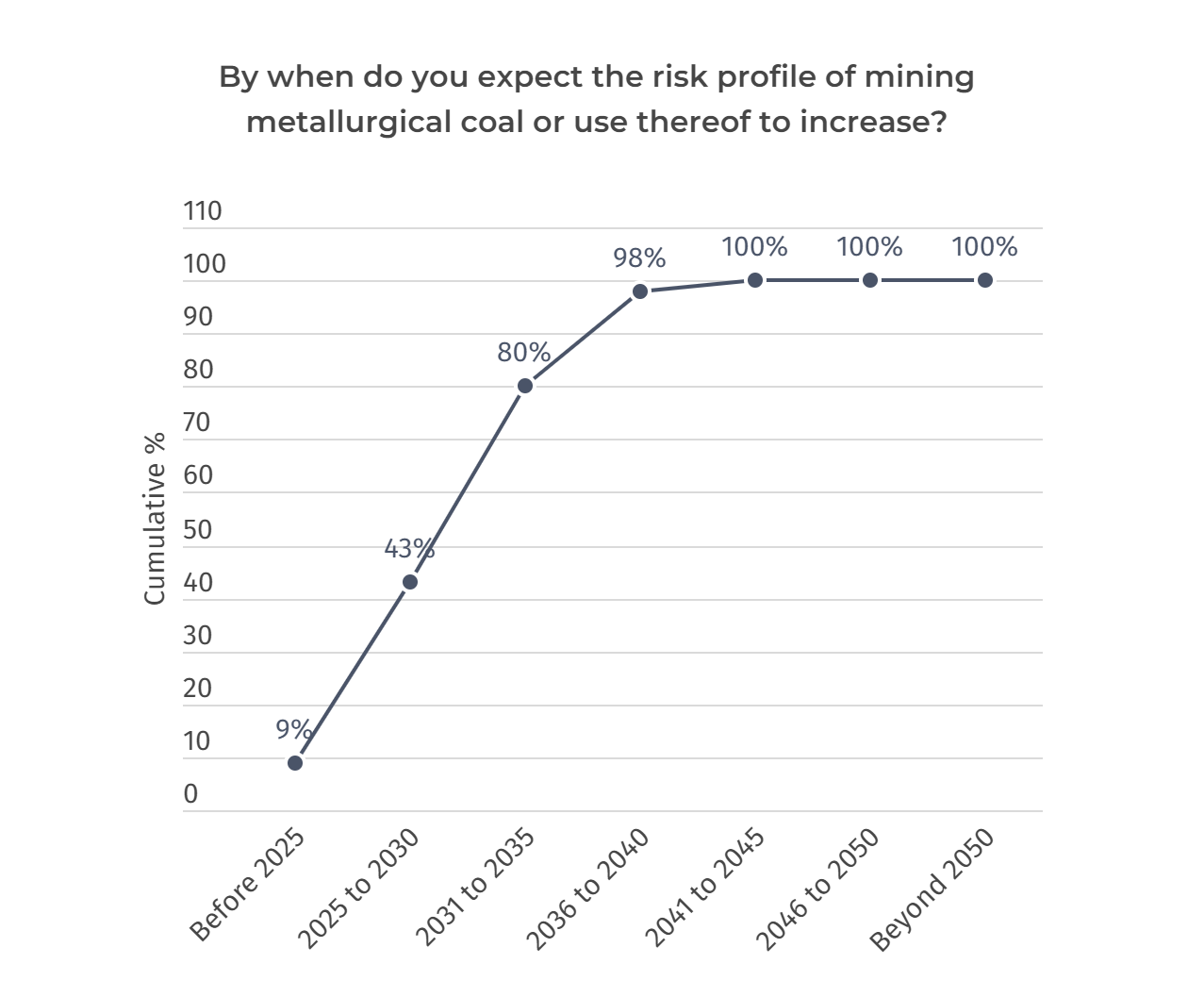

80% of investors believe metallurgical coal’s risk profile will increase in the next decade.

- The finding suggests a large majority of investors see metallurgical coal’s risk profile increasing by 2035, much sooner than many companies are banking on, which corresponds with recent findings from the IEA and Australian Government that markets are moving away from metallurgical coal.

- This is important as companies are making investment decisions now that could lock-in emissions and the associated risks from metallurgical coal. Companies may face consequences as investor appetite for this risk decreases.

Most investors in China (72%) do not believe metallurgical coal has a continued role in steelmaking.

- China, the world’s largest steel producing region, is also among its most carbon intensive. The finding is significant because it shows investor sentiment deviates substantially from China’s current reliance on coal-based steelmaking. Coal-based steelmaking makes up around 90% of China’s steel production, compared to the global average of around 70%.

3. Low-carbon energy

59% of investors also support the import of green iron as a practical solution in regions where renewable energy capacity is constrained.

- The results show investors see green iron as a viable option for steelmakers who don’t currently possess the low-carbon energy capacity necessary to reduce the carbon intensity of their production.

- The finding also suggests investors can engage further with companies and policymakers across the global steel value chain to incentivise and drive demand for green iron corridors.

- Such demand could enable countries such as Australia and Brazil, where green hydrogen is cheaper to produce, to become major green iron exporters, while steelmakers in Japan, who have limited access to renewable resources, could transition away from coal-based iron processing.

4. Policy and lobbying

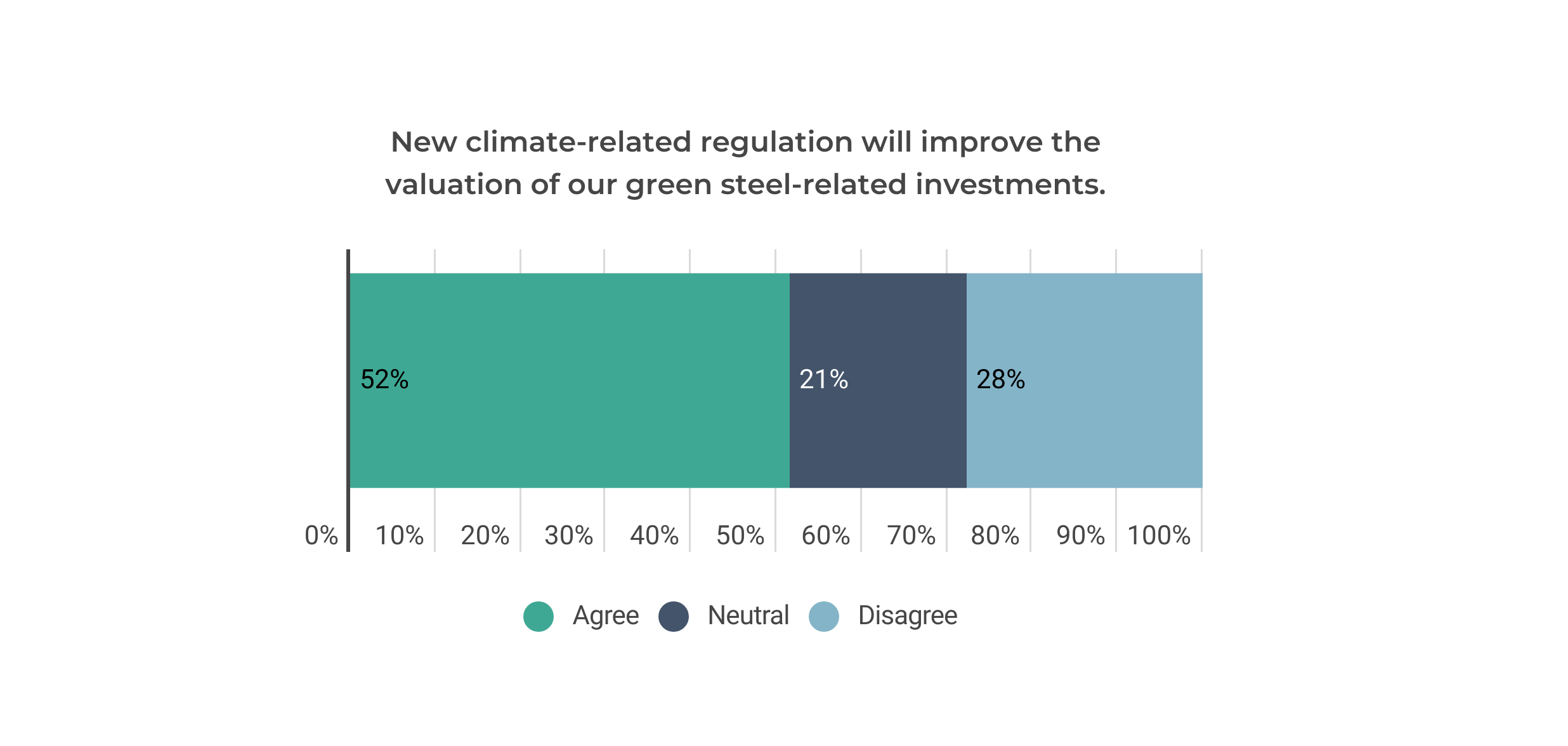

A majority of investors are supportive of incentives and regulations which catalyse the green steel transition.

- The results show investors are inclined to support and potentially advocate openly for ambitious policy and regulation which removes barriers to the uptake of green steel.

- With investors split (50% positive; 50% negative/neutral) on the level of upfront investment required (full results, p. 17) and the uncertain ROI from green steel, it also suggests policy which allays these concerns will help drive further investor support for green steelmaking.

More than half of investors understand company lobbying is a key contributor to the persistence of metallurgical coal in steelmaking, and 45% of those surveyed are undertaking their own lobbying to counter this.

- The finding demonstrates investors understand the role of lobbying in making - or breaking - policy decisions, and suggests investors are aware that company lobbying to retain metallurgical coal in steelmaking contradicts the increasing risk profile it has.

- The survey also found investors were undertaking direct policy advocacy that supports climate goals and the steel sector transition. Nearly half of the respondents said that they are lobbying their government for incentives to attract renewable energy development, a crucial component for decarbonising steelmaking and reaching net zero.

5. Investor action and information sources

While some investors are satisfied with the availability of information to factor decarbonisation into their investment decisions about steel, the results remain quite mixed.

- The finding shows companies need to increase the quality and quantity of the information they provide about their climate-related lobbying activities and decarbonisation strategies, so investors can make more comprehensive company assessments and investment decisions.

Further Reading

ACCR has recently published a range of resources for investors engaging with companies across the steel value chain.

- The Forging Pathways report sets out the range of decarbonisation technologies available to the steel industry, and their emissions reduction potential, as well as analysis of the readiness of 20 major steel and diversified mining companies for the green steel transition. It also provides policy insights and investor recommendations.

- The investor handbook for engaging with the steel sector uses the research from Forging Pathways to provide a practical tool for investors to use in engagements with steelmakers and diversified miners. The handbook sets out questions to ask these companies, best practice responses, as well as information and evidence to support discussion.

- The steel decarbonisation announcements tracker serves as a centralised hub, providing users with easy access to the latest progress in global steel decarbonisation. The database covers 20 major companies within the steel value chain, representing 41% of global iron ore production and 27% of global steel production.

Download Ahead of the game: investor sentiment on steel decarbonisation | 07/2024

Please read the terms and conditions attached to the use of this site.