Publication Glencore Plc: Assessment of progress against its climate plan

Glencore Plc

(ISIN:JE00B4T3BW64, SEDOL:B4T3BW6)

Assessment of progress against its climate plan

AGM date and location: 12.00pm CEST, 28 April 2022, Zug, Switzerland

Summary

In December 2020, Glencore published its first three-yearly climate action transition plan, which was supported by 94% of shareholders at its 2021 AGM. In December 2021, Glencore published its 2021 Climate Report, Pathway to net zero - 2021 progress report, which provided an update on its progress against its emission reduction targets.

ACCR believes the overwhelming support Glencore received for its climate plan in 2021 was unwarranted, and there is ample reason to vote against its climate plan and progress at the 2022 AGM.

Voting recommendation: AGAINST

Key reasons to vote AGAINST the plan:

- Glencore is undertaking several significant coal expansion activities in Australia, including a new greenfield coal mine, which is directly at odds with its stated policy to “run-down” coal mines and coal production over time.

- Coal generates the majority of Glencore’s greenhouse gas (GHG) emissions, including almost 90% of its scope 3 emissions.

- There are real concerns that Glencore is underreporting its fugitive methane emissions from coal mining in Australia, and Scope 3 emissions from its investments.

- Due to the share of Glencore’s emissions generated from coal, Glencore’s emission targets are not consistent with the steeper decline pathways for coal as determined by the International Energy Agency (IEA) or the Intergovernmental Panel on Climate Change (IPCC) to stay within 1.5°C climate goals, even with overshoot.

- Glencore has not set an emissions reduction target for 2030, despite this being the critical decade for climate action.

- Unlike many of its peers, Glencore has failed to commit capital expenditure to reducing its operational and Scope 3 emissions, including renewable energy investments.

- Glencore is the 8th most obstructive company blocking climate policy action globally, and remains one of the few diversified miners still promoting thermal coal. Glencore’s direct and indirect advocacy through industry associations continues to stand in the way of ambitious climate policy in Australia.

- On its current trajectory, Glencore’s coal-related emissions will continue to outweigh the climate benefits of its future-facing commodities, casting doubt on its contribution to the energy transition and decarbonisation goals.

ACCR also recommends voting against the re-election of Peter Coates.

1. Say on Climate: Paris alignment is paramount

‘Say on Climate’ votes and subsequent progress votes are an opportunity to send a clear and non-binding message to the board about the veracity of emissions targets and whether the companies’ plans are aligned with the Paris Agreement. The vote is not about the general direction of travel or willingness of companies to meet and discuss its climate credentials.

Despite overwhelming support for Glencore’s climate action transition plan in 2021, few investors assessed that plan for alignment with the Paris Agreement, including the major proxy advisers:

- Glass Lewis recommended shareholders abstain due to its concerns around corporate governance and potential legal implications of a ‘say on climate’;

- ISS recommended shareholders vote in favour of the plan in recognition of Glencore’s “commitment to transparency and accountability to its shareholders” by providing a ‘say on climate’, despite acknowledging its lack of near-term targets and no clear commitments around thermal coal.

The Intergovernmental Panel on Climate Change (IPCC) Sixth Assessment Report—described as the “code red for humanity”[1]—concluded that “we are at imminent risk of hitting 1.5°C in the near term” and that “the only way to prevent exceeding this threshold is by urgently stepping up our efforts and pursuing the most ambitious path.”[2] An agreement endorsed by nearly 200 nations at last year’s COP26 climate summit in Glasgow included for the first time a pledge to begin curtailing coal from the energy mix. UN Secretary-General Antonio Guterres described coal as a “deadly addiction” and urged all governments, private companies and local authorities to “cancel all global coal projects in the pipeline”[3], while COP26 president Alok Sharma called on world leaders to “consign coal to history”.[4]

Glencore’s commitment to “manage the decline of [its] fossil fuel portfolio in a responsible manner”[5] is not matched by a decline in coal production required for Paris Agreement alignment. Glencore’s Australian coal production is 80% thermal coal and the company is pursuing several coal mine expansions as well as a major new greenfield coal mine.

In the 2021 Climate Action 100+ benchmark assessment,[6] Glencore failed to meet any criteria on short-term targets and capital allocation alignment. Glencore only partially met the criteria on medium-term targets, decarbonisation strategy, climate policy engagement and climate governance.

Table 1: Climate Action 100+ benchmark assessment for Glencore, 2021

| Indicator | Glencore’s performance |

|---|---|

| Net-zero GHG Emissions by 2050 (or sooner) ambition | Meets all criteria |

| Long-term (2036-2050) GHG reduction target(s) | Meets all criteria |

| Medium-term (2026-2035) GHG reduction target(s) | Partial |

| Short-term (up to 2025) GHG reduction target(s) | Does not meet any criteria |

| Decarbonisation strategy | Partial |

| Capital allocation alignment | Does not meet any criteria |

| Climate policy engagement | Partial |

| Climate Governance | Partial |

| Just Transition | NA |

| TCFD Disclosure | Meets all criteria |

ACCR strongly encourages investors to use alignment with the Paris Agreement, particularly the goal to limit warming to 1.5°C, as the primary measure to assess progress against climate transition plans. A vote against the Glencore climate change progress report will send a clear signal to the Glencore board that further work is required to align its coal production and capital allocation with broader climate goals. Emissions reduction targets and the company’s commitment to a managed decline of its coal assets must be consistent with a Paris-aligned production decline. Shareholders must be careful not to tacitly approve Glencore’s coal expansion plans.

2. Transition opportunities and challenges for sector

Glencore states that it is well placed to capitalise on the decarbonisation of global energy demand, by supplying future-facing commodities such as copper, cobalt, zinc and nickel that will be required in the transition to a low-carbon economy. However, Glencore’s significant coal-related emissions outweigh the climate benefits of its other commodities.

Coal remains a significant part of Glencore’s business. Despite contributing just 9% of revenue in 2021, Energy Products (which is mostly coal) produced 26% of EBITDA.

Table 2: Glencore revenue and EBITDA, 2016-21

| $m | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| Revenue | 205,476 | 219,754 | 215,111 | 142,338 | 203,751 |

| Adjusted EBITDA | 14,545 | 15,767 | 11,601 | 11,560 | 21,323 |

| Energy products revenue | 10,067 | 12,660 | 15,067 | 11,145 | 19,269 |

| Energy products EBITDA | 3,599 | 5,312 | 3,854 | 1,039 | 5,603 |

| Energy products revenue % | 5% | 6% | 7% | 8% | 9% |

| Energy products EBITDA % | 25% | 34% | 33% | 9% | 26% |

*Estimated

In 2020, coal accounted for 29% of Glencore’s operational emissions, and 80% of Glencore’s total emissions (Scopes 1, 2 and 3).

Table 3: Glencore emissions by commodity, 2020

| MtCO2e | Scope 1 | Scope 2 | Scope 3* |

|---|---|---|---|

| Coal | 5.9 | 1.2 | 300.0 |

| Copper | 1.3 | 1.6 | 4.5 |

| Ferroalloys | 3.0 | 4.1 | 4.5 |

| Nickel | 2.6 | 0.0 | 4.5 |

| Oil | 0.2 | 0.0 | 25.0 |

| Zinc | 2.0 | 2.4 | 4.5 |

| Total | 15.0 | 9.3 | 343.0 |

*Estimated commodity breakdowns

Glencore claims that its 2026 target lies within the range of IPCC 1.5°C scenarios, and its 2035 target is aligned to the IEANZE (Net Zero Emissions) 2050 scenario, which is consistent with IPCC SSP1-1.9. However, it would be more appropriate for Glencore to follow the coal production decline rate of the IEANZE pathway, instead of using the overall pathway for fossil fuel combustion.[7] In the IEANZE 2050 scenario, coal use drops by 55% from 2020 to 2030.[8] A 1.5°C-consistent pathway implies that coal production would decrease annually by 11% between 2020 and 2030.[9] A 1.5˚C-aligned reduction pathway for Glencore requires a higher reduction target.

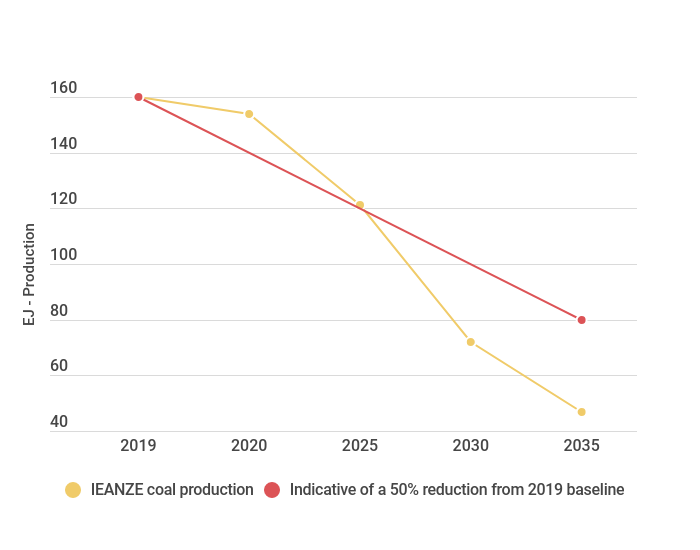

Figure 1 shows that the international coal production pathway in the IEANZE requires a greater than 50% reduction in coal production and associated emissions by 2035.

Figure 1: IEANZE coal production decline to 2035,[10] compared to a 50% reduction by 2035

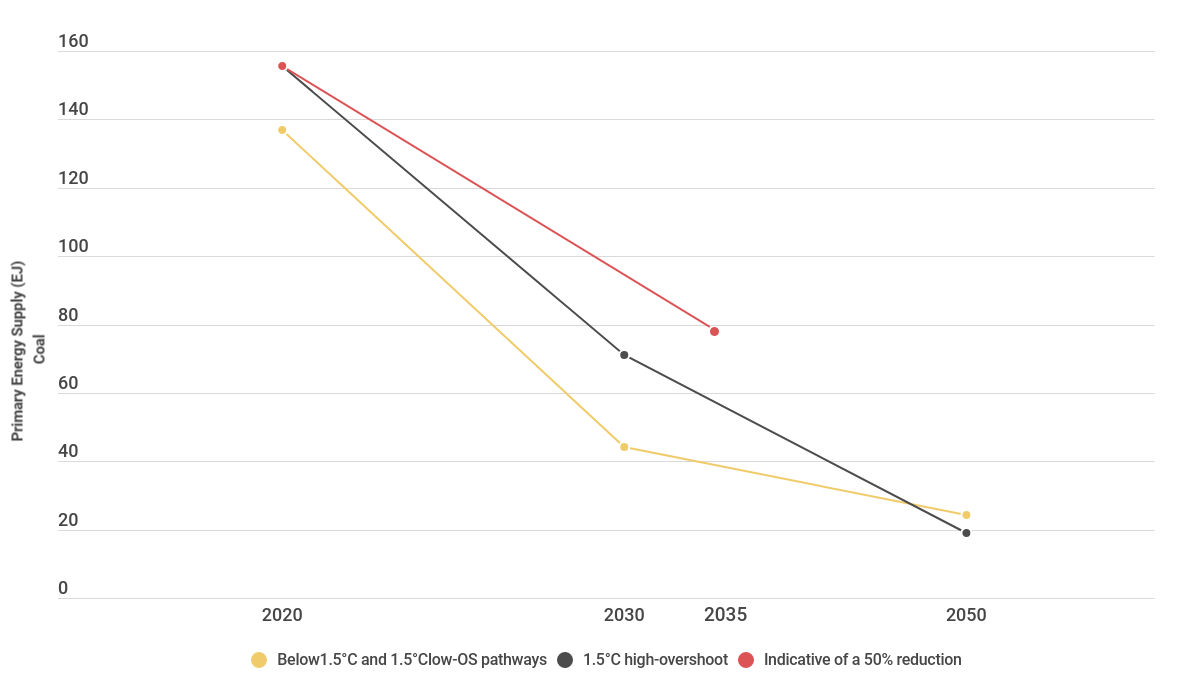

The IPCC’s Special Report on Global Warming of 1.5°C concluded that in the absence of, or with only a limited use of carbon capture and storage (CCS), the share of primary energy provided by coal must decline by 61-78% by 2030, and by 77-97% by 2050 (relative to 2010).[11]

Figure 2 is based on data from the IPCC 2018 Mitigation Pathways Compatible with 1.5°C in the Context of Sustainable Development report. It shows the IPCC 1.5°C scenarios for coal as a primary energy supply out to 2050. The median figures for both the high overshoot scenarios (black line) and low overshoot scenarios (yellow line) require a drop in coal supply that is notably greater than a 50% by 2035 reduction. The red line is illustrative only, demonstrating a 50% reduction target is outside the decline range required for coal. Glencore is likely to be relying on IPCC scenarios with the highest possible overshoot.

Figure 2: IPCC: Global primary energy supply of 1.5°C pathways from the scenario database (Supplementary Material 2.SM.1.3)

3. Company GHG emissions performance and targets

In June 2021, on the same day that Glencore announced it was acquiring the remaining two thirds of Cerrejón from Anglo American and BHP Group for $US588 million, it also updated its emissions reduction targets. Its current targets (including Scopes 1, 2 and 3 emissions) are as follows:[12]

- Short-term: reduce emissions by 15% by 2026 (on 2019 levels);

- Medium-term: reduce emissions by 50% by 2035 (on 2019 levels);

- Long-term: ambition for net-zero emissions by 2050.

Glencore intends to restate its 2019 baseline (Scopes 1+2: 29.3 MtCO2e, Scope 3: 343 MtCO2e) to account for 100% ownership of Cerrejón.[13]

Glencore and Fortescue Metals Group are the only two major miners to have set targets inclusive of their Scope 3 emissions. However, Glencore is the only major miner with ambitions rather than targets to meet net zero operational emissions by 2050.

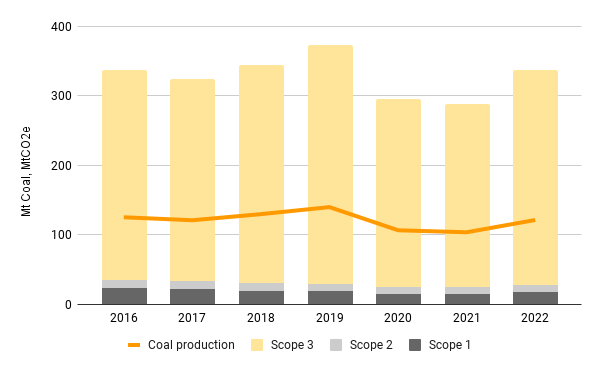

The use of sold products (Scope 3, Category 11), mostly made up of coal and some oil, contributes more than 90% of Glencore’s total carbon footprint.[14] Therefore, its GHG emissions performance is highly correlated with coal production.

In 2019, the year in which Glencore set its emissions baseline (Scopes 1+2: 29.3 MtCO2e, Scope 3: 343 MtCO2e), coal production reached a high of 139.5 million tonnes. In the two years since, coal production was significantly lower, due primarily to the pandemic depressing demand. However, Glencore forecasts that coal production will be 121 million tonnes in 2022 (+/-5 million tonnes),[15] so its total emissions are expected to rise by approximately 17% in 2022. This is likely to include the 100% ownership of Cerrejón production.

Table 4: Glencore’s GHG emissions performance, 2016-2022

| MtCO2e | 2016 | 2017 | 2018 | 2019 | 2020 | 2021* | 2022* |

|---|---|---|---|---|---|---|---|

| Scope 1 | 23.1 | 21.8 | 18.8 | 18.3 | 15 | 15 | 17 |

| Scope 2 | 11.9 | 11.5 | 11.8 | 11 | 9.3 | 9 | 10.6 |

| Scope 3 | 302 | 290 | 313 | 343 | 271 | 264 | 309 |

| Coal production | 124.9 | 120.6 | 129.4 | 139.5 | 106.2 | 103.3 | 121 |

*Emissions estimates based on actual 2021 production, forecast 2022 production

Beyond operational issues affecting production (e.g. weather, industrial action, safety incidents), it is difficult to determine the drivers for the significant swings in Glencore’s coal production. Glencore should commit to limit coal production (rather than capacity) in the medium-term, in order to ensure that production declines to 2030.

Figure 3: Glencore’s GHG emissions performance, 2016-2022

*Emissions estimates based on actual 2021 production, forecast 2022 production

4. Decarbonisation strategy

Glencore has identified seven pathways to delivering its emissions reduction targets:[16]

- Managing its operational footprint

- Reducing Scope 3 emissions

- Allocating capital to prioritise transition metals

- Collaborating with its value chains

- Supporting uptake and integration of abatement

- Utilising technology to improve resource use efficiency

- Transparent approach

We will address each of these pathways in detail below.

4.1 Managing its operational footprint

Glencore reduced its direct operational emissions (Scope 1) by 8.1 million tonnes CO2e between 2016 and 2020. The majority of these emissions reductions—69% or 5.6 million tonnes—came from a significant reduction in emissions from underground coal mines in Australia. In addition to flaring methane (rather than venting) and capturing methane for on-site use, Glencore confirmed the significant drop in fugitive emissions between 2017 and 2018 was “mainly due to the closure and sale of underground assets in Australia.”[17]

Table 5: Glencore’s Scope 1 emissions, 2016-20

| MtCO2e | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|

| Fossil fuels | - Solid fossil fuels | 2.0 | 1.9 | 1.9 | 2.3 | 1.9 |

| - Liquid fossil fuels | 5.1 | 5.2 | 5.7 | 5.3 | 4.3 | |

| - Gaseous fossil fuels | 0.9 | 0.7 | 0.7 | 1.1 | 0.7 | |

| Reductants | 5.3 | 5.8 | 5.6 | 5.2 | 4.1 | |

| Emissions from fossil fuel extraction | - Underground | 7.3 | 6.2 | 3 | 2.1 | 1.7 |

| - Open pit and stockpiling | 1.3 | 1.2 | 1.2 | 1.5 | 1.3 | |

| - Decommissioned mines | 0.3 | 0.4 | 0.3 | 0.4 | 0.6 | |

| Other direct GHG emissions | 1.0 | 0.4 | 0.4 | 0.4 | 0.4 | |

| Total | 23.1 | 21.8 | 18.8 | 18.3 | 15.0 |

Fugitive methane emissions made up 14% of Glencore’s 2019 operational emissions baseline, approximately 2.6 million tonnes CO2e.[18] The majority of Glencore’s coal production is from surface rather than underground mining (85% open cut vs 15% underground[19]). It is difficult to capture fugitive methane emissions from open cut coal mines, as almost all methane is released during blasting.[20]

A 2022 report by the International Energy Agency (IEA) found global methane emissions from the energy sector are about 70% greater than the amount officially reported by national governments, and that satellites have greatly increased the world’s knowledge of emission sources.[21]

Methane is the second most important GHG in terms of current anthropogenic climate forcing, and global anthropogenic methane emissions continue to increase. Methane is responsible for around 30% of the rise in global temperatures since the industrial revolution, and rapid and sustained reductions in methane emissions are key to limiting near-term warming.[22]

SRON Netherlands Institute for Space Research used satellite data from the European Space Agency to determine that Glencore’s Hail Creek coal mine was found to be a “super-emitter”.[23] The Hail Creek mine leaked an estimated 230,000 tons of methane a year in 2018 and 2019,[24] accounting for 20% of Australia’s methane emissions from coal mining even though it generates just 1% of Australia’s coal production. Glencore’s Oaky North mine was also identified as a “super-emitter”.[25] The findings suggest there may be “a large underreporting of methane emissions in Australia’s national inventory.”[26]

In the absence of more granular data, it is impossible to determine whether the outsized methane emissions from Hail Creek and Oaky North are captured in Glencore’s emissions reporting. Glencore does not disclose fugitive methane emissions data by jurisdiction or mine site, though it is assumed to be closely correlated to coal production and mine type (surface/underground). Glencore should address the concerns around super-emitting mines and improve its fugitive methane emissions disclosure.

Glencore reduced its indirect operational emissions (Scope 2) by 2.6 million tonnes CO2e between 2016 and 2020. The vast majority of these emissions reductions—64% or 1.7 million tonnes—was due to the reduced consumption of power due to the Covid-19 pandemic and some assets being on care and maintenance” in 2020.[27]

Table 6: Glencore’s Scope 2 emissions by commodity, 2016-20

| MtCO2e | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|

| - Agriculture | 0.2 | 0 | 0 | 0 | 0 |

| - Coal | 1.3 | 1.2 | 1.2 | 1.2 | 1.2 |

| - Copper | 1.7 | 1.8 | 1.7 | 1.5 | 1.6 |

| - Ferroalloys | 6.4 | 6.1 | 6.3 | 5.7 | 4.1 |

| - Nickel | 0 | 0 | 0.1 | 0.1 | 0 |

| - Oil | 0 | 0 | 0 | 0.1 | 0 |

| - Zinc | 2.1 | 2.3 | 2.5 | 2.5 | 2.4 |

| Total | 11.9 | 11.5 | 11.7 | 11 | 9.3 |

In order to reduce its Scope 2 emissions further, Glencore has a number of renewable projects planned or recently completed:

- Upgrade to Inga Hydroelectric Project (DRC), completed 2021

- Supply from wind power purchase agreements (PPAs) for Asturiana de Zinc (Spain), 2021-40

- Wind and solar at the Raglan mine (Canada), completed 2014, 2018 and 2021

- Glencore-Merafe ferrochrome renewable energy project, 2021-27

Despite these plans, the share of Glencore’s total electricity and energy sourced from renewable energy remained relatively static in the five years between 2016 and 2020. Furthermore, Glencore has not set a renewable energy target, nor has it committed to allocate a proportion of its capital expenditure to renewable energy projects.

Table 7: Glencore’s energy consumption, 2016-20

| 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|

| Direct Energy (PJ) | 131 | 115 | 120 | 125 | 103 |

| - Coal (%) | 15% | 17% | 16% | 19% | 19% |

| - Natural gas & Coal seam gas (%) | 13% | 11% | 10% | 10% | 12% |

| - Mineral oil (%) | 52% | 62% | 65% | 60% | 58% |

| - Renewable (hydropower etc) (%) | 19% | 10% | 9% | 9% | 11% |

| - Other sources (%) | 1% | 1% | 1% | 1% | 1% |

| Purchased electricity (PJ) | 90 | 87 | 88 | 85 | 77 |

| - Non-renewable (%) | 83% | 88% | 85% | 81% | 83% |

| - Renewable energy (%) | 17% | 12% | 15% | 19% | 17% |

| Renewable energy share of total energy usage (%) | 18% | 11% | 12% | 13% | 13% |

| Renewable electricity share of total electricity usage (%) | 23% | 23% | 23% | 27% | 25% |

Glencore’s 2021 Group Marginal Abatement Cost Curve (MACC) identifies projects capable of reducing emissions by 5.6 Mtpa CO2e per annum which are NPV positive. This amounts to just 19% of Glencore’s 2019 operational emissions baseline. Other projects will require an effective carbon price in excess of $US150/tCO2e. Glencore’s direct and indirect lobbying has, however, opposed carbon pricing (see Climate policy engagement).

4.2 Scope 3 emissions

Glencore is Australia’s largest coal producer and biggest contributor to carbon emissions from coal mining in the country. Figure 4 shows the coal and carbon dioxide emissions from mining companies operating in Australia in 2020.

Figure 4: Australian coal production by company, 2020

Glencore’s coal production guidance for 2022 will see a ~17% increase from 2021, up to 121 mtpa from 103 mtpa.[28] This is in part due to the full acquisition of the Cerrejón mine.

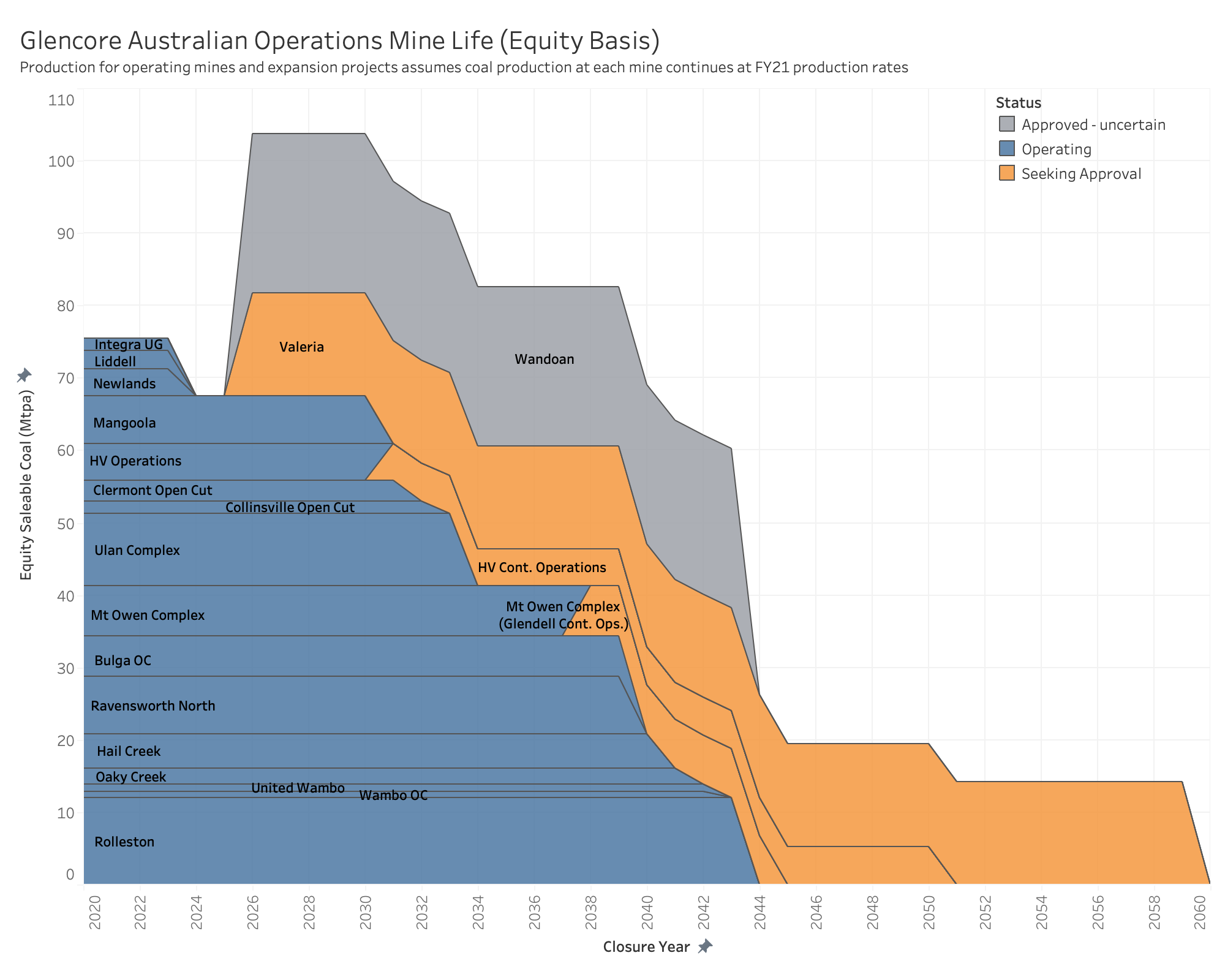

Glencore has significant growth plans for its Australian coal business, despite the IEA’s ‘Net zero by 2050’ scenario[29] concluding that no new coal, gas or oil developments can proceed beyond 2021, in order to limit global warming to 1.5°C.

Glencore plans to “continue to operate [its] mines until they reach the end of their lives.”[30] Yet Glencore is planning to expand existing and develop new coal projects. Since its 2019 commitment to cap production capacity, Glencore has added an additional 105 million tonnes of production capacity (on an equity share basis). Some of these mines are planned to commence production in 2026-27, and operate well beyond 2050 (see Table 8).

Table 8: Glencore’s coal expansion plans in Australia

| Project | Status | Resource | New capacity Mtpa | New capacity, equity share Mtpa | Estimated Start |

|---|---|---|---|---|---|

| Bulga Optimisation (NSW) | Approved 2020 | Thermal/Met | 10 | 10 | 2023+ |

| Glendell Continued Operations (NSW) | Assessment | Thermal/Met | 10 | 10 | 2022+ |

| Mangoola Continued Operations (NSW) | Approved 2021 | Thermal | 5 | 5 | 2023+ |

| Mt Owen Continued Operations (NSW) | Approved 2019 | Thermal/Met | 14 | 14 | 2020 |

| United Wambo (NSW) | Approved 2019 | Thermal/Met | 6.5 | 3 | 2020 |

| Hunter Valley Operations North (NSW) | Assessment | Thermal/Met | 20 | 9.8 | 2025+ |

| Hunter Valley Operations South (NSW) | Assessment | Thermal/Met | 22 | 10.8 | 2025+ |

| Valeria (QLD), Greenfield mine | Referred to Govt | Thermal/Met | 20 | 20 | 2027 |

| Wandoan (QLD), Greenfield mine | Approved 2017 | Thermal | 22 | 22 | 2026+ |

| Total new capacity | 129.5 | 104.6 |

Figure 5: Glencore’s operating, approved and mines under assessment in Australia 2022[31]

Glencore is currently seeking approval to extend the life of the Glendell mine to 2044, increasing annual production from 4.5 Mtpa to 6-10 Mtpa (million tonnes per annum), which will result in the extraction of an additional 135 million tonnes of predominantly thermal coal. The assessment process to date has received testimony from the Heritage Council of NSW that the mine expansion would result in “irreversible loss” to a place of “exceptional significance” with a “catastrophic heritage impact”.[32]

Glencore and its joint venture partner Yancoal are planning a significant expansion at the Hunter Valley Operations to extend the life of HVO North from 2025 to 2050, to produce up to 22 Mtpa. In addition, the joint venture is also proposing an extension to HVO South from 2030 to 2045, to produce up to 20 Mtpa.[33]

Glencore is also pursuing the significant new greenfield Valeria coal mine in the Bowen Basin, Queensland[34]. In December 2021, Valeria was referred to the federal government under the Environmental Protection and Biodiversity Conservation (EPBC) Act. Valeria would produce 16-20 Mtpa (run of mine) until 2067, and generate over 1 billion tonnes of Scope 3 emissions.[35] It would heavily impact productive agricultural land and destroy habitat “considered as critical to the species” for the koala.[36] Koalas have recently been declared endangered in NSW and Queensland, as koala populations are in decline.[37]

Glencore has also not abandoned its plans for the Wandoan mine, which received conditional approval by the federal government in 2011 and in 2017 the Queensland government approved three, 27-year mining leases for the Stage 1 Wandoan Coal Project.[38] Wandoan is a greenfield coal mine in the Bowen Basin, Queensland, capable of producing 22-30 Mtpa of mostly thermal coal.[39]

In November 2021, Glencore applied to the Queensland government for a new 73 km2 coal exploration permit (EPC27720) in the Bowen Basin.[40]

In December 2021, Glencore applied to the NSW government for a new coal exploration licence in the Hunter Valley.[41]

4.2.2 Scope 3 emissions - investments

Glencore has stakes in various companies involved in fossil fuel extraction. Glencore does not report the operational emissions from these investments under ‘Scope 3 - investments’. The emissions reported by Glencore under this category (2.294 MtCO2e) are attributed to Antamina (Copper), Century (Alumina), Cerrejón (Coal), Collahusi (Copper) and Viterra (formerly known as Glencore Agriculture).[42]

The most significant proportion of these emissions is produced by EN+ Group, which has a controlling stake in United Company Rusal PJSC.

Glencore should clarify how the emissions from its other investments are reported, and why they should not be included in its 2019 baseline, upon which its 2026 and 2035 emissions reduction targets are based.

Table 9. Glencore’s other investments, 2021[43]

| Fair value $USm | Issued capital % | Scope 1+2 emissions tCO2e | Glencore’s share of emissions tCO2e | |

|---|---|---|---|---|

| EN+ Group plc | 789 | 10.55% | 50,600,000 | 5,338,300 |

| PAO NK Russneft* | 50 | - | - | - |

| Yancoal | 160 | 6.40% | 2,114,527 | 135,330 |

| OSJC Rosneft | 485 | 0.50% | 81,000,000 | 405,000 |

| Other | 136 | - | - | - |

| Total | 1,620 | 5,878,630 |

*In December 2021, Glencore agreed to the sale of its interest in PAO NK Russneft

4.3 Allocating capital to prioritise transition metals

Glencore has committed to allocating approximately US$3.6 billion, or 75% of its annual capital expenditure between 2022 and 2024 to transition metals.[44] The remaining US$1.2 billion, or 25% will be allocated to sustaining capital expenditure in its energy products business.

While this is a laudable commitment, Glencore has allocated $US710 million to expansionary coal projects over the last five years (see Table 10). Given the expansionary coal projects Glencore has planned, it is unlikely that expansionary capital expenditure on coal will be zero in the three years ahead. If this is the case, Glencore should commit to abandoning those projects which are in the approvals or development phase.

Table 10: Glencore’s capital expenditure (ex Agriculture), 2016-20

| US$m | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022-24* |

|---|---|---|---|---|---|---|---|

| Copper | 1,638 | 1,917 | 2,300 | 2,284 | 1,618 | 1,919 | 3,600 |

| Zinc | 536 | 658 | 956 | 1,022 | 771 | 884 | |

| Nickel | 407 | 488 | 580 | 508 | 519 | 637 | |

| Ferroalloys | 114 | 167 | 160 | 149 | 115 | 128 | |

| Aluminium/Alumina | 0 | 2 | 0 | 0 | 0 | 5 | |

| Coal - sustaining | 353 | 544 | 751 | 840 | 607 | 567 | 850 |

| Coal - expansion | 145 | 100 | 135 | 150 | 180 | 157 | 0 |

| Oil | 73 | 98 | 157 | 322 | 244 | 95 | 350 |

| Corporate | 0 | 0 | 38 | 74 | 28 | 31 | 0 |

| Total | 3,266 | 3,974 | 5,077 | 5,349 | 4,082 | 4,423 | 4,800 |

| Coal % | 15% | 16% | 17% | 19% | 19% | 16% | 18% |

| Energy products % | 17% | 18% | 21% | 25% | 25% | 18.5% | 25% |

*Glencore forecasts

Unlike its peers, Glencore has not committed to allocate capital to climate solutions. In 2021, both Fortescue Metals Group and Rio Tinto committed very significant capital to decarbonising their operational and Scope 3 emissions (see Table 11).

Table 11: Major miners’ climate investments

| Company | Climate investments |

|---|---|

| Anglo American[45] | US$108 million investment to develop technology to capture SO2 from its Polokwane platinum smelter in South Africa. |

| BHP Group[46] | US$400 million Climate Investment Program (CIP) over 5 years (announced July 2019); has internal shadow carbon pricing, amount not disclosed. |

| Fortescue Metals Group[47] | Allocation of 10% net profit after tax (NPAT) to fund Fortescue Future Industries (FFI). The FY2021 allocation to FFI was US$1 billion, with expenditure of US$122 million. FY2022 expenditure is expected to be US$400-600 million; internal shadow carbon price between A$25-80/ tCO2e. |

| Glencore[48] | Glencore has not disclosed a budget for investment in climate solutions, however, has committed to “align capital allocation discipline with the goals of the Paris Agreement” through prioritising investment of transition metals. |

| Rio Tinto[49] | US$7.5 billion direct capital expenditure for decarbonisation of Rio Tinto’s assets from 2022 to 2030 (announced Oct 2021), internal shadow carbon price US$75/ tCO2e. |

| Vale[50] | $US4-6 billion investment by 2030 for GHG reduction and internal shadow carbon price of $US 50/tCO2e for all capital allocation decisions. |

4.4 Collaborating with its value chains

In February 2021, Glencore and Century Aluminium Company signed a long-term agreement with Austrian firm Hammerer Aluminium Industries to supply 150,000 metric tonnes of green aluminium over five years.[51]

Also in February 2021, Glencore strengthened its relationship with Norwegian battery manufacturer FREYR for the long-term supply of cobalt metal cut cathodes.[52] Then in August 2021, Glencore signed a strategic partnership with UK firm Britishvolt for the long-term supply of cobalt.[53] Glencore had previously signed cobalt supply agreements with SK Innovation, Samsung SDI and China’s GEM Co Ltd.

Long-term supply agreements for future-facing commodities are welcome. However, Glencore’s advocacy on climate and energy policy globally is at odds with a rapid transition away from fossil fuels (see Climate policy engagement).

4.5 Supporting uptake and integration of abatement

Glencore’s wholly-owned Carbon Transport and Storage Company (CTSCo) operates a demonstration carbon capture and storage (CCS) project in the Surat Basin, Queensland.[54] The project aims to demonstrate the viability of CCS with coal-fired power generation, by capturing CO2 emissions from the Millmerran power station and storing them underground. A final investment decision on the CTSCo project is expected in 2022.

The demonstration plant would capture 110,000 tonnes of CO2 per year and transport the gas 100 kilometres to Glencore’s tenement for permanent underground storage.[55] If successful, the volume captured and stored would equate to less than 2% of the 5.7 million tonnes of CO2-e emitted annually by the Millmerran power station[56] and just 1.1% of Glencore’s annual operational emissions in Australia.[57]

Figure 6: Projected Emissions captured by the CTSCo project (CO2e tonnes p.a.)

Glencore’s CCS-related advocacy in Australia continues to delay the energy transition, by providing governments and local communities with false hope that it will be economic to retrofit coal-fired power stations with CCS. Such projects will only be viable with a substantial carbon price, which Glencore and its industry associations have actively opposed (see Climate policy engagement).

4.6 Utilising technology to improve resource use efficiency

Glencore’s 2021 progress report outlines the various ways in which it actively recycles copper, nickel, cobalt, zinc and precious metals.[58] Glencore also states that it is investigating extensions to existing recycling facilities and exploring new markets for recycling. There is insufficient public information to determine the likelihood of new projects going ahead in the short to medium term. Notably, Glencore’s use of recycled minerals has remained relatively static over the last five years.

Table 12: Glencore material used and recycled, 2016-20

| 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|

| Materials used by weight (million tonnes) | 641 | 314 | 303 | 322 | 295 |

| Secondary materials and recyclable wastes, ie scrap (%) | 0.2% | 0.3% | 0.8% | 0.3% | 0.3% |

| Non-hazardous mineral waste (million tonnes) | 1,829 | 1,901 | 2,041 | 2,284 | 1,861 |

| % mineral waste recycled | 0.6% | 0.8% | 1.0% | 1.0% | 1.0% |

| Total non-mineral waste (thousand tonnes) | 482 | 394 | 325 | 882 | 385 |

| % non-mineral waste recycled | 51% | 46% | 41% | 30% | 31% |

4.7 Transparent approach

While Glencore has published an annual climate and/or sustainability report for several years, there are a number of ways in which it could improve those disclosures, including but not limited to:

- Increased transparency on emissions by mine site;

- Increased transparency on Scope 3 emissions by commodity (metallurgical/thermal coal, oil);

- Increased transparency on methods used to measure and capture fugitive methane emissions;

- More detailed commentary on emissions performance, including key drivers of annual increases/decreases in emissions;

- Further detail on Glencore’s assessment of physical risks, including the vulnerability of jurisdictions and mine sites to acute and chronic weather events;

- Improved assessment of industry associations’ advocacy and whether it is consistent with the goals of the Paris Agreement.

5. Climate policy engagement

In November 2021, InfluenceMap ranked Glencore as the 8th most obstructive company blocking climate policy action globally.[59] Glencore scored a D- for its climate policy footprint and was identified as “one of the few companies in the top 25 whose climate policy footprint is predominantly associated with direct advocacy in favour of thermal coal.”[60]

InfluenceMap also identified a dense network of industry associations opposed to climate policy, including in Australia and South Africa, of which Glencore is a part. Furthermore, there is a strong trend of companies using nominally positive messaging to indicate support for climate action, while using industry groups to block regulations impacting their operations in the near term.[61]

Table 13: Glencore’s misaligned industry associations[62]

| Industry association | InfluenceMap Performance Band |

|---|---|

| Australian Industry Greenhouse Network | D |

| Chamber of Minerals and Energy WA (CME) | E |

| Eurometaux | D |

| Minerals Council of Australia (MCA) | E+ |

| Minerals Council South Africa | D+ |

| Mining Association of Canada | D+ |

| NSW Minerals Council | E- |

| Queensland Resources Council (QRC) | E |

| South African Petroleum Industry Association (SAPIA) | D- |

NB: Grades from D to F indicate increasingly obstructive climate policy engagement

Glencore remains one of the largest members of some of Australia’s biggest blockers of climate action: the Minerals Council of Australia (MCA), the NSW Minerals Council and the Queensland Resources Council (QRC). The MCA was found by InfluenceMap in 2021 to be the single largest negative influence on Australian climate-related policy.[63] Despite nominally positive top-line statements, its detailed regulatory lobbying continues to counter Paris-aligned climate policy.

In June 2021, the MCA published a report “Australian Export Thermal Coal: The Comparative Quality Advantages”,[64] that claimed Australian coal could “reduce emissions” in Asia by displacing other types of coal. The MCA consistently advocates for carbon capture and storage (CCS) to decarbonise coal-fired power generation, rather than a rapid transition to renewable energy.[65]

The MCA’s Climate Action Plan progress report[66] (June 2021) focused almost exclusively on actions taken by the mining industry to reduce their operational emissions. It ignored the emissions from coal combustion, and the MCA’s advocacy to ensure that the coal mining industry continues to grow. The MCA has consistently lobbied against a carbon price or a carbon tax in Australia.[67]

In December 2021, the MCA was vocal in its criticism of the Australian Labor Party’s plan to strengthen the federal government’s weak Safeguard Mechanism.[68] The MCA argued against this policy, claiming that reducing emissions should not come at the cost of international competitiveness.[69] The MCA is also consistently one of the largest political donors in Australia.[70]

Throughout 2020-21, the NSW Minerals Council called for the approval of new/expanded coal mines to aid the recovery from the COVID–19 pandemic.[71] The NSW Minerals Council campaigned for pro-coal candidates in a 2021 NSW by-election.[72] In the same period, Glencore directly hosted the campaign launch for the Nationals candidate for the Upper Hunter by-election at its Ravensworth coal mine. The now NSW Premier Dominic Perrottet said of the industry: “there is no better friend of the mining industry than the NSW government.”[73]

Throughout 2020-21, the QRC attempted to exploit the COVID-19 pandemic to advocate for further expansion of the coal industry as part of the Queensland government’s Resource Industry Development Plan, while successfully lobbying the Queensland government for a freeze on royalty payment increases[74] and a rent waiver for new coal exploration.[75],[76] The QRC was heavily involved in the Queensland election in 2020, funding anti-Greens party advertising and urging voters to support pro-mining candidates.[77]

6. Climate governance

In 2021, Glencore replaced its Climate Change Working Group with a Climate Change Taskforce (CCT), accountable to the Board of Directors.[78] The CCT’s members include the Chief Executive Officer, Chief Financial Officer, Head of Industrial Assets and General Counsel, as well representatives from key corporate functions, including commodity departments.[79] This appears to be the appropriate level of oversight of climate risk.

Glencore states that during 2021, it contributed to the London Stock Exchange’s Climate Governance Score and the Financial Reporting Council’s Stewardship Regulators Group work on stewardship on climate change.[80] It also responded to its banks’ requests for climate information and the Australian Prudential Regulation Authority (APRA) climate modelling. While this appears to be an appropriate level of engagement with governments on climate risk, in Australia, Glencore’s industry associations appeared before a parliamentary inquiry in 2021[81] to criticise financial institutions’ reluctance to support the coal industry.

Glencore’s CEO is responsible for driving the climate strategy within the company. The CEO’s scorecard for the short-term incentive (annual bonus) is as follows:

55% Financial, comprising:

- 30% Funds from operations;

- 15% Net debt;

- 10% Capex;

30% Health, Safety, Environment and Communities, comprising:

- 15% Safety;

- 15% Progress towards 2035 CO2 targets;

15% Individual targets.

While the quantum of the short-term incentive relating to climate change (15%) is broadly in line with investor expectations, it is inappropriate to assess progress against the 2035 emissions reduction target. It would be appropriate to assess the short-term incentive on the 2026 target, as well as other measures including proportion of renewable energy used, capex allocated to transition metals, etc.

Glencore has not disclosed an assessment of the climate change competency of its board. Other resources companies are disclosing competencies for knowledge and experience of climate-related threats and opportunities including climate science, low carbon transition and public policy. Glencore would benefit from new directors with this experience. Short-term climate change courses will not address the lack of technical expertise of the board, especially in regard to climate and transition risks.

The board’s Health, Safety, Environment and Communities Committee, chaired by Peter Coates, is responsible for Glencore’s failure to manage climate risk through coal expansion, and poor emissions oversight. Peter Coates chairs that committee, and a vote against his re-election is warranted:

- Coates joined the board in April 2011, and is now its longest-serving member;

- Coates is not considered to be independent due to the length of his tenure, and his previous roles at Glencore and Xstrata Coal;

- As recently as February 2019, Coates delivered a speech in Australia on “Why Coal Matters”,[82] arguing that “coal will remain a major part of the energy mix for a long time to come”;

- During Coates’ tenure as Chair of the Minerals Council of Australia (MCA), it lobbied then Australian Prime Minister John Howard to oppose ratification of the Kyoto Protocol.[83]

7. Just transition

Glencore has failed to have an honest conversation with its workforce about the future of the coal industry. In November 2021, Glencore wrote to workers outlining potential changes that could result in hundreds of job losses if a mine expansion was not approved.[84]

Glencore should explain to its workers the transition that is rapidly accelerating in the energy sector, and that decisions made in China, Japan and South Korea are very likely to shape their futures. Glencore’s failure to pursue pathways other than coal in Australia, continues to provide false hope to its workforce.

Glencore should provide practical support to its workforce to assist them transition to other commodities or careers, through financial advice, career and training advice, job search assistance and wellbeing support.

8. Conclusion

To conclude, Glencore’s failure to set a 2030 target, its pursuit of several significant new coal expansions in Australia, its failure to set targets around coal production, capital expenditure and renewable energy, and concerns around its fugitive methane emissions warrant a vote against its progress on its climate plan at the 2022 AGM.

The expected increase to Glencore’s 2019 emissions baseline to account for the acquisition of Cerrejón, coupled with its significant coal expansion plans, call into doubt Glencore’s ability to reduce both coal production and emissions consistent with a 1.5°C pathway.

The number and size of new and expanded coal mines Glencore has planned suggest that more frequent emission reduction milestones, linked to remuneration, are required. Glencore must set an ambitious 2030 target for coal production and emissions.

ACCR strongly encourages investors to pursue active engagement with Glencore to discourage coal expansion, commit to climate investments, and establish targets for coal production decline that are aligned with the Paris Agreement. ACCR recommends voting AGAINST at the upcoming vote on progress on the climate plan.

Contacts

Dan Gocher | Director of Climate and Environment | dan@accr.org.au

Naomi Hogan | Strategic Projects Lead - Australia | naomi.hogan@accr.org.au

Please read the terms and conditions attached to the use of this site.

Appendix 1: Methodology for Figure 5

Mine production data

Analysis based on saleable coal production by mine data sourced from Coal Services NSW and Qld state government. Note that these data are for the year ending 30 June 2021.

Glencore's coal mine equity holdings, as stated in their 2021 Reserves and Resources report, were applied to the mine saleable coal production data to obtain Glencore’s equity share of production. Coal production at existing mines is projected to remain at 2021 levels.

For proposed new mines, projected coal production is based on proposed production volume stated in applications. For Valeria, a 14 Mtpa figure was used as a conservative estimate.

For proposed expansion projects (i.e. Hunter Valley Operations and Glendell Continued Operations), the current production rate has been used to project future production rates.

Mine operational life

For Qld operating mines, the mine is assumed to close on their mining lease expiry date and for NSW operating mines on the date to which mining is permitted under currently issued development consents.

For mines not yet approved or operational, the closure year is based on dates in approval application documents.

Analysis

Mines that are operating are shaded blue, mines granted all their approvals, including mining lease & environmental authority but are not certain, are shaded grey, and projects that are currently in the approvals pipeline are in orange.

United Nations, “Secretary-General calls latest IPCC climate report ‘code red for humanity’, stressing ‘irrefutable’ evidence of human influence’, press release, 9 August 2021, link\ ↩︎

ibid. ↩︎

Nick O'Malley, “World must break its deadly addiction to coal says UN Chief”, Sydney Morning Herald, March 2021, link ↩︎

Nina Chestney, “Rich nationals must consign coal power to history UK Cop26”, Reuters, July 2021, link ↩︎

Glencore plc, ‘Glencore agrees to acquire JV partners’ shares in the Cerrejón mine and strengthens climate commitments’, 28 Jun 2021, link ↩︎

CA100+, Company Assessment: Glencore plc, link\ ↩︎

Glencore plc, 2021, Pathway to Net Zero - 2021 Progress Report, Appendix One, link ↩︎

IEA, 2022, Global Methane Tracker: Strategies to reduce emissions from fossil fuel operations, link\ ↩︎

SEI, IISD, ODI, E3G, and UNEP, 2020, The Production Gap Report: 2020 Special Report, link ↩︎

International Energy Agency (2021), Net Zero by 2050, IEA, Paris ↩︎

IPCC, 2018, Special Report: Global Warming of 1.5°C, link\ ↩︎

Glencore plc, 2021, Glencore agrees to acquire JV partners’ shares in the Cerrejón mine and strengthens climate commitments, link ↩︎

ibid. ↩︎

Glencore plc, 2020 ESG Data Book and GRI Index including SASB References, link ↩︎

Glencore plc, 2021 Full Year Production report, link ↩︎

Glencore, 2021, Glencore publishes 2021 Climate Report, link ↩︎

Glencore plc, 2019, Sustainability Report 2018, p32, link ↩︎

Glencore plc, Pathway to net zero - 2021 progress report, 2022, link ↩︎

Glencore plc, 2020 ESG Data Book and GRI Index including SASB References, link ↩︎

Wasimi et al, 2022, ‘Australian Fugitive Methane Reduction: a case study for coal mining’, AusIMM Bulletin, link ↩︎

IEA, 2022, Methane emissions from the energy sector are 70% higher than official figures, link ↩︎

IEA, 2022, Global Methane Tracker: Strategies to reduce emissions from fossil fuel operations, link\ ↩︎

Aaron Clark, “Three Australian Coal Mines Are Super Emitters”, Bloomberg, November 2021, link ↩︎

ibid. ↩︎

Australian Mining, “Glencore’s Australian Coal Mine Revealed as Methane Super Emitter”, November 2021, link\ ↩︎

Sadavarte P, Pandey S, Maasakkers JD, Lorente A, Borsdorff T, Denier van der Gon H, Houweling S, Aben I. Methane Emissions from Superemitting Coal Mines in Australia Quantified Using TROPOMI Satellite Observations. Environ Sci Technol. 2021 Dec 21;55(24):16573-16580. doi: 10.1021/acs.est.1c03976. Epub 2021 Nov 29. PMID: 34842427; PMCID: PMC8698155, link ↩︎

Glencore plc, 2021, Sustainability Report 2020, p111, link ↩︎

Glencore plc, Full Year 2021 Production Report, 2022, link ↩︎

IEA, 2021, Net Zero by 2050 - Analysis and key findings, link\ ↩︎

Glencore plc, Pathway to net zero - 2021 progress report, 2022, link ↩︎

See methodology in Appendix 1 ↩︎

Umwalt, 2020, Ravensworth Homestead Complex – Glendell Continued Operations Project – Heritage Council comments on Response to Submissions Report, link ↩︎

Hunter Valley Operations, 2022, Hunter Valley Operations Continuation Project, link ↩︎

Queensland Government, 2021, Valeria Project, link ↩︎

Australian Government, 2021, EPBC Act referral: 2021/9077 - Valeria Project, link ↩︎

ibid. ↩︎

Environmental Defenders Office, 2022, Koalas formally declared at greater risk of extinction in NSW, QLD and ACT following 2019-2020 bushfires – Update and Summary of Implications, link ↩︎

Glencore, 2020, Wandoan Coal Project: Fast Facts, link ↩︎

Queensland Government, 2010, Coordinator General’s Report Wandoan Coal project summary, link ↩︎

Queensland Department of Resources, updated November 2021, Exploration tender outcomes since 2016, coal tab, link ↩︎

NSW Government, 2022, ELA6253 Market Interest Test – Coal Operational Allocation, link ↩︎

Glencore plc, 2020 ESG Data Book and GRI Index including SASB References, link ↩︎

Glencore plc, Annual Report 2021, link ↩︎

Glencore plc, Pathway to net zero - 2021 progress report, 2022, link ↩︎

Anglo American, Sustainability Report 2020, link, p. 61. ↩︎

BHP, Climate Transition Action Plan 2021, link, p. 10. ↩︎

Fortescue Metals Group, FY21 Full Year Results, 30 Aug 2021, link, p.2 ↩︎

Glencore, Pathway to Net Zero 2021, link, p.24-25. ↩︎

Rio Tinto, Our Approach to Climate Change 2021, link, p 26. ↩︎

Vale, Climate Change Report 2021, link, p. 8. ↩︎

Glencore plc, ‘Glencore and Century Aluminum to Supply 150,000 metric tons of Natur‐Al™ to Hammerer Aluminium Industries’, 4 Feb 2021, link ↩︎

Glencore plc, ‘Glencore strengthens cobalt partnership with FREYR’, 1 Feb 2021, link ↩︎

Glencore plc, ‘Glencore and Britishvolt sign strategic partnership for long-term supply of cobalt, 17 Aug 2021, link ↩︎

Glencore plc, 2021, CTSCo’s Surat Basin Carbon Capture Use and Storage Project, link\ ↩︎

Glencore, 2022, About Glencore’s CTSCo Surat Basin Carbon Capture Use and Storage Project, link ↩︎

Australian Government Clean Energy Regulator, 2021, Millmerran Power Station (facility), link\ ↩︎

Australian Government Clean Energy Regulator, 2021, Corporate emissions and energy data 2019-20, link ↩︎

Glencore, Pathway to Net Zero 2021, link, p30. ↩︎

Influence Map, 2021, Corporate Climate Policy Footprint: The 50 Most Influential Companies and Industry Associations Blocking Climate Policy Action Globally, link ↩︎

ibid. ↩︎

ibid. ↩︎

Influence Map, Glencore International, link ↩︎

Influence Map, 2021, Corporate Climate Policy Footprint: The 50 Most Influential Companies and Industry Associations Blocking Climate Policy Action Globally, link ↩︎

Minerals Council of Australia, “Reducing emissions & powering jobs with Australian thermal coal”, June 2021, link\ ↩︎

ibid. ↩︎

Minerals Council of Australia, 2020, Climate Action Plan, link ↩︎

Influence Map, 2021, Minerals Council of Australia (MCA), organisational score table, link ↩︎

Minerals Council of Australia, 2021, MCA supports maintaining international competitiveness as Australia heads towards net zero, link ↩︎

ibid. ↩︎

Melissa Clarke and Henry Belot, “Sources of millions in funding to Labor and Liberals kept secret in political donations disclosures”, ABC News, February 2022, link ↩︎

Graham Readfearn, “NSW plan for 21 coal mines would create seven years of nation's emissions, expert says”, The Guardian, August 2020, link\ ↩︎

Stephen Galilee, “Anti-mining campaign based on myths”, Newcastle Herald, May 2021, link ↩︎

Alexandra Smith, “Nationals say byelection won’t be ‘won or lost’ over coal, kickstart campaign at mine”, Sydney Morning Herald, April 2021, link ↩︎

Queensland Resources Council, 2020, Royalty certainty essential to protect Qld economy from COVID-19 impacts, link ↩︎

Queensland Government, 2020, COVID relief extends for explorers, link ↩︎

Queensland Resources Council, 2021, Queensland Resources Industry Development Plan to set strong vision, link ↩︎

Queensland Resources Council, 2020, QRC urges Queenslanders to ‘Protect Your Job’ on election day, link\ ↩︎

Glencore, Pathway to Net Zero 2021, link, p3 ↩︎

ibid. ↩︎

ibid. ↩︎

Paul Karp, ‘Banks should be forced to service all ‘law-abiding businesses’, inquiry finds’, The Guardian, 17 Dec 2021, link ↩︎

Peter Coates, ‘Why Coal Matters’, AusIMM, February 2019, link ↩︎

Guy Pearse, High and Dry, 2007 ↩︎

Ian Kirkwood, “Hundreds of Jobs at Stake as Glencore Rearranges Mount Owen and Glendell Mines”, Newcastle Herald, November 2021, link ↩︎