Publication Information

- 2 MB PDF

- 11th December 2024

Stay Informed

Get email updates about new ACCR research and shareholder advocacy on specific topics of interest to you.

Sign UpRepurposing coal plants for flexibility has been a widespread and successful strategy amongst coal-powered nations since the earliest days of the energy transition. As more renewable energy enters the grid, particularly solar energy, flexibility mitigates the financial risks of a coal plant generating power during low-price periods and contributes to grid reliability in high-demand periods. The International Energy Agency (IEA) also identifies the flexible usage of repurposed coal plants as the single largest decarbonisation lever under the Announced Pledges Scenario (APS) for the world’s existing coal fleet - accounting for 60% of projected global CO2 emissions reductions through to 2050.[1]

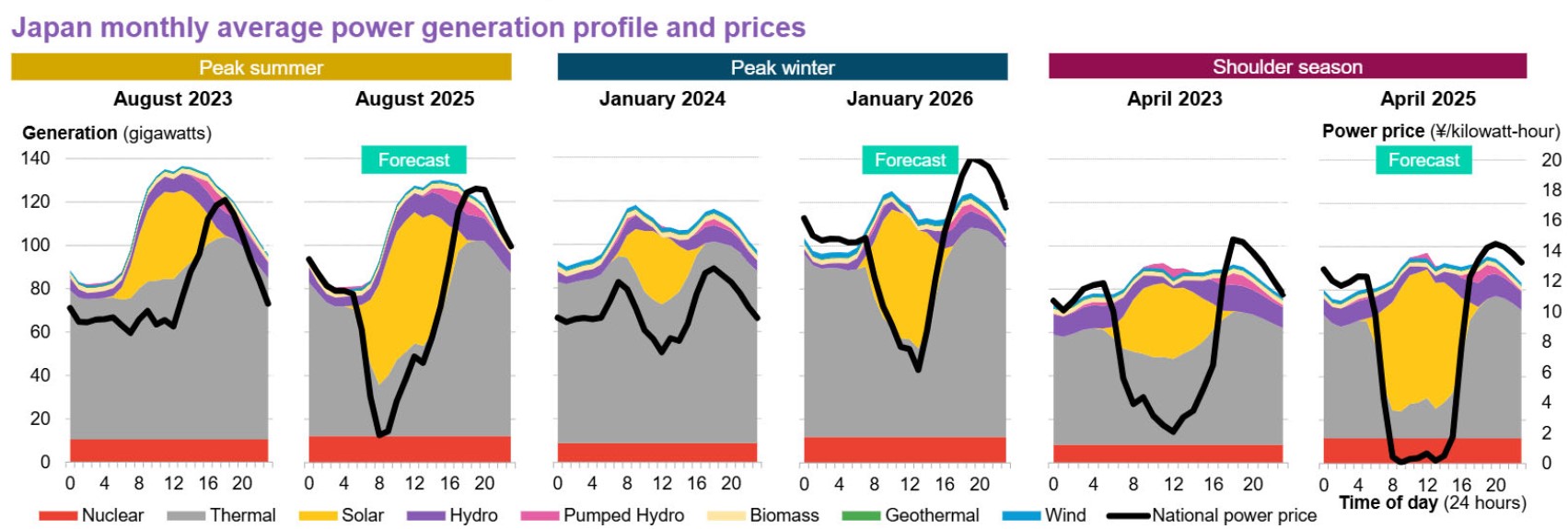

Solar is already the largest contributor among Japan’s sources of renewable energy. With the government’s 6th Strategic Energy Plan (SEP) aiming to increase the share of solar and the upcoming 7th SEP anticipated to accelerate that ambition, the penetration of solar into Japan’s grid is set to increase. The anticipated significant volume of low-cost solar will likely drive midday electricity prices materially lower and increase intraday volatility.

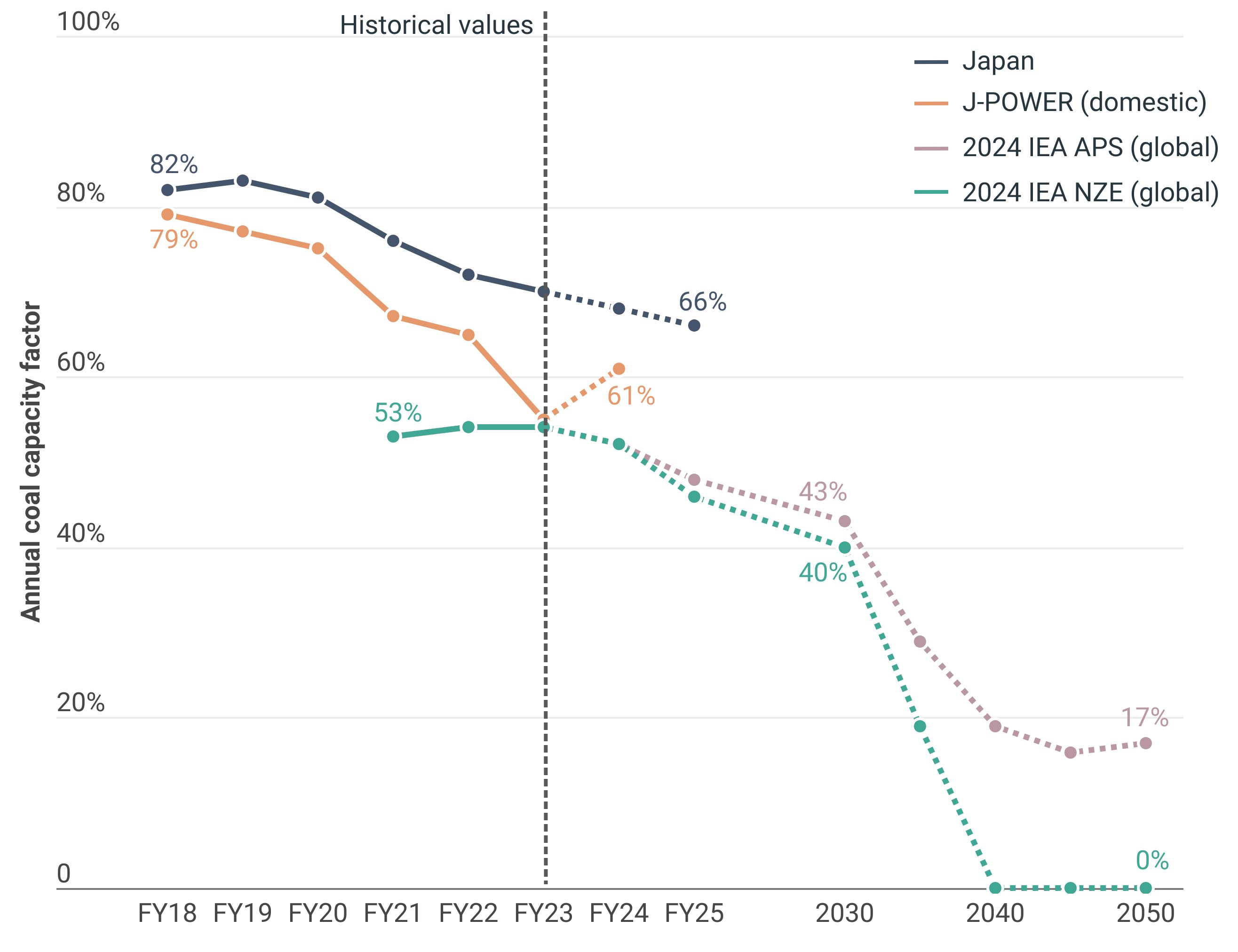

J-POWER is particularly vulnerable to this evolution in market dynamics. Almost 80% of its domestic electricity sales are generated from inflexible coal plants[2] – more than double that of the next most coal-dependent of Japan’s five largest generators – putting it at risk of exposure to low-pricing periods driven by rising solar.

Recognising this risk, J-POWER recently acknowledged the growing importance of flexibility in thermal power to support renewable energy expansion[3], saying it aims to reduce the financial impact of lower load factors by enhancing coal plant flexibility.[4] However, the company has not disclosed any plans on how it will achieve this.

The focus of J-POWER’s coal fleet decarbonisation strategy is still on unproven and costly technologies, including converting higher-efficiency thermal power plants[5] using ammonia co-firing, coal gasification, and carbon capture, utilisation and storage (CCUS).[6] This does not align with the IEA's recommendations for Japan's newer coal power plants, which includes retrofitting or repurposing them as flexible energy sources to prevent them from becoming stranded assets.[7]

To protect long-term shareholder value in an evolving market, J-POWER needs to prioritise investment in initiatives that lower minimum load levels and increase the flexibility of domestic coal plants – and clearly articulate this in its decarbonisation strategy.

Chart: BNEF expects more solar generation will cause a bigger dip in midday prices and higher volatility

Source: BNEF, Japan Power Market Outlook 1H 2024, May 2024, p7.

Chart: J-POWER's declining coal capacity factors reflect efficiency challenges and align with the downward trends forecast for Japan and global coal utilisation

Source: Company disclosures, BNEF (forecast for Japan coal capacity factor), IEA

Investors can incorporate the following questions into future engagements with J-POWER to better understand the risks of its strategy:

Download a PDF of Investing in coal plant flexibility: a strategic approach for J-POWER’s transition | 12/2024

Please read the terms and conditions attached to the use of this site.

IEA, Coal in Net Zero Transitions, Nov 2022, p66. https://iea.blob.core.windows.net/assets/4192696b-6518-4cfc-bb34-acc9312bf4b2/CoalinNetZeroTransitions.pdf ↩︎

Excluding procured electricity; J-POWER, 2024 Integrated Report, p105. https://www.jpower.co.jp/english/ir/library/pdf/2024/jpower_integrated2024_e_all.pdf (Japanese version) https://www.jpower.co.jp/ir/pdf/rep2024/jpower_integrated2024_all.pdf ↩︎

J-POWER, 2024 Integrated Report, p19. https://www.jpower.co.jp/english/ir/library/pdf/2024/jpower_integrated2024_e_all.pdf (Japanese version) https://www.jpower.co.jp/ir/pdf/rep2024/jpower_integrated2024_all.pdf ↩︎

J-POWER, 2024 Integrated Report, p30. https://www.jpower.co.jp/english/ir/library/pdf/2024/jpower_integrated2024_e_all.pdf (Japanese version) https://www.jpower.co.jp/ir/pdf/rep2024/jpower_integrated2024_all.pdf ↩︎

J-POWER, 2024 Integrated Report, p19. https://www.jpower.co.jp/english/ir/library/pdf/2024/jpower_integrated2024_e_all.pdf (Japanese version) https://www.jpower.co.jp/ir/pdf/rep2024/jpower_integrated2024_all.pdf ↩︎

J-POWER, 2024 Integrated Report, p63. https://www.jpower.co.jp/english/ir/library/pdf/2024/jpower_integrated2024_e_all.pdf (Japanese version) https://www.jpower.co.jp/ir/pdf/rep2024/jpower_integrated2024_all.pdf ↩︎

IEA, Innovation and market reform needed to drive Japan’s clean energy transition, IEA policy review finds, Mar 2021.https://www.iea.org/news/innovation-and-market-reform-needed-to-drive-japan-s-clean-energy-transition-iea-policy-review-finds ↩︎

METI, Outline of Strategic Energy Plan, Oct 2021, p12. https://www.enecho.meti.go.jp/en/category/others/basic_plan/pdf/6th_outline.pdf (Japanese version) https://www.enecho.meti.go.jp/category/others/basic_plan/pdf/20211022_02.pdf ↩︎

BNEF, Japan Power Market Outlook 1H 2024, May 2024, p7. https://about.bnef.com/blog/power-market-outlook-east-meets-west-as-japan-prices-cool/ ↩︎

Excluding procured electricity; J-POWER, 2024 Integrated Report, p105. https://www.jpower.co.jp/english/ir/library/pdf/2024/jpower_integrated2024_e_all.pdf (Japanese version) https://www.jpower.co.jp/ir/pdf/rep2024/jpower_integrated2024_all.pdf ↩︎

Top 5 generators by volume in FY23 according to METI https://www.enecho.meti.go.jp/statistics/electric_power/ep002/results.html; Excluding procured electricity. ↩︎

Assuming J-POWER’s domestic coal capacity factor remains at the FY24 forecast level of 61%, mirroring FY22 and FY23 seasonal variations, selling 100% of electricity generated from its thermal assets, without accounting for transmission or other losses, and that all electricity is sold on the wholesale market. ↩︎

BNEF, Japan Power Market Outlook 2H 2024: Tailwinds Ahead, Oct 2024, p2. https://www.bnef.com/insights/34981 (Japanese version) https://www.bnef.com/insights/34981/view?language=ja ↩︎

BNEF, Japan Power Market Outlook 2H 2024: Tailwinds Ahead, Oct 2024, p21. https://www.bnef.com/insights/34981 (Japanese version) https://www.bnef.com/insights/34981/view?language=ja ↩︎

IEA, World Energy Outlook 2024, Oct 2024, p305, 311. https://iea.blob.core.windows.net/assets/02b65de2-1939-47ee-8e8a-4f62c38c44b0/WorldEnergyOutlook2024.pdf ↩︎

Implied capacity factors under the APS and NZE scenarios for unabated coal power plants were calculated using generation volumes and capacity projections. ↩︎

J-POWER, 2024 Integrated Report, p105. https://www.jpower.co.jp/english/ir/library/pdf/2024/jpower_integrated2024_e_all.pdf (Japanese version) https://www.jpower.co.jp/ir/pdf/rep2024/jpower_integrated2024_all.pdf ↩︎

IEA, Innovation and market reform needed to drive Japan’s clean energy transition, IEA policy review finds, Mar 2021. https://www.iea.org/news/innovation-and-market-reform-needed-to-drive-japan-s-clean-energy-transition-iea-policy-review-finds ↩︎

J-POWER, 2024 Integrated Report, p19. https://www.jpower.co.jp/english/ir/library/pdf/2024/jpower_integrated2024_e_all.pdf (Japanese version) https://www.jpower.co.jp/ir/pdf/rep2024/jpower_integrated2024_all.pdf ↩︎

J-POWER, 2024 Integrated Report, p30. https://www.jpower.co.jp/english/ir/library/pdf/2024/jpower_integrated2024_e_all.pdf (Japanese version) https://www.jpower.co.jp/ir/pdf/rep2024/jpower_integrated2024_all.pdf ↩︎

Get email updates about new ACCR research and shareholder advocacy on specific topics of interest to you.

Sign Up