Publication Origin Energy: Climate Transition Action Plan Analysis

Origin Energy Ltd

(ASX:ORG, ISIN:AU000000ORG5)

AGM date and location: 10:00am (AEDT) 19 October 2022, Sydney, Australia.

Contacts:

Harriet Kater, Climate Lead, Australia

Alex Hillman, Carbon Analyst

Summary

In September 2022, Origin Energy (Origin) released its Climate Transition Action Plan (CTAP), recognising that, “greater ambition and action will be required by society, including Origin, to limit the global average temperature rise this century to 1.5°C.”

The emissions targets and strategy in the CTAP present Origin as a company that is committed to a 1.5°C decarbonisation pathway. The company’s plan is materially enabled by the closure of the Eraring coal fired power station, which was recently brought forward from 2032 to the mid-late 2020s. Whilst Origin’s prioritisation of renewable energy, storage and green hydrogen is encouraging, ACCR had significant concerns about the credibility of the CTAP due to the potential future emissions trajectory and capital expenditure requirements of the company’s persistent gas exploration in the Beetaloo, Canning and Cooper-Eromanga basins. However, on 19 September 2022, Origin announced it was divesting its Beetaloo Basin interests to Tamboran Resources, along with announcing an intention to exit its other upstream exploration permits. This announcement addressed many of the inconsistencies within the CTAP.

Origin’s early retirement of Eraring and its strategic exit from gas exploration are significant developments that are worthy of shareholder support. These decisions are also aligned with the expectations of 44% of shareholders who supported ACCR’s 2021 advisory resolution, which sought that the company align its capital expenditure with a 1.5°C pathway.

ACCR recommends that shareholders vote FOR Origin’s CTAP, whilst also engaging on the following:

- Divestment is not decarbonisation. The portfolios of institutional investors will be exposed to the physical climate impacts of the Beetaloo Basin regardless of which company develops it. Whilst Origin has deemed the project to be inconsistent with its 1.5°C-aligned strategy, its gas offtake agreement with Tamboran still aids the development of this carbon bomb. We encourage investors, particularly universal owners, to monitor and challenge Origin’s ongoing role in unlocking the Beetaloo Basin.

- Alternatives to divestment exist for the Canning and Cooper-Eromanga basins: In support of its 1.5°C commitment, Origin could: write-down any residual value of these assets, allocate no further capex to the projects, commit to not apply for production licences and work constructively with State governments to ensure these resources are kept in the ground. Importantly, we are not recommending that Origin contravene the conditions of any exploration licences. ACCR acknowledges this is unconventional thinking. However unprecedented times call for unprecedented strategies.

- APPEA and the QRC are a risk to Origin’s strategy: The Australian Petroleum Production and Exploration Association (APPEA) and Queensland Resources Council (QRC) have a long-standing, negative influence on Australian climate policy. This influence poses a risk to the implementation of Origin’s ambitious climate strategy. If constraining this advocacy is not possible, Origin should exit APPEA and the QRC. Regardless, Origin should be advocating positively and publicly for the climate and energy policy settings it needs for its 1.5°C-aligned strategy to succeed.

- Just Transition implementation at Eraring requires more detail: Including on how principles will be applied in practice, along with assurance that subcontractors will also be supported.

ACCR is also recommending a vote against the re-election of non-executive director Greg Lalicker due to his role as CEO of Hilcorp, which was recently identified as the most carbon and methane polluting upstream oil and gas company in the United States.

Voting recommendation: FOR

Introduction

The Australasian Centre for Corporate Responsibility (ACCR) has been engaging with Origin for the past six years in relation to the climate change impacts of the company's current and future activities. In September 2022, Origin released its Climate Transition Action Plan (CTAP). Following Origin Energy’s strong messaging around its commitment to 1.5°C in 2021,[1] investors expected Origin’s 2022 CTAP would present climate targets consistent with 1.5°C, along with detail on how these targets are supported by its strategy, capital allocation and remuneration.

This analysis reviews both the CTAP and Origin’s more recent announcement to divest from its Beetaloo Basin interests, and the intent to exit its other upstream exploration permits. This analysis commences with ACCR’s view of how Origin’s strategy and commitments align with each indicator from the Climate Action 100+ (CA100+) Net Zero Company benchmark. It then moves to an explanation of the climate significance of Origin’s exploration activities, and the impact they could have on Australia’s emissions profile. The report then provides analysis on all other aspects of the CTAP, including the decarbonisation strategy, capital allocation, just transition, governance as well as Origin’s recent industry association review.

While Origin’s commitment to decommission the Eraring coal fired power plant before 2030 offers strong emissions reductions, ACCR remains concerned about Origin’s role in facilitating the development of major new gas basins in Australia via divestments linked to offtake agreements with the new operator. Origin could play a major role in preventing these emissions from being released by refraining from divesting assets to operators pursuing development. The Beetaloo divestment and gas offtake agreement do not instil confidence that the company takes the need to constrain global emissions in line with the Paris Agreement seriously. To the contrary, Origin CEO Frank Calabria stated that the agreement struck with Tamboran “ensures another operator present in the area and committed to developing its resources, can continue to take the venture forward.”[2]

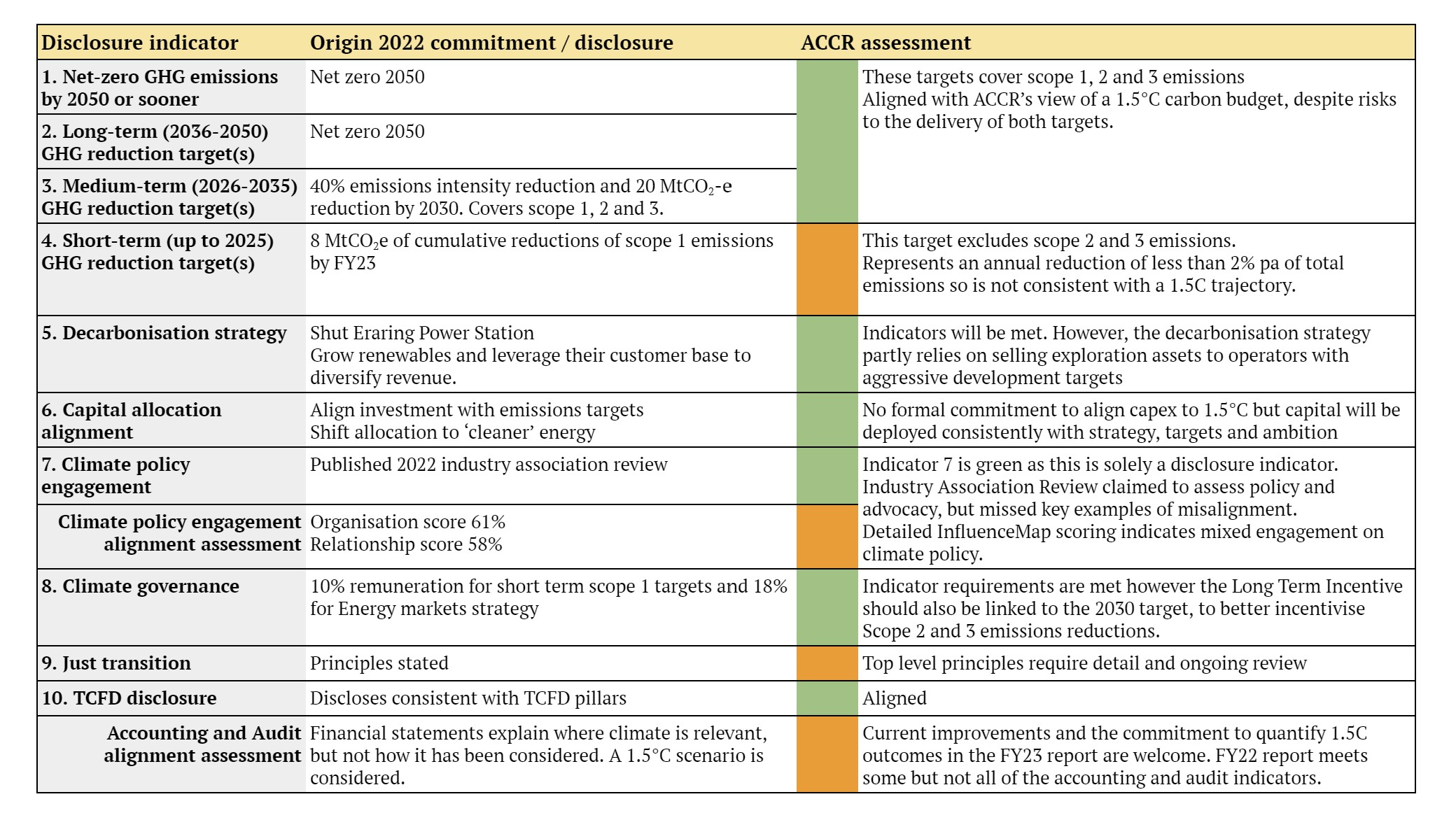

ACCR assessment of Origin’s CTAP against CA100+ Net Zero Company Benchmark

The CA100+ Net Zero Company Benchmark provides a useful framework to assess a company’s approach to climate change. We note that Origin’s benchmark score was updated in September 2022, however this update did not capture the recently released CTAP or announcement regarding the exit from gas exploration. Table 1 presents ACCR’s summarised view of how Origin and the CTAP should be assessed against the benchmark today.

Table 1: ACCR assessment of Origin’s CTAP against CA100+ Net Zero Company Benchmark

Origin still has options to prevent climate impacts from its gas basins

The development of large new unconventional gas resources across Northern Australia is a nationally significant climate risk. On 19 September 2022, Origin announced it was divesting its Beetaloo Basin interests, along with an intention to exit its other upstream exploration permits.[3] Importantly, asset divestment is not decarbonisation. Whilst divestment to companies with smaller balance sheets may decrease the probability of carbon bombs such as the Beetaloo Basin being unleashed, it far from guaranteed. Options remain within Origin Energy’s control to mitigate the climate impacts of these projects.

The Beetaloo Basin, Northern Territory

For several years, Origin received significant opposition to its Beetaloo Basin exploration program, including from Traditional Owners, due to concerns that Free, Prior and Informed Consent could not have been received from all relevant parties.[4] The gas resource is sizable, and from exploration activities to date, Origin booked 6.6 Tcf of resources for the Beetaloo (2C resources, gross).[5] This made Origin’s share of the Beetaloo resources 20% larger than its share of remaining 2P reserves at APLNG.

In divesting its Beetaloo Basin assets to ASX listed Tamboran, of which private oil billionaire Byann Sheffield has a 5.7% stake,[6] significant emissions from the Beetaloo Basin remain a threat to the goals of the Paris Agreement. Tamboran has stated to shareholders that it “intends to accelerate the appraisal and commercialisation of its licences in the Beetaloo Sub-basin.”[7] Whilst the company’s market capitalisation currently sits at just $175.6 million[8], Tamboran has been awarded a grant of up to $7.5 million by the federal government to support the drilling of the Maverick 1H well on a neighbouring Beetaloo licence.[9] Tamboran has a binding MOU with gas pipeline company Jemena, which is promoted as “a formal framework and infrastructure solution to bring Tamboran’s gas resource to market.”[10]

Despite Origin’s supposed commitment to being a 1.5°C aligned company, after the Tamboran deal was announced Origin’s CEO continued to promote gas extraction from the Beetaloo Basin in a recent interview in the Australian newspaper:[11]

“From our perspective, this is all about continuing its development. And that’s the nature of the transaction we’ve entered into… We’ll also enter into commercial arrangements like this offtake and royalties that have us continuing to participate in that value chain. So I think that we’re going to continue to see the development of it and it’s important that it does, because gas will play an important role for many years to come”.

Origin’s remaining exploration assets: The Canning and Cooper-Eromanga basins

The Canning and Cooper-Eromanga Basins are two less explored basins where Origin has been progressing gas development. At the Canning Basin in the Kimberley region of WA, Origin has a 50 per cent equity share in five petroleum permits with Buru Energy and a 40 per cent equity share in two permits with Buru and Rey Resources. When Origin announced this farm-in in December 2020, it stated the Canning Basin was one of Australia’s material onshore exploration and production basins.[12] Geoscience Australia estimated that the best estimate of potentially recoverable gas resources for the Canning basin as 438 Tcf,[13] which is six times more gas than Australia has produced to date. Origin has stated that this gas could be used for LNG backfill,[14] which could include linking the gas development to processing through the Woodside-operated Karratha Gas Plant.

Closer to the upstream fields and infrastructure for Origin’s APLNG project, the Cooper-Eromanga Basin of Western Queensland’s Channel Country is also a target for Origin. In 2021, Origin was granted Queensland government approval for more than 250,000 hectares of gas licence to explore for shale gas, roughly the size of the Australian Capital Territory. A range of estimates have been made for the Cooper-Eromanga basin, with an average of 170 Tcf of potentially recoverable gas resources.[15]

Potential climate impacts of new gas basins

Figure 1 shows the potential emissions from developing the Beetaloo Basin, based on Reputex scenarios[16] along with the potential emissions from the Cooper-Eromanga and Canning Basins. Reputex’s Beetaloo emissions estimate has been linearly extrapolated to estimate the emissions from the other basins, based on potentially recoverable resource estimates.[17]

This analysis includes all scope 1, 2 and 3 emissions from the developments. The majority of these emissions would necessarily occur overseas, via LNG export. The values presented for Origin’s 1.5°C target similarly include scope 1, 2 and 3 emissions - both domestic and exported. Emissions from the development of these three basins would be even larger than Australia’s cumulative domestic emissions, should the country follow a 1.5°C national trajectory.

Importantly, there are decisions available to Origin Energy that will influence whether these carbon emissions are unlocked. These options are discussed further below.

Figure 1: Potential emissions from undeveloped basins compared to Origin and Australia’s 1.5°C carbon carbon budgets (MtCO2-e)

Options for Origin to prevent or reduce the climate impacts from new gas basins

Origin’s recent announcement to divest its Beetaloo Basin interests and exit its upstream exploration permits shows that the company no longer sees gas exploration as part of its portfolio. However Origin still supports the development of these gas basins by other parties, proving once again that fossil fuel asset divestment is an ineffective tool for reducing or preventing emissions being released. [18] If Origin is to uphold its support for the Paris Agreement, it should not only remove exploration assets from its own strategy and balance sheet, but also take steps to discourage their development by other parties.

For the Beetaloo Basin, subject to Origin’s contractual arrangements, the company could exit the 10 year, 32.6 PJ/annum gas sales agreement [19] with Tamboran Resources. The continued existence of this offtake will help to de-risk the ongoing development of the resource for Tamboran.

For the Canning and Cooper-Eromanga basin permits, an alternative option to divestment is for Origin to take steps that prevent the development of a resource by any party. Whilst this is counter to traditional corporate decision making, this would be the most compelling and measurable way to prevent significant carbon emissions. ACCR understands that there are legal conditions of use attached to Origin’s exploration licences and ACCR is not recommending Origin breach, or in any way circumvent these obligations. Rather, we are recommending that Origin comply with its commitments under its exploration licences and also:

- Stop any further capex allocation beyond that required by its legal obligations,

- Commit to not apply for production licences; and

- Confirm with the relevant state and territory authorities that if the land covered by these licences were to be made subject to restrictions against oil and gas production, or converted to a form of tenure than prevented fossil fuel exploration or production, Origin would support this, and would not seek compensation for the value of the gas that could potentially have been produced.

If the above recommendations were implemented, this would see Origin write-down any booked value for the Canning and Cooper-Eromanga basin assets. The divestment of Beetaloo resulted in Origin receiving $60m upfront consideration and booking a post-tax $70-90m loss.[20] At face value, this reduces the value of Origin’s exploration assets from $286m[21] to $97-126m, out of a $24 billion asset base.[22] At just 0.5% of total assets, or about 1.3% of net assets, these licences are immaterial to Origin’s balance sheet. In fact, impairing 100% of these investments would be just a fraction of the $1.8 billion impairment that Origin made in its 2021 Annual report.[23]

Whilst this suggested approach is novel, unprecedented times call for unprecedented strategies. We encourage investors to contemplate and advocate for these strategies over Origin’s current plans for divestment/farm-downs. Whilst we wait for governments to catch up, normalising such actions is critical if we are to limit warming to 1.5°C.

Origin’s portfolio emissions profile to 2065

Origin unequivocally supports the Paris Agreement and believes its 2030 emissions intensity target is “consistent with the goals of the Paris Agreement to limit the increase in the average global temperature to 1.5°C above pre-industrial levels.”[24] Figure 2 presents ACCR’s view on Origin’s future emissions pathway, in order to assess whether it is consistent with a 1.5°C carbon budget.

To do this using publicly available information, we have:

- Developed a forecast of emissions from the operating components of Origin’s Integrated Gas segment (APLNG) and its energy markets (Eraring, other generators and trading).

- Developed a 1.5°C target built from a 1.5°C aligned domestic emissions trajectory and the IEA’s view of a 1.5°C compatible Australian LNG profile.

- Adjusted the target for the recent sell down of APLNG.

- Included the 10-year, 36.5PJ pa offtake from Beetaloo, as agreed with Tamboran Resources[25]

- Included a sensitivity on the closure of the Eraring Power Station.

This shows that Origin’s consistency with a 1.5°C carbon budget is dependent on when Eraring is decommissioned. Origin has stated that it will close Eraring “potentially as early as August 2025”.[26] An August 2025 closure results in Origin’s emissions aligning with its 1.5°C carbon budget. Should the Eraring closure be even marginally delayed, our model shows that Origin will exceed its 1.5°C carbon budget. A delay to December 2030 would mean the budget is exceeded by 13%. These results are shown in Table 1 and Figures 2 and 3.

The assumptions, along with a brief description of sources and uncertainties, are outlined at Appendix 1.

Table 2. Origin’s portfolio emissions and 1.5°C budget

| Emissions 2023 - 2065 (MtCO2-e) | ||

|---|---|---|

| Eraring closing 2025 | Eraring closing 2030 | |

| Currently operating assets | 538 | 615 |

| Beetaloo | 32 | 32 |

| Total Origin emissions | 571 | 647 |

| 1.5°C Target | 574 | 574 |

| 1.5°C Target exceedance | 4 (0.5%) | 73 (13%) |

Figure 2: Origin’s emissions forecast, with Eraring closing in Aug 2025 compared to a 1.5°C target (MtCO2-e pa)[27]

Figure 3: Origin’s emissions forecast, with Earing closing in Dec 2030 compared to a 1.5°C target (MtCO2-e pa)

Origin’s short, medium and long term targets

In 2018 Origin established a 2 degree-aligned emissions target that was certified by the Science Based Targets initiative (SBTi).[28] SBTi subsequently updated its policy and now it solely certifies Scope 1 and 2 targets that are 1.5°C aligned,[29] meaning that Origin Energy’s target needed to be updated. Origin communicated that it will update its SBTi target to be 1.5°C aligned once the long promised oil and gas guidance was released.[30]

In March 2022, SBTi released an updated Oil and Gas policy, which states “companies with any level of direct involvement in exploration, extraction, mining and/or production of oil, natural gas, coal or other fossil fuels, irrespective of percentage revenue generated by these activities” can no longer submit SBTi targets for certification until the new guidance is released.[31] Since the guidance has still not been released, Origin is unable to update its target under SBTi and has instead had its target assured by a paid consultant, stating: “Our resulting 2030 emission intensity target and methodology has been independently assured on a limited basis for consistency with the IPCC scenarios and the SBTi draft guidance and recommended 1.5°C scenarios”.

Importantly, SBTi is best practice and independent. It is ACCR’s recommendation that Origin seek SBTi accreditation as soon as possible following the release of the updated oil and gas guidance. The following sections address Origin’s updated short and medium term targets as presented in the CTAP.

Short term target: FY23 Scope 1 equity emissions

Origin has set a new target to reduce scope 1 equity emissions by a cumulative 8 MtCO2-e between FY21 and FY23. Origin’s scope 2 and 3 emissions are two thirds of its emissions however, so should also be included in this target. With adjusted FY21 scope 1, 2 and 3 emissions of just over 47 MtCO2-e, the 8 MtCO2-e target represents an annual reduction of less than 2% pa. On its own, a 2% annual reduction is not aligned with climate science. However it is noted that the closure of Eraring post 2023 will significantly escalate Origin’s emissions reductions.

The section of the CTAP that addresses the short term target does not outline the specific steps the company will take to meet this target. It does however identify a risk that the company will not meet the target due to Eraring and other generation potentially being required “to run at higher output levels in the near term to meet customer demand and provide reliability to the market”.[32]

Medium-term target: Scope 1, 2 & 3 equity emissions

Origin has set two 2030 medium term targets, both of which cover all emission scopes. The first is to reduce emissions intensity by 40% and the second is to reduce emissions by 20 MtCO2-e, which equates to 40% reduction with an FY19 baseline of revised[33] FY19 baseline approximately 50 MtCO2-e. These targets are similar if energy production remains stable however if it changes, then one of the targets will become a binding constraint. Only the emissions intensity target has been subject to limited assurance.[34]

The 1.5°C carbon budget that ACCR constructed results in Origin’s 1.5°C target being 30 MtCO2-e in 2030. This is 19 MtCO2-e less than the adjusted FY19 emissions. As such, we see a 20 MtCO2-e reduction target as 1.5°C aligned.

A key pillar for achievement of this target is the closure of the Eraring coal-fired power station, since it comprised 20-30% of Scope 1, 2 and 3 emissions over the last 5 years.[35] Origin has indicated this could happen as early as August 2025[36], however the CTAP states it will “continue to assess the market over time, and this will inform any final decisions on the timing for closure of all four units of Eraring”.[37]

Long-term target: Net zero scope 1, 2 & 3 by 2050

Origin has a net zero scope 1, 2 and 3 goal for 2050. Known activities that will contribute to the achievement of this target are gas generation asset retirements, a decline in APLNG production as reserves deplete, expanded supply of green energy products and carbon offsets.[38]

ACCR’s model shows that APLNG is likely to still be operating in 2050, albeit at decreased rates.[39] Without resorting to divestment, which ACCR does not support, Origin could achieve net zero by stopping production of APLNG reserves early or implementing negative emissions technologies. Where negative emissions are used, ACCR supports the SBTi Net Zero Standard’s principle that companies should “reduce emissions by at least 90% through their long-term science-based targets”[40] before relying on high quality carbon removals to achieve net zero. ACCR’s model suggests APLNG will emit 3.7 MtCO2-e in 2050. If this is Origin’s only material emission sources in 2050, then neutralising these with high quality removals would be appropriate.

Decarbonisation strategy to meet 2030 target

Being an electric utility, Origin has some genuinely viable and exciting transition prospects. Origin’s strategy to ‘transition to net zero’ and ensure that it ‘lead[s] the energy transition through cleaner energy and customer services’ is generally sound. Origin’s priorities for meeting its 2030 target are analysed below.

Accelerate exit from coal-fired generation

As detailed above, bringing forward the closure of Eraring from 2032 is “the most significant step”[41] Origin will take to meet its medium-term target, contributing approximately 57% of the targeted reduction to 2030. It is currently unclear when and how Eraring will be closed and Origin recognises that “material changes to the decommissioning timeline for Eraring Power Station”[42] is a risk to achieving its 2030 target.

Reduce emissions from gas operations

The CTAP states that there will be an increase in wells coming online for APLNG in the coming years[43]. This will likely see an increase in Scope 1 emissions at a minimum. Regardless, Origin is targeting a reduction in APLNG methane emissions. This is welcome and necessary, but APLNG’s total scope 1 and 2 emissions represented less than 4% of Origin’s FY19 emissions, so any reductions in methane contribution will not make a material contribution to Origin’s targets.

Origin is solely relying on the decarbonisation of the national electricity grid to lower scope 2 emissions for the upstream APLNG operations.[44] This is disappointing for a utility that has the capability to revise its electricity contracting strategy to source a higher share of renewable energy. The CTAP states that since 2016, Origin has “committed to 1,200 MW of PPAs from wind and solar generation and will continue to identify further opportunities as part of our aim to grow renewables”[45] and yet it does not appear to be exploring these opportunities to decrease its own scope 2 emissions.

With regard to scope 3 emissions from gas production and LNG sales prior to 2030, the CTAP states that this would be challenging and APLNG would “need to work with its customers to better understand their decarbonisation goals and identify opportunities to manage Scope 3 emissions”.[46] Irrespective of the conversations that Origin has with its customers, if APLNG continues to sell LNG, then it is continuing to produce scope 3 emissions. Origin should instead focus on making sure that it does not facilitate additional gas developments such as in the Canning or Cooper basins.

Evolve our portfolio

Origin’s aim to grow its renewables and storage capacity to 4GW by 2030 is ambitious and will partially offset the closure of the 2.8GW Eraring power station. Meeting this target may be challenged by supply chain considerations,[47] along with the renewable energy development market being highly competitive.[48]

Whilst there are risks, an enabling policy environment will be important to facilitate this renewable capacity goal. ACCR expects to see Origin engaging proactively in all policy consultation exercises that will influence grid decarbonisation and the build out of electricity transmission infrastructure, along with proposals to expedite the shift away from gas to renewable electrification.

Virtual power plant

Origin’s efforts to expand the virtual power plant (VPP) are a positive contribution, which may well complement Origin’s 4GW capacity goal due to VPPs reducing the need to “invest in capital-intensive, large-scale generation assets.”[49]

Investments in future fuels

Origin’s prioritisation of green hydrogen over the significantly more carbon-intensive blue hydrogen[50] is a positive step. Whilst conjecture remains around the full extent of hydrogen’s role in the transition[51] and its viability as an export industry,[52] Origin is hedging its approach at this early stage by exploring hydrogen opportunities for both export and domestic use. Origin has an ambitious goal to produce green hydrogen for the domestic market by the mid 2020s[53] and has announced a partnership with Orica,[54] suggesting the company is targeting industrial applications of green hydrogen to displace fossil gas in chemical and fertiliser production.

Low carbon products and solutions

The investment in the Octopus customer management company and renewable electricity retailer gives Origin strong exposure to a clean energy business and global operations. The low carbon products and solutions, builds on Origin’s competitive advantage managing a large customer base. ACCR does however think that carbon offsets should not be used as a primary component of a decarbonisation strategy and notes that carbon offsets currently underpin Origin’s “Green Gas” and “Green LPG”, relying on Climate Active certification.[55]

Capital allocation

At the 2021 AGM, 44% of Origin shareholders supported an ACCR advisory resolution seeking that the company commit to align its capital allocation with a 1.5°C pathway. With its recent decision to divest its Beetaloo Basin interests and its intention to exit other upstream exploration permits, Origin appears to be responding to the expectations of shareholders, noting the company did allocate $65 million (19% of total) in capital expenditure to oil and gas appraisal programs in the Beetaloo and Canning in FY2022.[56] Planned exploration in the Beetaloo was about to require a significant increase in capex, spending that would have been impossible to align with a 1.5°C pathway.

Origin acknowledged the significant shift in capital allocation prioritisation in its Beetaloo divestment statement, outlining:[57]

“The decision to divest our interest in the Beetaloo and exit other upstream exploration permits over time, will enable greater flexibility to allocate capital towards our strategic priorities to grow cleaner energy and customer solutions, and deliver reliable energy through the transition.

… it can be capital intensive to bring projects into production. Ultimately, we believe Origin is better placed prioritising capital towards other opportunities that are aligned to our refreshed strategy.”

If Origin’s recent announcement does in fact mean it is ceasing its gas expansion activities for new projects, capital allocation to ‘upstream & thermal assets’ between 2025-2030 would comprise 30% of total, compared with ~60% of total between 2018-2022.[58] Origin’s capital allocation ratio between 2022 and 2025 is unclear. Expressing capital allocation as a ratio only captures part of the story, since the quantum of indicative spend is unknown. Regardless, the International Energy Agency’s (IEA) Net Zero Emission (NZE) scenario sees investment in oil and gas halving between the 2020s and the 2030s.[59] As such, Origin’s pivot to lower amounts of capital allocated to upstream and thermal assets, and its stated intention to exit upstream exploration permits, is better aligned with the IEA NZE.

In future disclosures, ACCR recommends that Origin provide more specific metrics around its intended capital allocation to fund its transition away from fossil fuels to 2030.

Origin’s indirect lobbying activities are not 1.5°C aligned

In 2021, 36.63% of Origin’s shareholders supported an ACCR advisory resolution on climate related lobbying, seeking that the company strengthen its review of industry associations to ensure that it identifies advocacy that is inconsistent with the Paris Agreement.[60] In August 2022, Origin released its latest Review of Industry Associations,[61] with some concerning conclusions, including that no “non-supportive statements” could be found for industry associations ranked as a D or below for climate policy engagement by InfluenceMap.

Table 2: Origin’s industry associations that are misaligned with the Paris Agreement[62]

| Industry Association | Origin Energy’s 2022 Review of Industry Associations findings [63] | InfluenceMap Performance Band |

|---|---|---|

| Queensland Resources Council (QRC) | Partially aligned Public statements: Supportive, no non-supportive statements found | E |

| Australian Petroleum Production and Exploration Association (APPEA) | Aligned Public statements: Supportive, no non-supportive statements found | E+ |

| Australian Industry Greenhouse Network (AIGN) | Aligned Public statements: Supportive, no non-supportive statements found | D |

The methodology used by Origin to review the public statements of its industry associations was insufficient for providing a thorough insight into advocacy activity. The statements selected for the review appear to be cherry picked in order to provide the impression that all association statements are supportive of the Paris agreement.

ACCR saw insufficient evidence that advocacy and policy submissions by industry associations had been carefully interrogated and reconciled against public statements and disclosures. It is ACCR’s view that far greater disclosure on the fundamentals of political influence is required. This includes detail on the political donations, ministerial meetings, major submissions and advertising campaigns executed by industry associations. The current reviews persistently fail to address the actual advocacy that is relevant to meeting the Paris Agreement, and instead focus on top line policy statements.

A simple look through key submissions and media releases by APPEA and the QRC over the past year would have provided ample evidence of advocacy that is misaligned with the Paris Agreement, for example:

Most recently in September 2022, the new head of APPEA, Samantha McColloch, used an opinion piece in the Australian[64] and an interview with the AFR[65] to push messages including:

- “If we want to accelerate the global transition to net zero, Australia should invest in more gas supply to fuel the energy transition.”

- "We need new supply. We need confidence for investors to invest in exploration and expansion."

In February 2022, APPEA claimed that, “Australia’s gas industry will enjoy strong growth in demand stretching through to 2050”.[66]

In a 2021 submission to an Australian parliamentary inquiry, APPEA suggested that Australia can only meet the Paris Agreement by developing new gas resources.[67]

In its 2021 submission to the Victorian Gas Substitution Roadmap, APPEA argued against the sensible policy to enhance domestic electrification opportunities, labelling attempts to phase down domestic gas use as ‘short sighted’. APPEA instead promoted its Gas Vision 2050 report,[68] which encourages continued investment in gas, hydrogen and gas pipelines.

In March 2022, the QRC used Russia’s invasion of Ukraine to push for ongoing legal and assessment processes to be disregarded in order to approve New Hope's New Acland thermal coal mine in Queensland.[69]

In November 2021, the QRC put out a media release where it stated, "Right now, steel can only be produced commercially by using metallurgical coal, and thermal coal is the only 100 percent reliable way to produce energy”.[70]

It’s time to leave APPEA

Considering Origin’s recent announcement to divest its Beetaloo Basin interests and its intention to exit other upstream exploration permits[71], there is very limited justification for continuing to allocate shareholders’ capital to paying industry association membership fees to APPEA. The misalignment between APPEA and Origin is only set to become more pronounced as Origin undertakes its strategy to pivot more strongly to “strategic priorities to grow cleaner energy and customer solutions”.[72] In its new position with limited exposure to gas exploration activities, Origin should consider withdrawal from APPEA.

Climate governance

According to Origin’s Corporate Governance Statement 2022, the Origin Board undertook a strategy refresh during FY2022 which was presented to investors in March 2022. As part of this strategic refresh, “the Board directly considered the impact of climate change and the energy transition on Origin’s business model and strategic direction”.[73] While not apparent within the CTAP, the announcement to divest Beetaloo Basin assets and intention to exit other exploration permits to divert capital to clean energy projects demonstrates significant decisions were made through this process.

Remuneration

The short term climate target for FY23 comprises 10 per cent of the 40 per cent non-financial targets within the CEO’s short-term incentive plan[74], while 18 per cent is on energy markets strategy - effectively a transition strategy. 50 per cent of the long-term incentive equity grants for the CEO are based on the Board’s satisfaction of progress across a suite of nonfinancial metrics, including climate-related metrics such as absolute emissions, emission intensity, solar PV sales and other air emissions.[75] In FY2022, the climate change target was defined as a percentage reduction in Origin’s Scope 1 emissions from a FY2017 baseline. A more credible remuneration approach would have included scope 2 and scope 3 emissions reduction targets, through linkage with the updated 2030 target.

Recommendation to vote against the re-election of Greg Lalicker

Greg Lalicker was appointed to the board as a non-executive director in 2019[76] and is a member of Origin’s Safety and Sustainability Committee. Mr Lalicker is the Chief Executive Officer of Hilcorp Energy Company, based in Houston, USA. Hilcorp is the largest privately held independent oil and gas exploration and production company in the United States.[77]

In July, the 2022 Oil & Gas Benchmarking report was released by CERES in the United States. This report included company-level summary data hydrocarbon production, GHG emissions, emissions intensity, and

sources of emissions for the 100 largest hydrocarbon producers in the U.S.[78] Hilcorp Energy was found to be polluting significantly more CO2 and methane than any other operator in the United States, despite only being the 7th biggest producer. The research found Hilcorp had the highest rate of process and equipment methane venting and one of the highest emissions intensity scores across all top 100 producers. This data followed a 2021 EPA report that found Hilcorp Energy reported almost 50 percent more methane emissions from its operations than the largest producer, Exxon Mobil, despite pumping far less oil and gas.[79]

The data is a damning indictment on the company for failure to prevent potent methane greenhouse gases being vented directly into the atmosphere during oil and gas extraction. Presumably Mr Lalicker was appointed to the Origin board due to his experience in the upstream oil and gas sector. However, ACCR is concerned that Lalicker’s association with and contribution to Hilcorp’s track record is not in the interests of Origin Energy’s shareholders, particularly considering Origin Energy’s role as operator of the upstream APLNG assets where methane management is critical. This re-appointment could send the message that Origin does not give due priority to methane emissions management or decarbonisation efforts.

ACCR recommends a vote against the re-election of Greg Lalicker.

Just transition principles must be followed for Eraring closure

Eraring Power station is a large facility in a coal mining region with a workforce of ~500 people that has been in operation since 1984.[80] It is crucial that the principles of a Just Transition are enacted by Origin Energy through the closure of the Eraring Power Station. It is now widely recognised that any transition that does not include fair treatment of workers and communities, and does not involve serious efforts to ensure ongoing opportunity in regions, carries an additional set of risks for investors.[81]

The commitments outlined in Origin’s CTAP demonstrate the company has been taking action to incorporate critical feedback to enact Just Transition principles at Eraring. Origin’s commitment to “open, inclusive and transparent engagement” and “advocating for policies and regulation to support a just transition” is welcomed.

Recommendations for Origin Energy:

- Origin must provide a clearer sense of what the company is doing for the subcontracting workforce. Equivalent support should be made available to contract, subcontract, casual and supply chain workers.

- Contribute to the establishment of a fit-for-purpose regional structural adjustment policy and associated institutions.[82] This is a solution being advocated for by the Hunter Jobs Alliance, a local organisation active in Just Transitions in the Hunter Valley. Origin is well placed to provide contributions to regionally based efforts to diversify the Hunter Valley as it prepares for future opportunities as coal-based industries phase down.

Recommendations for investors:

- Investor monitoring is recommended for the specific actions committed to and being undertaken to support workers through the closure process, and evidence of worker participation in decision making on workforce transition issues, are priority areas for attention.

- Investors should seek more specific disclosures of the actions being undertaken. Investor actions could include direct engagement with the company, engagement with impacted stakeholders, and monitoring against specific metrics of worker support and retraining outcomes.

Accounting and audit

Financial statements

Climate change has previously been insufficiently reflected in Origin’s financial statements and audit report. This was the catalyst for ACCR filing a shareholder resolution seeking that the company include a climate sensitivity analysis, including a 1.5°C scenario, in the notes to its financial statements. We welcome the subsequent improvements that Origin has made in its FY22 financial statements and its enhanced commitment for FY23.

The FY22 notes to the financial statements specify where climate change has an impact, but not how climate change has been addressed or what impact it has had. For example, in Note C2 on exploration and evaluation assets, Origin states that “future climate-related conditions, legislation and policies may impact whether reserve quantities are capable of economic extraction.”[83] Although this is correct, the financial statements do not explain what inputs have been assumed, or what impact these have had.

The financial audit does not explain how climate change has been considered, beyond stating that climate has been considered as a macroeconomic input.[84]

The major improvement in the FY22 financial statements is a new section explaining how a 1.5°C scenario would impact the company.[85] This concludes that the energy markets segment would be positively impacted, with the exception of Eraring which has already had most of its carrying value impaired. It also concludes that the APLNG investment would be negatively impacted and subject to impairment in a 1.5°C scenario, although the size of the impairment is not disclosed.

In the Notice of Meeting for the 2022 AGM, Origin has said that it “plans to include a climate sensitivity analysis using a 1.5°C scenario, that presents the quantitative estimates and judgements and covers operating business segments”[86] in the 2023 financial statements. ACCR welcomes this announcement. The only gap between the ask of ACCR’s resolution and Origin’s commitment relate to the impact of a 1.5°C scenario on the exploration assets. With the divestment of Beetaloo and the announced intention to divest the remaining assets, an assessment of the exploration assets is arguably no longer decision relevant for investors. As such, Origin is adhering to the ask of the resolution and by making this commitment, it is leading in the Australian market for climate related financial disclosures, subject to the implementation of this commitment in FY23.

CTAP audit

The CTAP has been subject to limited assurance by EY. The assurance considered whether the 2030 emissions intensity target is consistent with a 1.5°C pathway; that the scenario analysis is transparent, neutral, relevant and defensible; and that the CTAP is complete. The assurance did not find that these criteria have not been met.[87]

The criteria used for the assurance are stated as those “summarised in the Report [CTAP] in the Targets and Scenario analysis sections and includes consideration of the Climate Action 100+ Net Zero Company Benchmark Framework”.[88] These criteria are articulated in the CTAPs “Basis of Preparation”, which does not appear to be available to investors. As such, it is not clear which of the CA100+ benchmark criteria have been assured.

We note that since the CTAP was issued, Origin divested its more advanced exploration asset. At the date of EY’s assurance however Origin was actively exploring in the Beetaloo basin. Considering the information that was in the CTAP, it is ACCR’s view that Origin’s exploration activities should have been considered by EY. As shown in Figure 1, Origin was actively opening up exploration basins that could dwarf Australia’s emissions. With this in mind, it is hard to accept that the CTAP included all ‘relevant’ material, was ‘defensible’ or was ‘complete’. As a minimum, the audit report should have stated that the opinion was based on Origin’s exploration assets not progressing.

Appendix 1: Assumptions for the Origin’s portfolio emissions and 1.5°C target profiles

ACCR has made the following assumptions to build this profile:

- Eraring closes in August 2025[89]. In the CTAP, Origin notes delays to the “timing for closure of all four units of Eraring” as a risk to its decarbonisation journey.[90]

- Emissions from energy markets follow a straight line trajectory to net zero in 2050 in accordance with Origin’s current targets.[91] There does not appear to be sufficient disclosed detail to make a more granular forecast.

- 74% of 2C resources for APLNG are converted to 2P reserves (based on APLNG FID analogue).[92] The reserves replacement ratio for APLNG however has been close to 100% for the last 5 years,[93] since additional resources are being upgraded to reserves.

- The 36.5PJ from Beetaloo is processed at an Origin operated LNG facility. If it was tolled through a facility operated by another company, or sold into the domestic gas market, this would change the allocation of emissions between scopes, but not the total emissions.

- The exploration activities in the Canning and Cooper/Eromanga basins do not result in fossil fuel developments or do not remain part of Origin’s portfolio. Should this change, any emissions associated with these developments would mean Origin exceeds its 1.5°C target.

- The ratio of scope 1, 2 and 3 emissions remains constant for APLNG and also applies to Beetaloo.[94]

- Scope 1 and 3 LNG emissions assume 1.8% is emitted as fugitives (including leaks, venting and incomplete combustion), and the rest is combusted.[95] Higher vent rates have been demonstrated in many facilities and Origin does not control its downstream value chain.

- APLNG post plateau production follows an analogue from another Queensland coal seam gas LNG project[96]. Beetaloo’s production profile uses the same tail. Beetaloo’s ramp up is based on the mid case profile from Reputex.[97] Beetaloo’s peak production is proportional to APLNG’s peak production, scaled down based on the ratio of APLNG’s 2P reserves to the cumulative Beetaloo offtake.

- No assessment has been made of how APLNG will operate at the lower rates that are modelled through later decades. Even if APLNG cannot operate at these low turn down rates, the reserves may still be developed in a number of ways, such as consolidating with neighbouring LNG facilities, or via the domestic gas market.

- It reflects current equity stakes of each project. Historic APLNG production has been scaled down from Origin’s historic 37.5% equity share to its current 27.5% equity share.[98] This is inline with the approach for adjusting targets in the case of acquisitions and divestments in the Greenhouse Gas Protocol.[99]

ACCR has based Origin’s 1.5°C target on a mix of domestic and global LNG inputs:

- The domestic emissions target is a 50% reduction by 2030 and net zero by 2045, which is the weakest target consistent with 1.5°C (Climate Analytics).[100]

- The exported emissions target is based on the IEA’s NZE profile for Australian LNG production.[101] After the modelled period ends in 2050, a linear decline has been applied to zero emissions in 2060. Additional projects have made FID since the IEA NZE was published, which means that to keep to the same carbon budget, more fossil fuel developments will need to close earlier than what would have been their economic end of life. This asset stranding is not currently reflected in our mode, but may be in future.

Please read the terms and conditions attached to the use of this site.

Australasian Centre for Corporate Responsibility

Origin Energy, Climate Change Management Approach, 2021 ↩︎

Origin Energy, Origin to divest Beetaloo Basin interests, intends to exit upstream exploration permits, 2022 ↩︎

Origin Energy, Origin to divest Beetaloo Basin interests, intends to exit upstream exploration permits, 2022 ↩︎

UTS Jumbunna Institute, Hydraulic Fracturing and Free and Prior Informed Consent (FPIC) in the Northern Territory, 2019 ↩︎

Falcon Oil and Gas, Declaration of Material Gas Resource, 2017 ↩︎

AFR, Parsley Energy billionaire buys into Tamboran, November 2021 ↩︎

Proactive Investors, Tamboran Resources on a mission to create tomorrow’s energy solutions, 2021 ↩︎

At 23 September 2022 ↩︎

Bloomberg, Tamboran Awarded Grant of up to $7.5 Million under Drilling, March 2022 ↩︎

Tamboran presentation, March 2022 ↩︎

The Australian, Origin Energy CEO Frank Calabria bets on green for earlier payback, Sept 2022 ↩︎

Origin, Origin farms into prospective Canning Basin permits, 2020 ↩︎

Geoscience Australia, Gas, Table 4 ↩︎

Origin, Origin farms into prospective Canning Basin permits, 2020 ↩︎

Geoscience Australia, Gas, Table 4 ↩︎

Reputex Energy, Analysis of Beetaloo Gas Basin: Emissions & Carbon Costs, 2021, p11 ↩︎

Geoscience Australia, Gas, Table 4 ↩︎

AFR, The great transition turns blue chips into green chips, August 2022 ↩︎

Origin to divest Beetaloo Basin interests, intends to exit upstream exploration permits, 19 Sep 2022 ↩︎

Origin to divest Beetaloo Basin interests, intends to exit upstream exploration permits, 19 Sep 2022 ↩︎

2022 Annual Report, p107 ↩︎

2022 Annual Report, p86 ↩︎

2021 Annual Report, p104 ↩︎

Origin Energy, CTAP, p 11 ↩︎

Origin to divest Beetaloo Basin interests, intends to exit upstream exploration permits, 19 Sep 2022 ↩︎

Origin Energy, CTAP, p 16 ↩︎

S1, S2 and S3 in the legend refer to scope 1, scope 2 and scope 3 emissions. ↩︎

https://sciencebasedtargets.org/companies-taking-action#table ↩︎

https://sciencebasedtargets.org/step-by-step-process#develop-a-target ↩︎

Origin Energy, Our carbon commitments, 2021, website since updated ↩︎

Science Based Targets, Oil and Gas ↩︎

Origin Energy, CTAP 2022, p 36 ↩︎

This has been rebaselined to adjust for the farm down of APLNG for 37.5 to 27.5% in February 2022 ↩︎

Origin Energy, CTAP 2022, p 11 ↩︎

ACCR analysis of Origin disclosures from FY17 - FY22 ↩︎

Origin Energy, Origin proposes accelerated coal-fired exit, 17 February 2022 ↩︎

Origin Energy, CTAP 2022, p 12 ↩︎

Origin Energy, CTAP, p 20 ↩︎

Appendix 1 identifies options available to produce APLNG reserves even at low rates ↩︎

SBTi, Corporate Net-Zero Standard, 2021, p10 ↩︎

Origin Energy, CTAP, p16 ↩︎

Origin Energy, CTAP, p21 ↩︎

Origin Energy, CTAP, p16 ↩︎

Origin Energy, CTAP, p16 ↩︎

Origin Energy, CTAP, p17 ↩︎

Origin Energy, CTAP, p16 ↩︎

Origin Energy, CTAP, p 21 ↩︎

Origin Energy, CTAP, p 17 ↩︎

Origin Energy, CTAP, p 18 ↩︎

Longden et al, ‘Clean hydrogen? Comparing the emissions and costs of fossil fuel versus renewable electricity based hydrogen’, Applied Energy, 2022\ ↩︎

Paul Berrell, “Not going to be a thing” It will be too expensive to ship hydrogen around the world, says Liebrich”, September 2022\ ↩︎

Michael Barnard, “Chemical Engineer Paul Martin reflects on Liebrich’s hydrogen ladder”, September 2021 ↩︎

Origin Energy, CTAP, p 43\ ↩︎

Orica, Orica and Origin to partner on hunter valley hydrogen hub, February 2022\ ↩︎

Origin Energy, CTAP, p 19 ↩︎

2022 Annual Report, p23 ↩︎

Origin Energy, Origin to divest Beetaloo Basin interests, intends to exit upstream exploration permits, 2022, link ↩︎

Origin Energy, CTAP, p 23\ ↩︎

IEA, World Energy Outlook 2021, Table 6.1 ↩︎

ACCR, ACCR Shareholder Resolutions to Origin Energy Ltd on climate-related lobbying and Paris-aligned capital expenditure, 2021 ↩︎

Origin Energy, Industry Association Review, 2022 ↩︎

InfluenceMap, Industry Associations, accessed September 2022 ↩︎

Origin Energy, Industry Association Review, 2022 ↩︎

The Australian, Gas will power us to net-zero future - Opinion Piece by Samantha McColloch, Sept 2022 ↩︎

AFR, Gas never more important, says APPEA’s new CEO, Sept 2022 ↩︎

APPEA, New Government report highlights gas demand for decades to come, 2022, link ↩︎

APPEA, Submission number 62 to the Joint Standing Committee on Trade and Investment Growth, 2021 ↩︎

See the APPEA submission to the Victorian Gas Substitution Roadmap ↩︎

QRC, Time to approved New Acland, 2022 ↩︎

QRC, Qld’s high quality coal industry here for the long haul, 2022 ↩︎

Origin Energy, Origin to divest Beetaloo Basin interests, intends to exit upstream exploration permits, 2022 ↩︎

Ibid. ↩︎

Origin, Corporate Governance Statement 2022, p9 ↩︎

Origin, Corporate Governance Statement 2022, p10 ↩︎

Origin Energy, Climate Transition Action Plan, 2022 ↩︎

Origin Energy, Origin to appoint Greg Lalicker to its Board, 12 February 2019 ↩︎

Origin Energy, 2019, Origin to appoint Greg Lalicker to its board ↩︎

CERES, 2022, Oil and gas benchmarking report 2022, go to pages 23, 24, 25 ↩︎

New York Times, 2021, Here are America’s Top Methane Polluters\ ↩︎

AAP, Eraring workers blindsided by Origin’s announcement, February 2022\ ↩︎

Hunter Jobs Alliance, Just Transition Investment and the Hunter Valley, 2022 ↩︎

Ibid. ↩︎

2022 Annual Report, p107 ↩︎

2022 Annual Report, p146 ↩︎

2022 Annual Report, p90 ↩︎

Notice of Annual General Meeting 2022, p13 ↩︎

A ‘reasonable’ level of assurance would be required to find that these criteria had been met. ↩︎

- ↩︎

Origin Energy, CTAP, p16 ↩︎

Origin Energy, CTAP, p20 ↩︎

Origin, Climate change management approach, p1 ↩︎

Derived from Origin, Australia Pacific LNG: Final Investment Decisions, slide 8 ↩︎

2022 Annual Report, p156 ↩︎

Ratios are based on ACCR analysis of Origin’s reporting ↩︎

Reputex Energy, Analysis of Beetaloo Gas Basin: Emissions & Carbon Costs, 2021, p10 ↩︎

Santos Oil Search and Santos Scheme Booklet, 2021, p591 ↩︎

Reputex Energy, Analysis of Beetaloo Gas Basin: Emissions & Carbon Costs, 2021, p8 ↩︎

Origin, Origin completes sale of 10 per cent interest in Australia Pacific LNG, 2022 ↩︎

Greenhouse Gas Protocol, p36 ↩︎

Climate Analytics, Australian election 2022 political party and independent climate goals: analysis, link. This is similar to the SBTi power sector guidance, “Combined with the emissions pathway, this is equivalent to an 85% reduction in emissions intensity between 2020 and 2035. After 2035, the MESSAGE-GLOBIOM Low Energy Demand scenario leads to an emissions intensity of approximately zero by 2050” ↩︎

IEA, Net Zero by 2050: A Roadmap for the Global Energy Sector, 2021, p175 ↩︎