Publication What’s next for Woodside?

Executive Summary

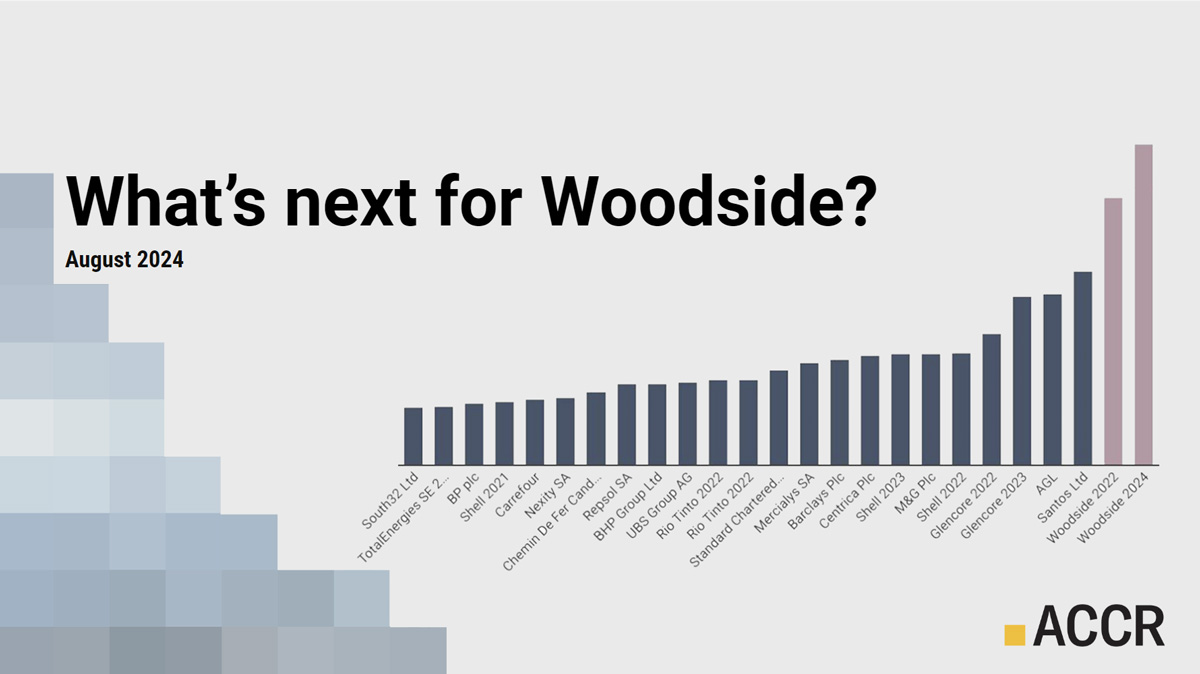

At Woodside’s 2024 AGM, a majority (58%) of shareholders voted against the company’s Climate Transition Action Plan (CTAP). This is the largest vote ever against a company climate plan, superseding the previous record of 49%, which was set by Woodside last time it put its climate plan to shareholders.

This research considers how Woodside can deliver a credible strategy for managing climate risk and securing shareholder value.

It finds that ceasing development of its high-cost, high-emissions, pre-FID greenfields gas projects offers Woodside a significant opportunity to enhance shareholder value and reduce exposure to climate risk. A capital allocation framework that returns free cash flow to investors currently offers more value and less risk than fossil fuel production growth.

The recent acquisition of Driftwood LNG adds another long-duration, high-cost, high-emissions project to Woodside’s pre-FID portfolio - underscoring the urgent need for a reassessment of its current company strategy.

Key findings

Woodside’s pre-FID greenfields gas projects are not Paris-aligned or low-cost.

- Browse is more expensive than 70% of the world’s unapproved gas projects; Sunrise and Calypso are even more expensive.

- Share buybacks would deliver 140% more NPV upside than executing Browse and Sunrise.[1]

- Not developing Browse, Sunrise and Calypso would move Woodside towards Paris alignment by avoiding 80% of the emissions from its pre-FID upstream portfolio.

Like Trion, the recent Driftwood announcement is another example of Woodside pursuing a long-duration, high-capex and uncompetitive project. Driftwood is more expensive than 76% of other pre-FID US LNG projects.

Woodside’s track record on exploration is poor. It hasn’t made a major discovery since 2005 and this has led to Woodside paying more to find oil and gas resources than it costs to buy developed reserves.

Oil and gas has underperformed the broader market for more than a decade, and Woodside has underperformed its peers.

Ceasing fossil fuel exploration and development could create >$4 billion more NPV upside than if Woodside executed its current pre-FID upstream oil and gas portfolio.

Browse:

- is more expensive than 70% of the world’s unapproved gas projects

- over 50% more expensive than sanctioned Qatar and unconventional Permian projects

- makes up half of Woodside’s upstream pre-FID portfolio by capex, production and emissions

- has not been developed, despite having being discovered in the 1970s, had multiple FEED studies completed and suffered one negative FID

- is not Paris-aligned.

Sunrise and Calypso:

- are even more expensive than Browse

- are being progressed by Woodside despite being classified by Rystad as ‘uncommercial’ or commercial ‘uncertain’.

Recommendations

Investors have voiced discontent with Woodside’s climate plan for several years, but Woodside has not responded with material changes.

- We think it is now appropriate for investors to become more specific and to challenge Woodside’s executives and board on allocating capital to:

- pre-FID, long-duration, high-cost, high-emission, low-value projects, specifically Browse, Sunrise, Calypso and Driftwood

- oil and gas exploration, especially considering Woodside’s poor track record.

Unless these points are addressed, it is not possible for Woodside to produce a credible climate transition plan. However, implementing these changes is likely to enhance shareholder value.

- In addition, investors should assess whether the board has the right mix of high-calibre and appropriately skilled directors, with the requisite judgement to serve shareholder interests during the energy transition.

Download What's next for Woodside? | August 2024

Please read the terms and conditions attached to the use of this site.

Even though Woodside is actively progressing Calypso, it is excluded since it has a negative NPV based on Rystad data and assumptions. ↩︎