Publication Woodside Petroleum Ltd: Assessment of 2021 Climate Report

Woodside Petroleum Ltd

(ASX:WPL, ISIN:AU000000WPL2)

AGM date and location: 19 May 2022, Perth, Australia

Contacts:

Dan Gocher, Director of Climate and Environment

Harriet Kater, Climate Lead, Australia

Alex Hillman, Carbon Analyst

In March 2021 Woodside (ASX:WPL) announced that it would provide shareholders with an advisory vote on its climate reporting (a ‘Say on Climate’) at its 2022 annual general meeting.[1] The company has not committed to providing this vote on an ongoing basis.

It is ACCR’s view that there is sufficient reason to vote against the approval of Woodside’s 2021 Climate Report. Our primary rationale is provided below:

- Woodside’s climate targets exclude 90% of emissions by not covering scope 3. This conflicts with the expectations of 49.63% of Woodside shareholders that supported ACCR’s 2020 shareholder resolution, which asked the company to set Paris-aligned Scope 1, 2 and 3 targets.

- Woodside’s scope 1 and 2 decarbonisation strategy is dominated by the use of offsets. Investor groups have clearly indicated that offset use should be avoided or minimised. The Science-Based Targets initiative does not accept offsets as an alternative to abatement, arguing that offsets should only be additional to absolute reductions in the corporate value chain. Without offsets, the company’s scope 1 and 2 equity emissions grow to 2030.

- Woodside is allocating 67% of committed and sustaining capital to new oil and gas fields and 33% to existing fields. Should the BHP Petroleum merger be approved, unlocking US$5billion for new energy projects and US$8 billion of new fossil fuel developments, 53% of combined capital will be allocated to new oil and gas. The merged portfolio allocates 4.5 times the share of capital to new oil and gas fields than the IEA’s Net Zero Emissions scenario.

- Woodside’s planned hydrogen investment is heavily weighted to fossil hydrogen at H2Perth. Unabated hydrogen produced with gas is more carbon intensive than direct use of gas. Offsets are an unacceptable abatement measure for new fossil fuel emissions.

- Woodside’s scenario analysis demonstrates that its portfolio does not protect shareholder value in Paris-aligned scenarios. The company’s free cash flow in the IEA net zero scenario is one third of that in the IEA STEPS scenario (2.6°C). The analysis excludes debt repayments.

- Woodside is highly oppositional to Paris-aligned climate policy in Australia, undermining not just its own decarbonisation efforts but those of the entire economy.

In light of the above, ACCR recommends that investors:

- Vote against the Say on Climate resolution

- Vote against the re-election of Ann Pickard, who as the chair of Woodside’s sustainability committee has heightened responsibility for Woodside’s climate change plan.

- Forcefully engage with Woodside’s management to improve Woodside’s 2023 climate plan.

Voting recommendation: AGAINST

Say on Climate: 1.5°C alignment is paramount

The 2018 Intergovernmental Panel on Climate Change (IPCC) Special Report on the impacts of global warming at 1.5°C [2] cemented the acceptance that “keeping 1.5°C alive”[3] must be prioritised over limiting warming to 2°C or below in all climate mitigation efforts.

The 2021 IPCC Sixth Assessment Report—described as the “code red for humanity”[4]—concluded that “we are at imminent risk of hitting 1.5°C in the near term” and that “the only way to prevent exceeding this threshold is by urgently stepping up our efforts and pursuing the most ambitious path.”[5]

The IPCC also emphasised that the 1.1°C of warming we have already experienced is increasing the frequency and intensity of extreme weather events.[6] Many attribution studies have found that major floods, fires and droughts in 2021 were either ‘virtually impossible’, ‘much more likely’ or ‘made worse’ due to climate change.[7]

The 2022 IPCC Working Group II Report on impacts and adaptation reinforced that if warming exceeds 1.5°C in the “coming decades or later, then many human and natural systems will face additional, severe risks, compared to remaining below 1.5°C”[8] and that “near-term actions that limit global warming to close to 1.5°C would substantially reduce projected losses and damages related to climate change in human systems and ecosystems, compared to higher warming levels”.[9]

“The cumulative scientific evidence is unequivocal: Climate change is a threat to human well-being and planetary health. Any further delay in concerted anticipatory global action on adaptation and mitigation will miss a brief and rapidly closing window of opportunity to secure a liveable and sustainable future for all.”[10]

Consequently, ACCR strongly encourages investors to use alignment with the Paris Agreement, particularly the goal to limit warming to 1.5°C, as the primary measure to assess climate transition plans. It is no longer acceptable to reward companies for transparency or the ‘direction of travel’. We are in a critical decade for action and the time for incrementalism and gentle encouragement has passed.

Transition options for the oil and gas industry

Prior to assessing Woodside’s 2021 Climate Report in detail, we first reflect on the options available to pure play oil and gas and gas companies in the face of climate change and the Paris Agreement. Unlike diversified miners or power utilities, climate change presents an existential risk to the oil and gas industry. This limits the genuine options available to the industry and has shaped the paths chosen to date.

Deny

Many companies have, until remarkably recently, not viewed climate change as a material risk, or espoused that fossil fuels provide greater benefits than they do harm. Just 6 months ago Woodside’s Board-approved climate change policy stated that Woodside sees natural gas playing “an increasingly important role globally both in the energy mix and in reducing greenhouse gas emissions”. Many would see the insistence that natural gas reduces emissions as denial of the role that Woodside’s products have in causing climate change.[11] Companies that openly deny climate change, or their role in it rapidly lose community and investor support.

Obfuscate and delay

A close cousin of denial. Despite publicly stating that climate change requires a response, the messaging from companies has focused on the risks of transitioning from fossil fuels, whilst ignoring the costs of inaction. This often involves funding delay through “disinformation and lobbying”[12], along with elevating technologies that prolong the existing energy system. Woodside’s planned use of fossil gas to make hydrogen at H2Perth could be seen to fall into this category. In addition to the obvious climate change impacts, this choice prevents management from learning how to thrive in a clean energy future, whilst peers or agile start-ups capture market share.

Diversification

Companies can attempt to manage climate risk by adding low carbon assets to an existing, and sometimes expanding fossil portfolio. This approach overlooks that to limit warming, an absolute reduction in emissions and fossil fuel use is needed in addition to investment in low carbon energy sources. If diversification is executed on a timeline consistent with what the science requires, it can be a valid approach to managing climate risk. However transitioning any business is no easy feat, with 70% of companies that attempt to transition failing[13].

Danish company Orsted is one of few fossil fuel companies that have successfully and completely transitioned to renewable energy. Importantly, Orsted commenced its transition fourteen years ago in 2008.[14] In addition to the cultural and commercial challenges that companies face in the energy transition, the question needs to be asked whether the directors of those companies only just exploring such a transition in 2022 have left it too late and whether recent fossil fuel investment decisions will result in stranded assets.

Divestment

When faced with investor or social pressure due to the carbon intensity of their business, some companies have elected to divest carbon intensive assets. Arguably this is what BHP is doing through the proposed merger of BHP Petroleum with Woodside.[15] Whilst this can reduce the climate risk exposure for an individual company, if the asset(s) continues to operate, it does nothing to reduce global emissions. For universal owners, these emissions could remain within their portfolio and even if they do not, the emissions will contribute to climate impacts on other parts of the portfolio, such as drought impacts on agriculture portfolios. Importantly not all divestment leads to adverse climate outcomes, with some buyers motivated to expedite the transition whilst realising commercial outcomes.[16]

Capital discipline

An oil and gas company that accepts the inevitability of the energy transition and the gravity of climate change, should be hesitant to invest in projects that rely on sustained fossil fuel prices. They could instead adopt Paris-aligned pricing assumptions, stop investing in projects that are not Paris-aligned and return excess cash to shareholders. This will avoid investments that aren’t resilient to the energy transition, and allow shareholders to determine how they want to use these funds.

What option has Woodside taken?

ACCR considers Woodside’s climate change strategy to primarily be obfuscation and delay, with some early signs of diversification. Such choices in 2022 will inevitably see a growing range of reputational and commercial risks for the company.

Woodside’s contribution to climate change

Woodside’s equity emissions profile is presented in Figure 1 (along with BHP Petroleum equity emissions) and its operated emissions profile is presented in Figure 2. Since Woodside operates a significant share of its assets, its scope 1, 2 and 3 operational emissions total (82 MtCO2-e in CY21) is more than twice that of its equity emissions (38 MtCO2-e in CY21). For both equity and operational emissions, scope 1 emissions have remained relatively stable over the last three years and scope 2 emissions are immaterial.

Woodside commenced publishing scope 3 emissions for the use of its products in 2019. Use of sold production increased in 2020 and fell back to 2019 levels in 2021[17]. Woodside broadened its scope 3 disclosures in 2021 and now discloses emissions associated with use of traded LNG (17% of inventory), as well as upstream emissions from traded LNG (3%), shipping (2%) and ‘selected other upstream’ (0.5%)[18]. The additional categories increase the reported emissions by 9.3 MtCO2-e, or 26% of the 2019 disclosures.

Investors may be interested to note that despite LNG trading representing 20% of the emissions inventory, there has been no reportable revenue from trading activities in 2019, 2020 or 2021[19]. This suggests that Woodside is increasing its carbon footprint and risk profile, without generating a return for investors.

Adding BHP Petroleum’s portfolio would double Woodside’s scope 1, 2 and 3 equity emissions to 77 MtCO2-e[20]. BHP does not disclose operated scope 3 emissions, so a similar comparison cannot be made for operated emissions.

Figure 1: Equity emissions for Woodside and BHP Petroleum (% covered by target; MtCO2-e)[21]

Figure 2: Woodside operated emissions CY19-CY21 (MtCO2-e)[22]

Woodside’s short, medium and long-term climate targets

In 2020 49.63% of Woodside shareholders supported an ACCR resolution seeking that Woodside set Paris-aligned Scope 1, 2 and 3 emission reduction targets.[23] However, to date Woodside has solely set scope 1 and 2 equity emissions targets (see Table 1), excluding at least 90% of the company’s emissions (as shown in Figure 1). The Investor Group on Climate Change (IGCC) guidance on climate transition plans states that “fossil fuel producers in particular should set short, medium and long-term targets that apply to scope 3 emissions”[24].

Woodside states[25] that its scope 1 and 2 targets are “aligned with the IPCC’s Paris Aligned scenarios”.[26] However the company has also indicated that based on its current portfolio[27] and its merged portfolio[28] ‘production growth’, will lead to an increase in scope 1 and 2 emissions by 2030. Importantly, an increase in emissions to 2030 is inconsistent with the goals of the Paris Agreement.

Table 1: Woodside Scope 1 and 2 emissions reduction targets

| Date | Baseline | Scope 1 and 2 target |

|---|---|---|

| 2021 | Average annual gross equity emissions 2016 - 2020 | 10% reduction in net equity emissions |

| 2025 | 15% reduction in net equity emissions | |

| 2030 | 30% reduction in net equity emissions | |

| 2050 | Reduce net equity emissions by 100% (aspiration) |

Peer benchmark

Noting that very few oil and gas companies have commitments in place that are consistent with limiting warming to 1.5°C, there is still some merit in assessing Woodside’s targets against its peers (see Table 2). Woodside’s scope 1 and 2 targets are generally weaker than most companies and its lack of a scope 3 emissions target is unique amongst the group. There are also differences in target scope and this is discussed further below.

Table 2: Peer benchmark - Scope 1, 2 and 3 emissions reduction targets

| Company | Scope 1 and 2 targets (comment relative to Woodside) | Scope 3 targets |

|---|---|---|

| BP[29] | Reduce operated emissions: by 20% by 2025 by 30% by 2030 to net zero by 2050 | Reduce equity emissions of upstream production: by 20% by 2025 by 35-40% by 2030 to net zero by 2050 |

| BHP[30] | Operated emission targets: Hold emissions to 2017 levels until 2022 30% absolute emissions reduction by 2030 Net zero by 2050 | Net zero by 2050 “goal” |

| Chevron[31] | Net zero upstream equity emissions by 2050 | 5% portfolio intensity reduction by 2028 |

| Equinor[32] | Reduce absolute operated emissions: to net zero 100% by 2030 to near zero for Norway by 2050 | Reduce net equity emissions by 100% by 2050 |

| Exxon[33] | Current plans reduce operated emissions by 20% by 2030 Aims to achieve net zero by 2050 | Current plans result in 12% reduction by 2030 |

| Shell[34] | Reduce operated emissions: by 50% by 2030 to net zero by 2050 | Reduce portfolio lifecycle emissions intensity: by 20% by 2030 by 45% by 2035 to net zero by 2050 |

| TotalEnergies[35] | Reduce operated emissions: by 15% by 2025 by 40% by 2030 to net zero by 2050 | Keep equity emissions below 2015 levels in 2030 Achieve net zero equity emissions by 2050 |

Target scope: operational vs equity

The majority of companies in Table 2 set targets based on operational emissions, whilst Woodside focuses on equity emissions. This difference introduces complexities when these same companies participate in joint ventures. For example, for the Woodside-operated North West Shelf (NWS)[36] joint venture:

- Woodside (16.67%) and Chevron (16.67%) targets cover their equity share of NWS emissions

- BHP (16.67%), Shell (16.67%) and BP (16.67%) all have operational emissions targets that cover no emissions from NWS

- ACCR cannot find any climate targets for MIMI (16.67%).

This means that to date at least 50%[37] of the North West Shelf’s emissions are not covered by any corporate emissions reduction target.

Woodside’s focus on equity emissions also means that the recent sale of 49% of Pluto 2 to Global Infrastructure Partners (GIP) will reduce the coverage of its targets for that asset. The nature of the deal however, means that Woodside retains responsibility for “exposure to additional scope 1 emissions liability above agreed baselines”.[38] Whilst this incentivises Woodside to manage all Pluto 2 emissions within regulatory limits, it reduces the emissions coverage under the corporate targets and ACCR can find no evidence that GIP will have in place a target for its 49% share.

ACCR acknowledges that companies have the option to set targets and report on operational or equity boundaries. However when joint venture partners take conflicting approaches, it leads to a material percentage of Woodside’s operational emissions that aren’t subject to emissions reduction targets. It is unfortunate that Woodside has not set its targets to ensure more complete coverage of its operated emissions.

Impact of licence conditions and offsets on targets

As shown in Table 1, the baseline for Woodside’s scope 1 and 2 target is 2018 annual gross equity emissions, whereas its scope 1 and 2 targets are net equity emissions. This difference between gross and net emissions relates to the treatment of offsets; with them being deducted from the total of net emissions, but ignored when calculating gross emissions. The magnitude of this nuance may not be immediately clear.

The 2007 Pluto LNG plant Ministerial Statement 757 issued under the Western Australian Environmental Protection Act, includes condition 12-2, which requires Woodside to “provide a greenhouse gas offset package which, at a minimum, offsets the reservoir carbon dioxide released to the atmosphere.”[39] Pluto’s reservoir carbon dioxide emissions are about 0.3 MtCO2-e[40] (0.27 MtCO2-e Woodside share). Pluto LNG was commissioned in 2012[41] and assuming Woodside met the minimum requirements of this Ministerial condition, this would reduce Woodside’s emissions baseline from 3.45 MtCO2-e to 3.18 MtCO2-e; or by 8%. When Woodside’s baseline is reported as net, by accounting for the impact of the Ministerial Statement, this removes more than half of the apparent ambition of the 2021 and 2025 targets and significantly weakens the 2030 target, as shown in Table 3 below.

As discussed in the Offset section below, there are many reasons why offsets should not be relied upon as a key driver of emissions reductions and there is a growing push for offset purchases to be accounted for separately, to enable the tracking of actual reductions.[42] If the impact of offsets are removed (see Table 3), Woodside does not have an emissions reduction target and its 2030 emissions are projected to be 10% above its gross emissions baseline.

Table 3. Comparison of Woodside targets: Announced vs Net baseline and target vs No offsets

| Target | Baseline: gross Target: net | Baseline: net Target: net | Baseline: gross Target: gross |

|---|---|---|---|

| Description | Woodside’s announced targets and metrics | ACCR adjustment of baseline to account for minimum legal offset obligation in baseline period1 | Credits not used to offset emissions |

| 2021 | 10% reduction | 2% reduction | 1.6% reduction (actual, not target) |

| 2025 | 15% reduction | 7% reduction | - |

| 2030 | 30% reduction | 24% reduction | 10% increase (projection, not target) |

Science-based target claim

Woodside claims that its scope 1 and 2 emissions targets are science based, as per an International Accounting Standards Board (IFRS) definition: “Targets are considered ‘science-based’ if they are in line with what the most recent climate science sets out is necessary to meet the goals of the Paris Agreement—limiting global warming to below 2 degrees Celsius above pre-industrial levels and pursuing efforts to limit warming to 1.5 degrees Celsius.”[43]

ACCR does not agree that this definition should be applied to an emissions target that excludes more than 90% of a company’s emissions. In ACCR’s view, calling a target that covers less than 10% of a company’s footprint Paris-aligned is potentially misleading and deceptive.

In response to the lack of consistency in net zero commitments, the Science Based Targets initiative (SBTi) released its Net Zero Standard in October 2021 with the specific intent of providing a “common, robust and science-based understanding of net-zero”[44]. Whilst oil and gas companies cannot obtain SBTi accreditation due to the absence of sector-specific guidance[45], in Table 5 below we have benchmarked Woodside’s commitments against the overarching criteria of SBTi’s Net Zero Standard.

Table 5 Woodside benchmark against SBTi Net Zero Standard requirements

| Criteria | Key elements | WPL aligned? | ACCR commentary |

|---|---|---|---|

| Focus on rapid, deep emission cuts | Rapid, deep cuts to value-chain emissions are the most effective and scientifically-sound way of limiting global temperature rise to 1.5°C. | ❌ | 90% of value chain emissions are excluded from the targets. Direct and indirect emissions are projected to increase to 2030. Setting a net emissions target against a gross emissions baseline further delays scope 1 and 2 emissions reductions to later in the decade. |

| Set near- and long-term targets | Companies adopting the Net-Zero Standard are required to set both near-term and long-term science-based targets. This means making rapid emissions cuts now, halving emissions by 2030. | Partial ❌ | Woodside has set short and medium term targets. It has a net zero ‘aspiration’. __ Woodside’s targets are not science based. The Scope 1 and 2 target for 2030 does not reflect a 50% reduction and Woodside does not have a Scope 3 emissions target. |

| No net-zero claims until long-term targets are met | Most companies are required to have long-term targets with emission reductions of at least 90-95% by 2050 | ❌ | Woodside is not attempting to reduce emissions even for the limited portion of its emissions that its targets cover, until at least 2030. |

| Go beyond the value chain | Companies make investments outside their science-based targets to help mitigate climate change elsewhere. These investments should be in addition to deep emission cuts, not instead of them. | ❌ | Woodside is investing in offsets, but these are included in their targets and are at the expense of emission reductions. |

Decarbonisation strategy

This section examines the three key strategies that Woodside has in place to meet its scope 1 and 2 equity emissions reduction targets, being design out, operate out and offset.

Design out

Design decisions will determine emissions from LNG facilities for decades. Since LNG facilities have high capex and relatively low operating costs it is difficult to make a business case to retrofit an LNG facility post construction. Therefore the design decisions for Scarborough and Pluto 2, which are expected to be operating past 2050[46], are a major opportunity for Woodside to deploy a broad range of technologies and to decrease the impacts of these facilities.

Woodside is a partner in the Australian Industry Energy Transitions Initiative (AIETI)[47], which was established with the goal of “supporting Australian industry to realise the opportunities of a decarbonised global economy”.[48] AIETI has identified a range of emission reduction measures for LNG production. These are split into three categories, based on their ability to support a net-zero facility[49]:

- Long term, zero or near-zero emissions potential:

- Leak Detection and Repair (LDAR), upgrade existing devices, install emissions control devices

- Carbon capture and storage (CCS) for reservoir gas[50]

- Electrified liquefaction, valves and pumps

- Important role in near term abatement but insufficient for net zero emissions:

- Electrified valves and pumps

- Blue hydrogen for power generation or gas turbine fuel

- Post-combustion CCS

- Potential role in transition to zero or near-zero emissions options

- waste heat recovery, aeroderivative turbines.

Woodside has stated that it is applying LDAR, a process to identify and reduce fugitive leaks and that it is considering ‘longer term opportunities for further electrification’.[51] However the AIETI report states that electrification of the liquefaction process is likely only applicable for greenfield applications and since this is not being considered for Pluto 2, it casts doubt on whether Woodside will ever deploy electrification at scale. Woodside has also stated it is using aero derivative and waste heat recovery in Pluto 2 and Scarborough.[52]

Despite Woodside’s claim that it prioritises the mitigation hierarchy[53] and its direct involvement in the AIETI study, it has chosen to implement few of the identified abatement opportunities. Those opportunities that have been prioritised are the cheaper and less significant ones. Woodside has made design decisions, such as gas-fired liquefaction for Pluto 2, which will likely prevent later application of material emission saving measures. This ‘locking’ in of emissions is visible in Woodside’s path to net zero by 2050 - with roughly half of the emissions in 2030 currently having no abatement plan.

Operate out

Woodside states that it surpassed its 2016-2020 energy efficiency target of 5%, achieving an 8% reduction by 2020[54]. In comparison, the targeted savings from “operate out” to 2030 sit at around 150 ktCO2-e, or 4%. That is - Woodside is planning on delivering half the emission savings over twice as long.

Of the three opportunities detailed in the 2021 Climate Change Report[55], the target abatement achieved from Karratha Gas Plant turbine optimisation dwarfs the other two, with a potential abatement range of 55 to 150 kt CO2-e per annum[56]. This opportunity sees Woodside relying upon the more efficient power generators at Karratha Gas Plant in periods when the plant is processing less gas. This type of saving should arguably be treated as business as usual, rather than an optimisation opportunity. Doing so reinforces the lack of urgency and priority that Woodside is placing on emissions reduction.

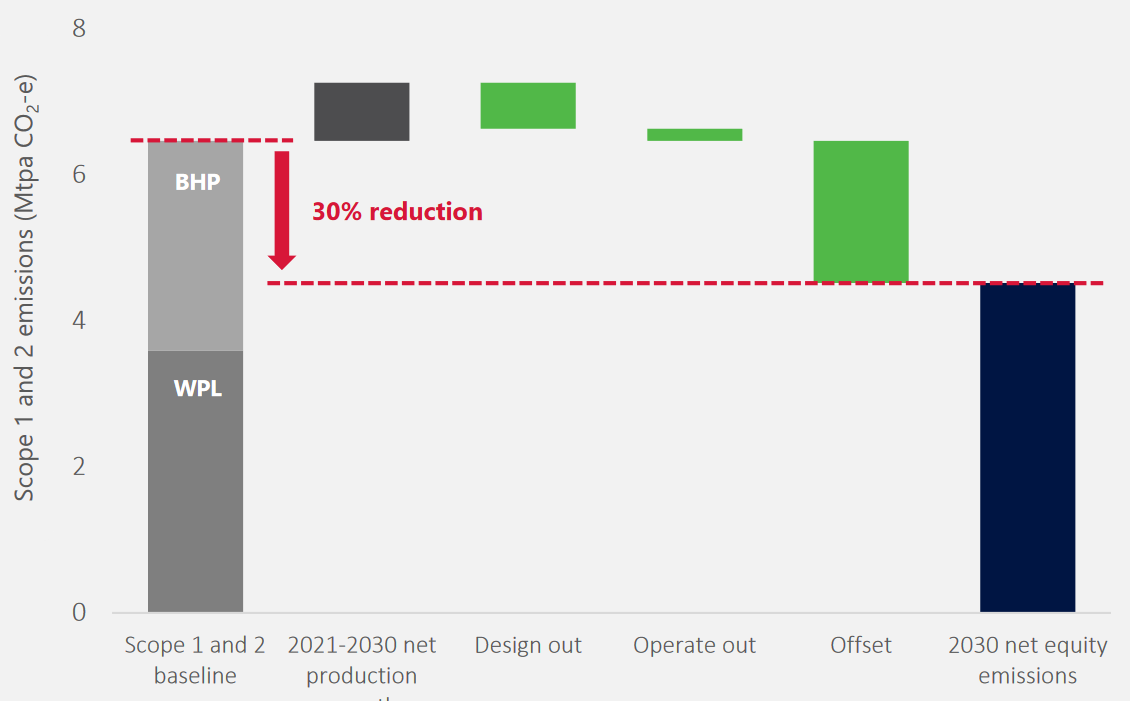

Offset

Whilst Woodside states that it applies a hierarchy of controls and prioritises emissions reductions above offsetting emissions, offsets dominate the company’s scope 1 and 2 decarbonisation strategy. Figure 3 shows that Woodside’s scope 1 and 2 emissions will increase to 2030 requiring more than 100% of net reductions to be delivered from offsets[57].

Figure 3: Woodside’s Emission Reduction plan highlighting reliance on offsets

In 2021 Woodside’s equity emissions reduced by 57 ktCO2-e, whilst 312 ktCO2-e were offset[58], meaning that 85% of the 369 ktCO2-e reduction was delivered using offsets. It is worth noting that production decreased by about 10% in 2021 and this is likely to have caused much, if not all, of the absolute emissions reduction.

Woodside has announced that its planned hydrogen project H2Perth will initially be using 40TJ per day of fossil gas to produce hydrogen[59]. The emissions from this quantum of gas is 600 ktCO2-e per year[60], more than Woodside’s share of the Wheatstone LNG facility[61]. Emissions from H2Perth do not appear to have been included in the company’s emissions projections. This would significantly increase the required amount of offsets from ~1.9 MtCO2-e in 2030 to ~2.5 MtCO2-e and that is prior to any impact from the BHP Petroleum merger.

This high level of reliance on offsets introduces a range of risks for Woodside. Key issues and developments relating of corporate offset use are detailed below:

- Offsets create false equivalence between fossil and land-based carbon sinks: Investment in activities that drive uptake of carbon in natural carbon sinks is no match for the disruption of inert fossil carbon sinks - the suggestion that such activities are equivalent and can net each other out is false.[62] The burning of fossil fuels “moves carbon from permanent storage into the active carbon cycle, causing an aggregate increase in land, ocean, and atmospheric carbon. Once added, this additional carbon cannot be removed through natural sinks on time-scales relevant to climate mitigation, leading to increased warming”.[63] In other words, the assumed fungibility of fossil and natural carbon is a myth[64] that was only ever established due to “political rather than scientific considerations.”[65]

- Increasingly used as a tool for historical emissions or those outside the value-chain: The Science Based Targets Initiative states that “carbon credits must not be counted as emission reductions toward the progress of companies’ near-term or long-term science-based targets”[66] and that they “may only be considered to be an option for neutralising residual emissions or to finance additional climate mitigation beyond their science-based emission reduction targets ”[67]. Rather than being a licence for continued polluting, carbon credits are increasingly being regarded as a tool for companies to address their historical emissions legacy, such as Microsoft’s commitment to “remove from the environment all the carbon the company has emitted either directly or by electrical consumption since it was founded in 1975.[68]

- No offset scheme is immune from integrity issues: Having long been hailed as a “well-designed and well-governed carbon offset market”[69] the recent controversy[70] surrounding the integrity of Australian Carbon Credit Units (ACCUs) is a reminder that no carbon offset market is immune from integrity issues. Use of offsets that do not represent “real and additional abatement”[71] to justify continued fossil fuel emissions is a worst case scenario for the climate.

- Heavy reliance on offsets is not supported by the investment community. The IGCC guidance for corporate climate transition plans states that offsets are ‘generally not considered [a] credible approach’[72]. The Climate Action 100+ Net Zero Company Benchmark states that “the use of offsetting or carbon credits should be avoided and limited if at all applied”[73] in its scoring methodology for the decarbonisation strategy indicator.

Due to an evolving range of factors, continued shareholder and community acceptance of Woodside’s over reliance of offsets in its climate strategy is far from guaranteed. As demonstrated in Table 4, without offsets, the company’s emissions reduction targets are meaningless.

BHP Petroleum merger

As detailed in Figure 4, Woodside’s strategy for meeting its emissions targets as a merged entity with BHP Petroleum mirrors its approach as a standalone entity. That is, absolute emissions growth due to production growth, partially negated by design and operating changes and an overreliance on offsets.

Figure 4: Woodside decarbonisation strategy post BHP Petroleum merger[74]

Capital allocation

The following section assesses Woodside's capital allocation plans and the significance of the company’s planned new energy investments, compared with its committed and planned oil and gas expansion.

Paris-aligned pathways for fossil fuel producers

To keep within the Intergovernmental Panel on Climate Change (IPCC) carbon budget for limiting warming to 1.5°C, the need for “immediate and deep cuts in the production of all fossil fuels” is unavoidable.[75]

“There is no practical emission space within the IPCC’s carbon budget for a 50% chance of 1.5°C for any nation to develop any new production facilities of any kind, whether coal mines, oil wells or gas terminals”

Calverley & Anderson, “Phaseout Pathways for Fossil Fuel Production with Paris-compliant Carbon Budgets”, Tyndall Centre for Climate Change Research, March 2022

It is therefore unsurprising that the International Energy Agency (IEA) 1.5°C-aligned Net Zero Emissions (NZE) scenario clearly concluded that no new oil or gas fields can be developed.[76] This is an elegant litmus test for whether investment profiles are Paris-aligned. Whilst it is common for industry to dismiss the IEA NZE with suggestions that it is just “one narrow formula”[77] to get to 1.5°C, alternative scenarios have not necessarily been designed to represent an optimum 1.5°C path. The IEA acknowledges these alternative pathways and explains the key differences[78], with the Executive Director of the IEA emphasising that the NZE is “the most technically feasible, cost-effective and socially acceptable”[79] pathway available. Consequently, any company claiming consistency with 1.5°C in a way that deviates from the NZE should first be challenged on the technical feasibility, cost-effectiveness and social acceptability of the pathway they claim to be aligned with.

The IEA NZE requires $10 trillion of investment in oil and gas by 2050[80]. This should not be confused with an argument for increasing oil and gas investment, since it is still 60% less than the IEA’s business as usual STEPS scenario[81]. It also does not justify investment in new oil and gas fields: “$10 trillion investment” and “no new oil and gas fields” are internally consistent conclusions of the NZE, since oil and gas investment can occur in existing fields.

In 2021, the oil and gas sector invested about $15 billion less than the IEA NZE annual average projection for the 2020s[82]. This again is no reason to suggest that new fields should be developed, but may show slightly lower investment in existing oil and gas fields. Of more relevance to Woodside, the IEA states that under the NZE, “most of the 200 bcm worth of LNG projects currently under construction do not recover their invested capital in the NZE” with up to $75 billion of this stranded”[83]. If projects under construction are not needed, it is unlikely Scarborough will meet its target returns under an NZE outcome.

Woodside’s capital allocation framework and plans through the 2020s

In December 2021, Woodside announced a target spend of US$5 billion in new energy products and lower carbon services by 2030, subject to completion of the BHP petroleum merger.[84] In addition, Woodside has adopted a new capital allocation framework that distinguishes between investment types, with a lower hurdle rate for new energy projects (IRR>10%), when compared with oil (IRR>15%) and gas (IRR>12%).[85] This reflects that lower emission projects have lower risks and can therefore tolerate lower investment hurdle rates. Whilst this is a welcome step, actual capital allocation has a greater climate impact than investment thresholds.

ACCR has compiled the capital allocation for Woodside and BHP from disclosures[86],[87], and assumptions[88] where disclosures were insufficient. Figure 5 shows most capex through the 2020s will still be committed to fossil fuel developments. Woodside’s ‘base’ categorisation covers investment in existing assets such as North West Shelf and Pluto and is therefore primarily related to existing oil and gas fields, but it also includes Pyxis, a new gas reservoir. The major new gas fields are the jointly owned Scarborough (~$9 billion) and BHP Petroleum’s Calypso ($3 billion). The main new oil field is BHP Petroleum’s Trion project ($5 billion). BHP Petroleum’s ‘other oil’ and ‘other gas’ includes a range of projects comparable to what Woodside has categorised as ‘base’.

Figure 5: Woodside and BHP Petroleum 2020’s investment portfolio (USD million)

Is Woodside’s planned new energy investment Paris-aligned?

Within the 2021 Climate Report, Woodside claims its “New energy investment [is] consistent with Paris aligned pathways”[89]. It defines Paris-alignment as the “relative oil and gas versus hydrogen potential investment” in a “range of outcomes predicted between IEA’s Net Zero Emissions (NZE2050) and Sustainable Development Scenario (SDS).”[90] Woodside is targeting 12% of its 2021 to 2030 investment in hydrogen. When compared to the IEA scenarios, this falls between the SDS (4%) and the NZE (33%[91]), so this technically does meet Woodside’s definition of Paris-alignment.

However, we limit climate change by limiting emissions. Investing in hydrogen alone does not guarantee emissions reductions, particularly if fossil fuel projects are still being progressed. As such, a more robust approach to determining the Paris-alignment of investment using IEA scenarios is to examine the ratio between investment in new and existing fossil fuel projects, and what the IEA defines as the adjacent industries for oil and gas: hydrogen, carbon capture and storage, biofuels and offshore wind. ACCR has grouped the capital allocation for Woodside and BHP Petroleum into these categories[92]. Since ‘Base’ includes at least some new gas fields the share allocated to new fields will be higher than this analysis shows.

As shown in Figure 6, Woodside’s business as usual (BAU) and committed portfolio allocates 67% of capital to new oil and gas fields. BHP’s committed project portfolio allocates 82% of capex to new fields. Both of these sit above the Stated Energy Policy Scenario (STEPS) which allocate 62% of relevant capex to new fields. The STEPS scenario is projected to result in 2.6°C of climate change by 2100, so these portfolios are clearly misaligned with the Paris Agreement.

Assuming the merger is executed and Woodside delivers on its new energy targets, the investment in new oil and gas fields will be diluted to 54%. This is still 4.5 times the proportional expenditure on new oil and gas fields than is seen in the NZE. As such, Woodside’s disclosed future capex is clearly misaligned with the IEA’s net zero scenario. The IEA does not disclose the investment split between new and existing fields for the 1.6°C Sustainable Development Scenario (SDS), so it is unclear whether the investment is more closely aligned with the SDS or the Announced Pledges Scenario (2.1°C).

Figure 6: Woodside and BHP Petroleum 2020’s capex compared with IEA scenarios (%)

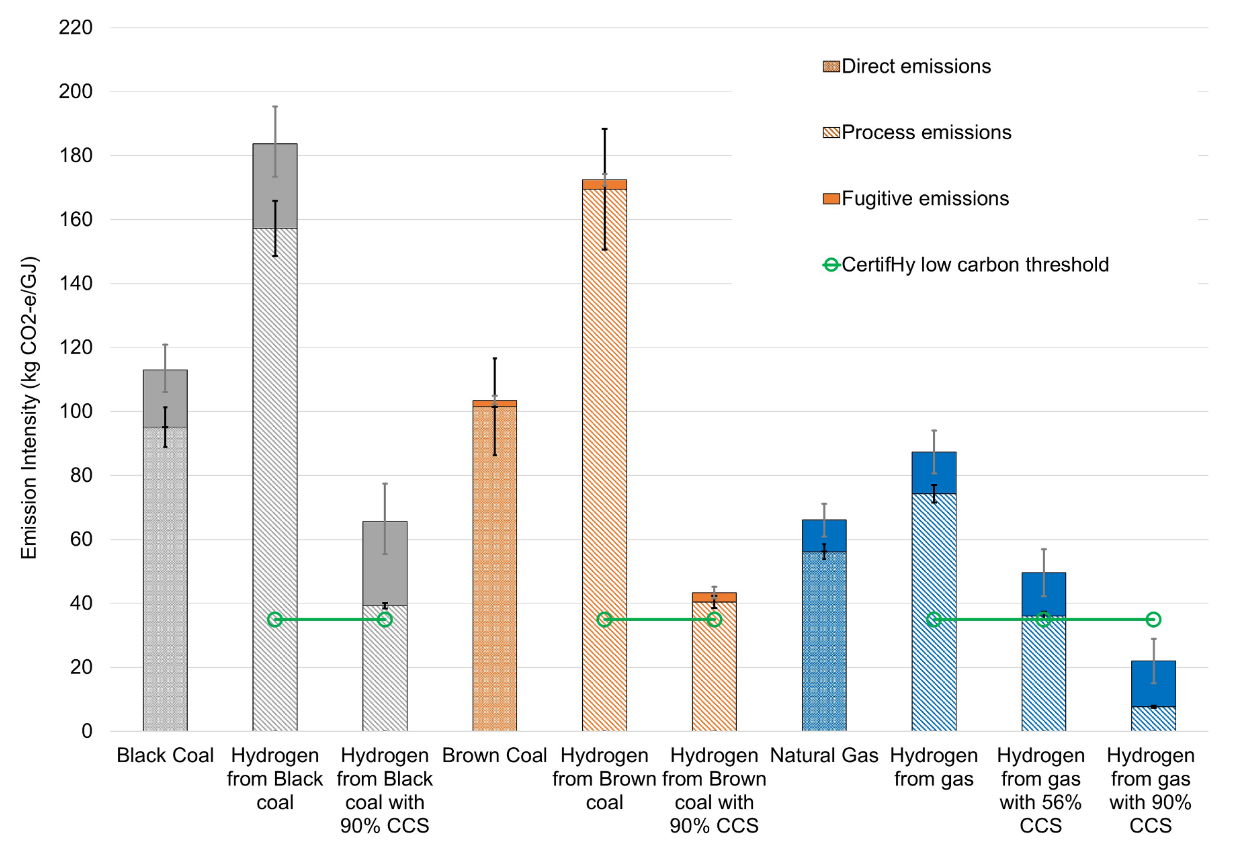

Woodside’s fossil hydrogen plans

Of Woodside’s new energy funding almost half of the announced initial, planned hydrogen production will be fossil hydrogen at the H2Perth project. Woodside plans to use offsets to abate the emissions from the project however as previously demonstrated, offsets do not negate the carbon impacts of fossil fuel emissions. Recent research from the Australian National University calculated the carbon intensity of hydrogen production for a range of fossil fuels (see Figure 7), demonstrating that the emissions intensity of gas-based hydrogen without carbon capture and storage (CCS) is greater than that from straight consumption of natural gas. Importantly, should Woodside amend its plans to incorporate CCS, the authors note that “emissions from gas…based hydrogen production systems could be substantial even with CCS”.[93]

Figure 7: Total emissions intensity of hydrogen production from different fossil fuels[94]

Woodside’s CEO recently stated that “for the new energy opportunities, we need to be customer-led”[95], however the H2Perth project suggests Woodside is less aware of its customers’ expectations than it claims to be. JERA, Japan’s largest power generator, recently announced a major tender for clean hydrogen in which it stipulated that at least 60% of emissions associated with fossil hydrogen must be geologically sequestered[96]. Considering the climate impacts, customer expectations and rapidly falling costs of green hydrogen[97], it is genuinely hard to understand what Woodside’s motivations are for prioritising the fossil component of the H2Perth project.

Scarborough: Climate risk is financial risk

The misalignment between the goals of the Paris Agreement and Woodside’s capex is not just detrimental to the climate. Taking the latest FID as an example, ACCR has shown[98] that Scarborough is a precarious financial investment under the Paris aligned SDS and NZE scenarios, when comparing gas prices in key markets and Scarborough’s cost of supply (see Figure 8). So Scarborough does not just put climate outcomes at risk; it will also fail to generate acceptable shareholder returns if the world follows a path that is consistent with either of the IEA’s Paris-aligned scenarios.

Figure 8: Japanese gas prices by IEA scenario, relative to Scarborough cost of supply (USD/MMBtu)

The project carries additional risks due to Woodside’s highly leveraged equity partner GIP[99] in Pluto 2 and the fact that Woodside has accepted nearly all construction and approvals risk, as well as retaining full exposure to product pricing[100].

Scenario analysis

Woodside has completed scenario analysis using IEA scenarios to test the “impact of each scenario on the potential average annual free cash flow” over 5 year intervals out to 2040.[101] The analysis does not incorporate the BHP merger and assumes that Scarborough is the last oil and gas project the company invests in.[102] Woodside’s primary conclusion is that free cash flow (FCF) is positive in all scenarios, including NZE[103], suggesting to investors that its business model is resilient in the face of rapid decarbonisation.

Woodside has presented the FCF using nominal amounts, which makes future values look larger than they would be in today’s money. To bring these FCFs into a single value, ACCR has discounted these free cash flows using a notional 10% nominal discount rate (7.5% real) and presented this in Figure 8. This shows that Woodside is highly sensitive to climate outcomes - with a 71% fall in present value of FCF between the most and least emissions intensive scenarios. The dramatic impact of climate policy on Woodside’s free cash flow shows it does not have a climate resilient portfolio.

Figure 9: Present value of free cash flows | Woodside & ACCR analysis

ACCR has concerns with the selection of FCF as a metric for scenario analysis, particularly for LNG companies, which are capital intensive and have relatively low operating costs. FCF is the difference between operating cash flow and investment cash flow. It does not consider cash flow associated with debt financing, so solvency requires having sufficient FCF to cover financing costs. Without further disclosure, it is difficult to assess whether Woodside would remain solvent under all IEA scenarios, especially considering ten-year average annual financing costs have been over $900 million[104]. Because of this lack of visibility of debt costs, FCF also cannot give a complete picture of returns on equity or capital, or the value of an entity.

The selection of carbon and product prices as the only variable assumptions in the scenario analysis could also be challenged. With such a high variation in FCF, assuming that credit ratings and debt costs remain fixed is unrealistic. It is likely that Paris-aligned decarbonisation would result in a vicious cycle where reduced cash flows decrease liquidity, challenge Woodside’s credit ratings and then increase debt costs. This should be addressed in future scenario analysis disclosures.

In summary, Woodside has improved the transparency of its scenario analysis disclosure. At face value, the analysis shows that Woodside maintains positive free cash flow in all scenarios. Woodside’s value is however highly dependent on climate change policies, suggesting that it does not have a strategy that protects shareholder funds in a low carbon economy. By presenting results as nominal, free cash flow, the analysis ignores key input assumptions such as its cost of debt that are likely to work against Woodside in a low carbon economy.

Climate policy engagement

In 2021, InfluenceMap found Woodside was the third most active company in Australia on climate and energy policy between 2018-21, scoring it D (scale A-F) for its opposition to Paris-aligned climate policy.[105] In March 2022, Woodside was given an organisational score of 41% in the Climate Action 100+ Net Zero Company Benchmark’s assessment of climate policy engagement (conducted by InfluenceMap). [106] Scores “below 50 indicate increasingly significant misalignment between the Paris Agreement and the company’s detailed climate policy engagement”.[107]

Due to Woodside’s adverse influence on Australian climate policy, ACCR has filed a shareholder resolution seeking that it “cease all private and public advocacy, both direct and indirect, that contradicts the conclusions of the IEA and the IPCC on 1.5°C alignment, including advocacy relating to the development of new oil and gas fields”[108]. ACCR’s investor briefing for this resolution, which includes various examples of Woodside’s direct and indirect advocacy, can be found at accr.org.au/research.

Climate governance

Key aspects of Woodside’s climate governance are assessed below.

Leadership

Woodside states that its board has oversight of climate change as a “complex and material”[109] governance issue. Within the 2021 Corporate Governance Statement[110] all board members are deemed to have either applied experience or awareness of a range of climate change risk areas. However there is a clear disconnect between the company’s conduct and the board’s supposed grasp of climate change risks.

The BHP Petroleum merger is being used to reset the structure of Woodside’s executive committee[111]. A new role has been created for Strategy and Climate and Tony Cudmore, current BHP Group Sustainability and Public Policy Officer, has been announced for that role[112]. The elevation of climate to encompass corporate strategy is a welcome acknowledgement that climate change is an existential risk to an oil and gas company. However appointing someone with a strong lobbying background including time as assistant director of the Australian Institute of Petroleum and over 12 years in corporate affairs with ExxonMobil, suggests Woodside still frames climate as a public relations issue to be managed, more than a major reason to restructure its business model.

Whilst the company persists with oil and gas expansion, its leadership will be increasingly challenged as climate change pressures erode its social licence. In 2021, Woodside experienced the highest voluntary staff turnover in 7 years[113], and it recently lost naming rights for the Perth Fringe Festival[114]. There is no evident recognition or plans to manage this looming risk within the company’s disclosures.

Remuneration

2021 saw a significant change to Woodside’s Corporate Scorecard to increase the focus on financial performance - with a change from 25% on NPAT to 40% split between Opex and EBITDA. This reduced the weighting for other metrics, including climate change. Elements of Woodside’s climate strategy are captured in two parts of the 2021 scorecard:

- Material Sustainability issues (20% weighting): Climate change and greenhouse gas emissions are included for consideration, along with a range of other ESG issues.[115]

- Delivery against Business Priorities (20% weighting): Progress against the H2OK project and Heliogen acquisition are listed as two of the 11 business priorities, along with progressing the BHP Petroleum merger, Scarborough, Pluto Train 2 and Sangomar.[116]

There is no explicit linkage to achievement of climate targets and it is unclear how climate change will be prioritised in the 2022 scorecard, or beyond. Production however is weighted a full 20%, showing that fossil fuel extraction remains a higher priority than decarbonisation.[117]

Just transition

The Just Transition section of Woodside’s 2021 Climate Report addresses Woodside’s role in providing ‘clean and affordable energy’ and ‘decent work’.[118] It does not address the fact that most of Woodside’s staff are engaged in the oil and gas industry, which has a rapidly diminishing role in the IEA’s 1.5°C scenario and what will happen to workers in this case. It also doesn’t talk to the large decommissioning liability that Woodside faces (especially if the BHP Petroleum merger is executed) or the impact that the decommissioning of Karratha Gas Plant, potentially starting in 2024[119], will have on the community of the nearby City of Karratha.

Conclusion

As demonstrated in this analysis, Woodside’s 2021 Climate Plan is far from aligned with the Paris Agreement and the urgent need to limit warming to 1.5°C. The company’s targets exclude more than 90% of emissions and its scope 1 and 2 decarbonisation plan is dominated by the use of offsets, which is an unacceptable strategy in 2022. In addition, the company’s fossil fuel expansion plans are grossly misaligned with the IEANZE scenario and its scenario analysis has failed to demonstrate that the company will thrive in response to rapid decarbonisation. Consequently, it is ACCR’s view that there is sufficient reason to vote against the approval of Woodside’s 2021 Climate Report.

Please read the terms and conditions attached to the use of this site.

ACCR employee Alex Hillman contributed to this report and was previously employed by Woodside, including as Woodside’s climate change advisor. Mr Hillman has ongoing contractual obligations not to disclose Woodside’s sensitive information and in compliance with these obligations, all information included in this report, or used to develop the analysis, uses publicly accessible sources or disclosed assumptions.

Australasian Centre for Corporate Responsibility

Woodside, Climate reporting and non-binding shareholder vote, 19 March 2021, link ↩︎

IPCC, Global Warming of 1.5°C: Headline statements for policymakers, link\ ↩︎

UNFCCC, “UN Secretary General: COP26 must keep 1,5 degrees celsius goal alive”, link\ ↩︎

United Nations, “Secretary-General calls latest IPCC climate report ‘code red for humanity’, stressing ‘irrefutable’ evidence of human influence’, press release, 9 August 2021, link\ ↩︎

ibid. ↩︎

ibid. ↩︎

Zero Carbon Analytics, “IPCC Sixth Assessment Report: Impacts, adaptation and vulnerability”, February 2022 Link\ ↩︎

IPCC, Climate Change 2022: Impacts, Adaptation, Vulnerability. Summary for Policymakers, 27 February 2022, link\ ↩︎

ibid. ↩︎

ibid. ↩︎

Woodside, Pluto LNG Facility Greenhouse Gas Abatement Program, Apr 2021, p42 link ↩︎

Wal van Lierop, Big Oil’s Strategy is Stalling The Energy Transition, Forbes, 28 January 2022, link\ ↩︎

McKinsey and Company, Losing from day one: Why even successful transformations fall short, 2021 link ↩︎

Orsted, Our Green business transformation: What we did and lessons learned, 2021, link ↩︎

John Quiggin, BHP’s offloading of oil and gas shows the global market has turned off fossil fuels, The Conversation, August 2021, link ↩︎

Nick O’Malley and Nick Toscano, Inside ‘Project Arise’: Cannon-Brookes’ secret plan to take over AGL, SMH, February 2022, link ↩︎

BHP reports emissions data on a FY basis so the WPL and BHP data is for overlapping, but different time periods. ↩︎

Woodside Climate Report 2021, p40; Woodside, 2021 Sustainable Development Report, p36; BHP Annual Report 2021, p284 link; Woodside merger and teleconference and investor presentation, 17 August 2021 p7 link ↩︎

Woodside, 2021 Sustainable Development Report, p36 ↩︎

Nick Toscano, Breakthrough moment: Woodside investors revolt on climate change, SMH, 30 April 2020 link\ ↩︎

IGCC, Corporate Climate transition plans: A Guide to investor expectations, March 2022, link\ ↩︎

Woodside, 2021 Climate Report, p15 ↩︎

ibid ↩︎

ibid, p16 ↩︎

Woodside Merger Teleconference and Investor Presentation, August 2021, slide 7 ↩︎

Chevron, Chevron Sets Net Zero Aspiration and New GHG Intensity Target link ↩︎

Exxonmobil, Advancinc Climate Solutions 2022 Progress report link ↩︎

Woodside, North West Shelf ↩︎

Woodside, Woodside agrees to sell 49% stake in Pluto Train 2 to GIP, link ↩︎

Environmental Protection Authority, Ministerial Statement 757, 2007 link ↩︎

Pluto LNG Facility Greenhouse Gas Abatement Program, p19 link ↩︎

Wim Carton, Jens Friis Lund and Kate Dooley, Undoing Equivalence: Rethinking carbon accounting for just carbon removal, Frontiers in climate, 16 April 2021, link ↩︎

IFRS, Climate-related Disclosures Prototype, November 2021, p15 link ↩︎

SBTi, The net-zero standard, October 2021, link ↩︎

SBTi, What is the SBTi’s policy on fossil fuel companies, link ↩︎

Woodside, Scarborough Offshore Project Proposal, February 2020, p29 link ↩︎

AIETI, p6 link ↩︎

AIETI, p58 ↩︎

The AIETI notes that use of LNG is challenged under a net zero world, but none-the-less assess options to reduce emissions of LNG production. ↩︎

Scarborough has very low levels of reservoir carbon dioxide - so for Scarborough’s specific application “CCS for reservoir gas” would not be a major emission saving. ↩︎

Woodside, 2021 Climate Report, p17 ↩︎

Scarborough FID Teleconference and Investor Presentation, p9 ↩︎

Woodside, 2021 Climate Report, p19 ↩︎

Woodside, 2021 Climate Report, p5 ↩︎

See page 27 ↩︎

Woodside, 2021 Climate Report, p27 ↩︎

Woodside, 2021 Climate Report, p16 ↩︎

Woodside, 2021 Climate Report, p24 ↩︎

Woodide’s H2Perth to Make Western Australia a Hydrogen Powerhouse, p2. link ↩︎

Using NGER combustion emission factor, which effectively stoichiometrically converts the carbon from CH4 to CO2 ↩︎

Based on WPL’s 13% of the 3.8MtCO2-e reported by Chevron under the Safeguard Mechanism in FY20 ↩︎

Wim Carton, Jens Friis Lund and Kate Dooley, Undoing Equivalence: Rethinking carbon accounting for just carbon removal, Frontiers in climate, 16 April 2021, link\ ↩︎

Wim Carton, Jens Friis Lund and Kate Dooley, Undoing Equivalence: Rethinking carbon accounting for just carbon removal, Frontiers in climate, 16 April 2021\ ↩︎

Kate Mackenzie, comment on carbon markets, Twitter, 17 March 2022 link\ ↩︎

Wim Carton, Jens Friis Lund and Kate Dooley, Undoing Equivalence: Rethinking carbon accounting for just carbon removal, Frontiers in climate, 16 April 2021, link\ ↩︎

SBTi, SBTI Corporate Net-Zero Standard, October 2021, p42 link ↩︎

SBTi, SBTI Corporate Net-Zero Standard, October 2021, p42 ↩︎

UNFCCC, “Microsoft: Carbon Negative Goal”, 2020 link ↩︎

Carbon Markets Institute, For the Private Sector in Australia’s carbon market: Opportunities and challenges, fact sheet, link\ ↩︎

ANU College of Law, Australia’s carbon market a ‘fraud on the environment’, 24 March 2022, link\ ↩︎

ibid. ↩︎

Investor Group on Climate Change, Corporate Climate Transition Plans: A guide to investor expectations, p. 8 link ↩︎

CA100+, Climate Action 100+ Net Zero Company Benchmark v1.1, March 2022, link ↩︎

Woodside merger teleconference and investor presentation, August 2021, p7 ↩︎

D Calverley and K Anderson, “Phaseout Pathways for Fossil Fuel Production with Paris-compliant Carbon Budgets”, Tyndall Centre for Climate Change Research, March 2022, link ↩︎

IEA, World Energy Outlook 2021, p 100, link ↩︎

APPEA, “Media release: ARENA investment remit changes put oil and gas in driver’s seat as truth about International Energy Report revealed”, May 2019, link ↩︎

IEA, Net Zero by 2050: A Roadmap for the Global Energy Sector, 2021, p62 - 64 ↩︎

IEA, Net Zero by 2050: A Roadmap for the Global Energy Sector, 2021, p3 ↩︎

Calculated from IEA, Net Zero by 2050, 2020, figs 4.2 and 4.7 ↩︎

IEA, World Energy Outlook 2021, extended data set ↩︎

IEA, Global gas market report Q1 2022, p16, link ↩︎

IEA, World Energy Outlook, 2021, p279 link ↩︎

Woodside, Investor Update 2021, December 2021, link ↩︎

Woodside, 2021 Climate Change Report, p11 ↩︎

New Energy: Investor update 2021, December 2021, p1 ↩︎

Scarborough: Scarborough FID Teleconference and Investor Presentation, p4 ↩︎

BHP merger is completed, BHP growth projects achieve FID, the mix of fossil and electrolytic H2 from H2Perth based on media reporting, Base and Exploration capex extrapolated from 2021 and 2022 disclosures. ↩︎

Woodside, Climate Report 2021, p21 ↩︎

ibid ↩︎

Note: ACCRs interpretation of the IEA investment data under the NZE is different to WPLs, but the conclusion that WPL is spending a smaller portion on hydrogen than the rest of the energy system under the NZE remains valid. ↩︎

Woodside is considering farming down Scarborough and Sangomar. These transactions shift assets from one party to another, so are not investments in the macro-economic sense of the term and have been excluded from this analysis. ↩︎

Thomas Longden et al, “Clean hydrogen? Comparing the emissions and costs of fossil fuel versus renewable electricity based hydrogen”, Journal of Applied Energy, Vol 306, Part B, 15 January 2022\ ↩︎

ibid\ ↩︎

Woodside, Full-year 2021 results briefing teleconference transcript link ↩︎

Peter Milne, Hydrogen hype gets real with big Japanese tender, SMH, 20 February 2022 link ↩︎

Goldman Sachs, Carbonomics: The clean hydrogen revolution, link ↩︎

ACCR, Facts over Fiction: Debunking gas industry spin, February 2022, link ↩︎

Market Forces, Net Zero Australian banks fund $3.5bn carbon bomb, Janurary 2022 link ↩︎

Pluto 2 has a tolling agreement to process Scarborough gas. Under a tolling arrangement it is appropriate that Pluto 2 owners (ie GIP) are not exposed to product pricing risk, since it doesn’t own the gas feed or the LNG product. This is still a deviation from previous joint venture arrangements such as Pluto and North West Shelf where joint venture partners took a fixed portion of an entire development including the reservoir, facilities and products. ↩︎

Woodside, Climate Report 2021, p22 ↩︎

ibid ↩︎

ibid ↩︎

Woodside 2021 Annual Report, p159 ↩︎

InfluenceMap, Australia - Corporate Climate Lobbying, link ↩︎

Climate Action 100+, Woodside Petroleum Ltd 2022 Assessment, link ↩︎

InfluenceMap, InfluenceMap Methodology for CA100+, September 2021, link\ ↩︎

ACCR, ACCR Shareholder Resolutions to Woodside Petroleum Ltd on climate-related lobbying & decommissioning, February 2022, link ↩︎

Woodside, Annual Report 2021, p35 ↩︎

Woodside, 2021 Corporate Governance Statement, p10, link ↩︎

Woodside, “Woodside announces executive leadership team for proposed merged company”, 15 February 2022, link ↩︎

ibid ↩︎

2021 voluntary turnover was 4.5%, 2015’s was 5.7%. All intervening years <4%. 2021 Sustainable Development Report, p63 & 2019 Sustainable Development Data Tables, p4 link ↩︎

Emma Young, Perth Fringe World to drop Woodside as principal sponsor after fossil fuel arts rage, WAtoday, June 2021, link ↩︎

Woodside, Annual Report 2021, p79 ↩︎

Woodside, Annual Report 2021, p79 ↩︎

ibid ↩︎

See page 38 ↩︎

Woodside, 'Woodside Investor Briefing Day 2020' (Transcript), 2020, link ↩︎